Stock market today: S&P 500 closes higher as Amazon surges on strong Q3 results

Life's little luxuries and the things we take for granted. A clash of titans over the weekend had the community in a prattle.

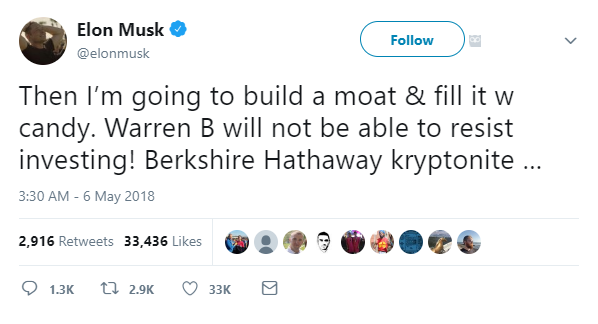

At his annual investor conference, famous investor Warren Buffett took a swipe at Elon Musk. Musk's recent comment that "moats are lame" must have struck a chord in the Oracle as it is his long-held view that businesses should create for themselves some competitive advantages.

The deeper argument here is about the pace of technological innovation. Moats were rather common in the middle ages but these days there are certainly much greater and more relevant methods of defense.

Things got a bit ridiculous when Musk went on the counter-attack and said he was going to start a candy company that will rival Buffett's See's Candy, likely under the name Cryptocandy. Another wisecrack in response to Buffett's comment that "Bitcoin is like rat poison."

then this...

As we'll see below, this type of behavior is the epitome of first world problems.

Today's Highlights

Stocks rise on Little Growth

Get Smart

Crypto eyes the Third World

Please note: All data, figures & graphs are valid as of May 7th. All trading carries risk. Only risk capital you can afford to lose.

Traditional Markets

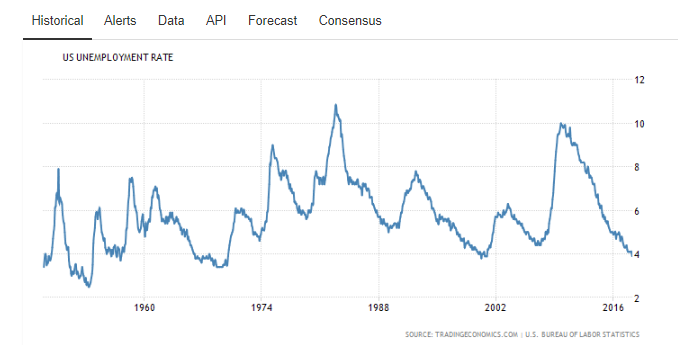

Friday's Jobs report was a doozy.

The good news is that the US unemployment rate dropped to 3.9%, its lowest reading in 18 years.

The not so great news was that wage growth came in a full percentage point less than expected. As we discussed in Friday's update, a weaker than expected wage growth figure is actually good for stocks since it lowers the expectation of rate rises from the Fed.

The Fed was likely a bit surprised by the number, though, as it really destroys any semblance they had of a narrative. Until now, they were saying that as unemployment goes down, wage growth will go up, which will spur inflation expectations.

Unemployment down - Check!

Inflation expectations - Check!

Wage Growth - Hey wait a minute!

