The Tuesday session offers very little in the way of economic announcements, with perhaps the only one of interest being the Reserve Bank of Australia offer an interest-rate announcement and more importantly, the statement afterwards. Because of this, we can perhaps get a hint as to how the Asian economies are doing overall, and with that it could affect risk appetite going forward during the session.

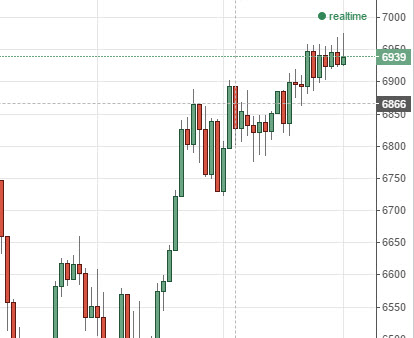

Looking at the FTSE, you can see that we trying to break out, but found far too much in the way of resistance again just below the 7000 handle. With that, it’s very likely that we will continue to grind sideways in the meantime, but we also recognize that buying calls will be the only way to go going forward. We believe that there is a massive amount of support all the way down to the 6700 level and that eventually we will break above 7000. Once we do, at that point in time becomes more of a buy-and-hold situation.

The EUR/USD pair tried to break out to the upside during the session on Monday, but found enough resistance above the 1.12 level to turn things back around and form a shooting star. The shooting star of course suggests that the market is going to show resistance, forming a selling opportunity every time we rally. We believe that buying puts going forward on rallies will be the way to go going forward.

The S&P 500 initially fell during the session on Monday, but found enough support at the 2100 level to turn things back around and form a very positive candle. With that, we are buyers and as a result we believe that buying calls above the 2120 level will be the way going forward. We have no interest whatsoever in buying puts, and believe that there is a significant amount of support below.