- Mood turns cautious amid geopolitical uncertainty in Libya and Gaza

- Fears of supply disruptions drive up oil prices, S&P 500 closes lower

- China concerns also weigh but European stocks turn positive as data awaited

Geopolitical Risks Take Over as Oil Rallies

Equity markets were mixed on Tuesday and the US dollar consolidated as investors turned cautious ahead of the week’s main events amid renewed fears about disruptions to oil supply.

Oil futures rallied sharply on Monday, extending their three-day rebound to more than 7%. The escalating hostilities between Israel and Hezbollah and the absence of major progress in the Gaza ceasefire talks over the weekend had already propelled oil higher, contributing to the formation of what appears to be a double-bottom pattern in the price action, which is a bullish signal.

But the energy commodity got a further boost yesterday from reports that Libya’s eastern government is closing down oil fields in the region, which make up almost all of the country’s production.

The declaration of ‘force majeure’ follows a dispute with the Tripoli government over attempts to oust the head of Libya’s central bank.

US Data and Earnings Eyed

On Wall Street, the S&P 500 and the Nasdaq both closed in the red as the Powell-led rally after Friday’s Jackson Hole speech had already started to fizzle out amid some nervousness ahead of NVIDIA's (NASDAQ:NVDA) earnings announcement on Wednesday.

Moreover, with the market’s attention now switching from when the Fed will cut rates to how much, there is even greater focus on the incoming data.

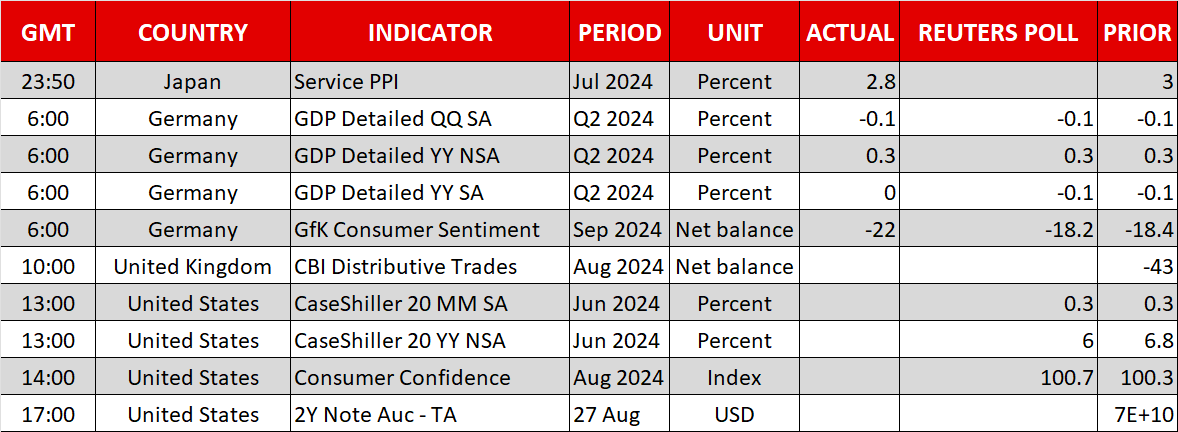

Yesterday’s very strong durable goods orders dented hopes of a 50-basis-point cut in September and today’s consumer confidence gauge will also be watched. But Friday’s personal consumption and core PCE inflation numbers will be more important in shaping expectations for the September meeting.

Equities Rebound May Already Be Underway

In Asia, shares were dragged lower by a slump in the stock of online retailer Temu’s parent company, PDD Holdings. The ongoing concerns about weak Chinese consumer demand overshadowed the positive signal from industrial profits, which picked up in July.

But European traders shrugged off the gloom as the major indices were lifted by strong gains in London’s FTSE 100, which was led higher by mining and energy stocks.

US futures also pointed to a mild rebound, suggesting that equity markets are ripe for another upleg but lack a strong catalyst.

Weaker Yen Keeps Dollar Afloat as Pound and Euro Climb

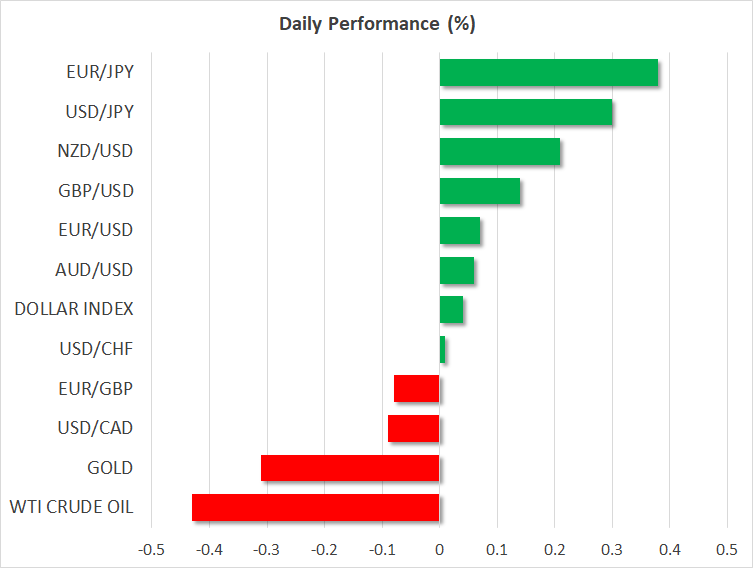

In FX markets, the US dollar was little changed against a basket of currencies as the major pairs mostly traded in tight ranges. One exception was the Japanese yen, which slid across the board. This could be a sign of improving risk sentiment.

The dollar was back above 145 yen in European trading but came under pressure against its other peers. The pound advanced above $1.3200 and the euro edged up to $1.1170 despite the possibility of flash inflation figures out on Friday reinforcing ECB rate cut expectations for September.

The Australian dollar underperformed, however, rising only marginally ahead of monthly CPI data out of the country in Wednesday’s Asian session.