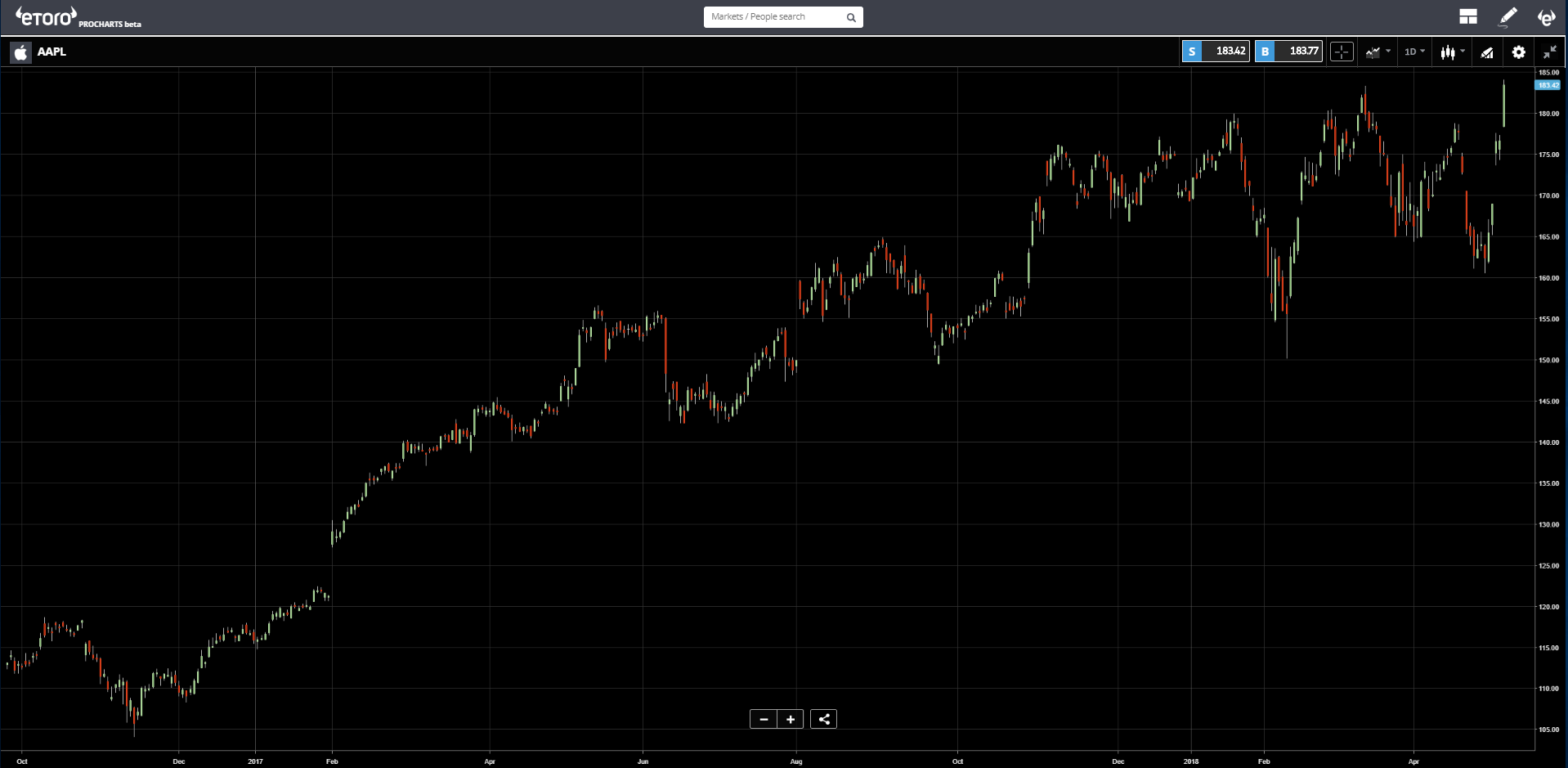

Stocks quickly rallied after the report, led by Apple, which reached a brand new all-time high.

For now, the news is rather focused on some upcoming political events. Mainly, the resumption of the NAFTA trade negotiations and the expectation that Trump will pull out of the Iran nuclear agreement.

The latter has the price of oil above $70 a barrel for the first time since 2014.

Get Smart

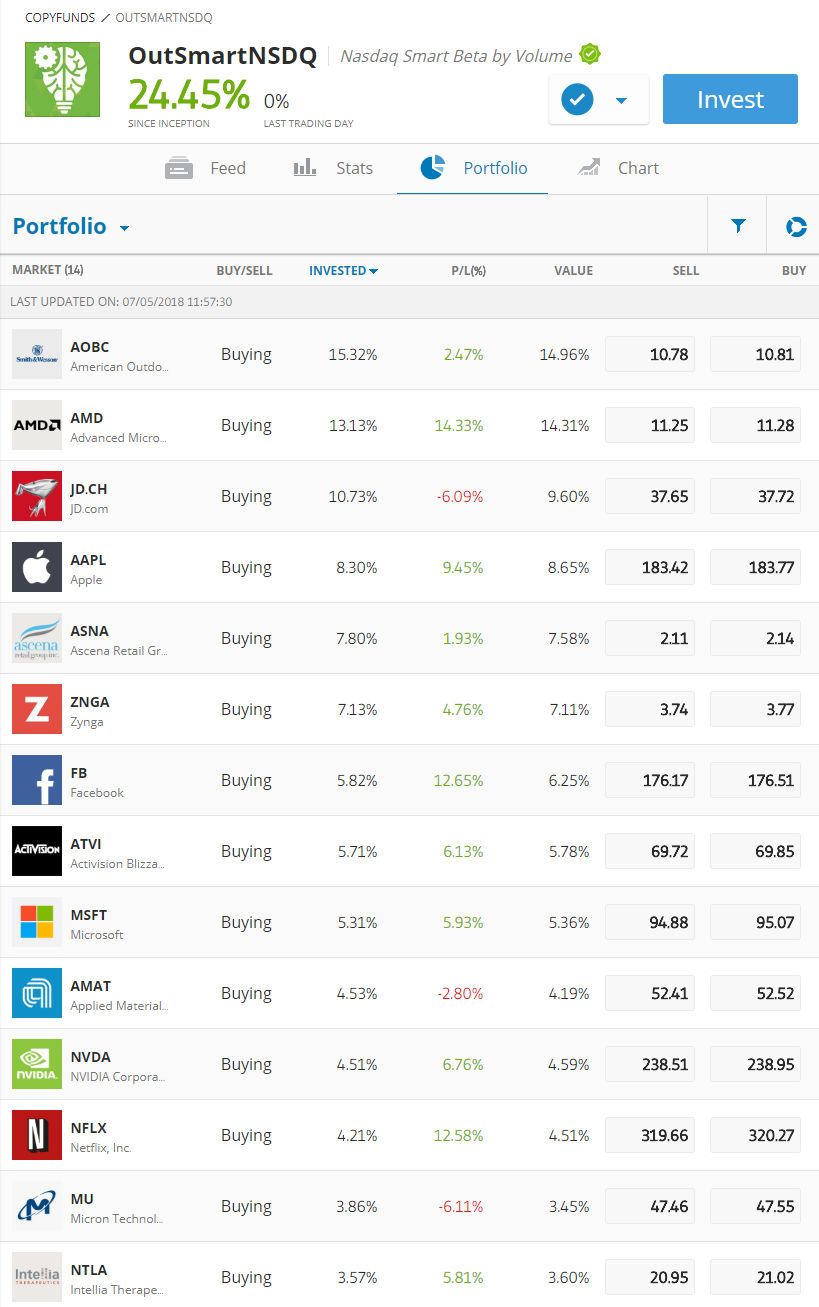

For those of you who haven't seen it yet, we have a brand new product that is crushing it in the markets called @OutSmartNSDQ.

The idea here is to use our own big data to deliver alpha. So far, alpha has been delivered. Here you can see that since its inception six months ago, the copyfund strategy has outperformed the benchmark index by 10%.

Just as a matter of curiosity, I had a peek under the hood to see which stocks it's currently holding at the moment.

I think that what's missing here is actually more telling than what's included.

Crypto Eye

While the events discussed above involving two of the wealthiest people in the world are rather entertaining, there are some much more solemn things that should also be addressed.

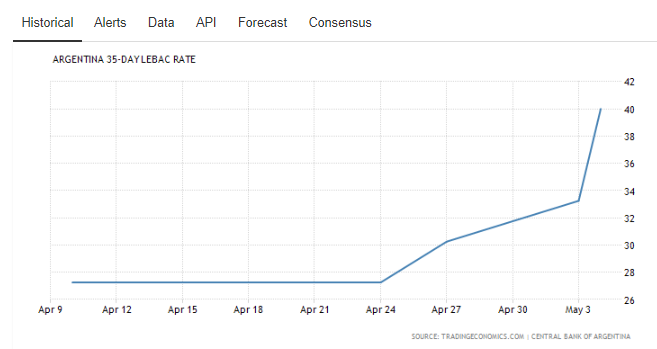

For example, the battered economy of Argentina, who has just raised their benchmark interest rate for the third time in two weeks, this time to an alarming 40%.

The peso has lost 25% of its value over the past year so the rate rises are intended to convince people not to move their money into alternative stores of value.

In India, a recent wave of rumors has dented the integrity of the 10 Rs coin. The Wall Street Journal reports that some rather nasty fake news has circulated making people think the coin is worthless and now many vendors and even banks refuse to accept them as payment.

In a country that is already strapped for cash, the loss of $775 million worth of Aluminum Bronze and Cupronickel is devastating.

In South Korea, they've now figured out how to deal with metal coins. It seems the metal used to make some of their currency was actually more valuable than the minted coin itself, leading to mass smelting. So now they're looking to go crypto.

See, some people might see bitcoin as rat poison or a "purely speculative asset" but some see it as the only alternative to what they currently have. A trustless line of defense for when trust erodes.

Wishing you an amazing week ahead!

eToro, Senior Market Analyst

Disclosure: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital you're prepared to lose.

Which stocks should you consider in your very next trade?

The best opportunities often hide in plain sight—buried among thousands of stocks you'd never have time to research individually.

That's why smart investors use our Stock Screener with 50+ predefined screens and 160+ customizable filters to surface hidden gems instantly.

For example, the Piotroski's Picks method averages 23% annual returns by focusing on financial strength, and you can get it as a standalone screen. Momentum Masters catches stocks gaining serious traction, while Blue-Chip Bargains finds undervalued giants.

With screens for dividends, growth, value, and more, you'll discover opportunities others miss. Our current favorite screen is Under $10/share, which is great for discovering stocks trading under $10 with recent price momentum showing some very impressive returns!