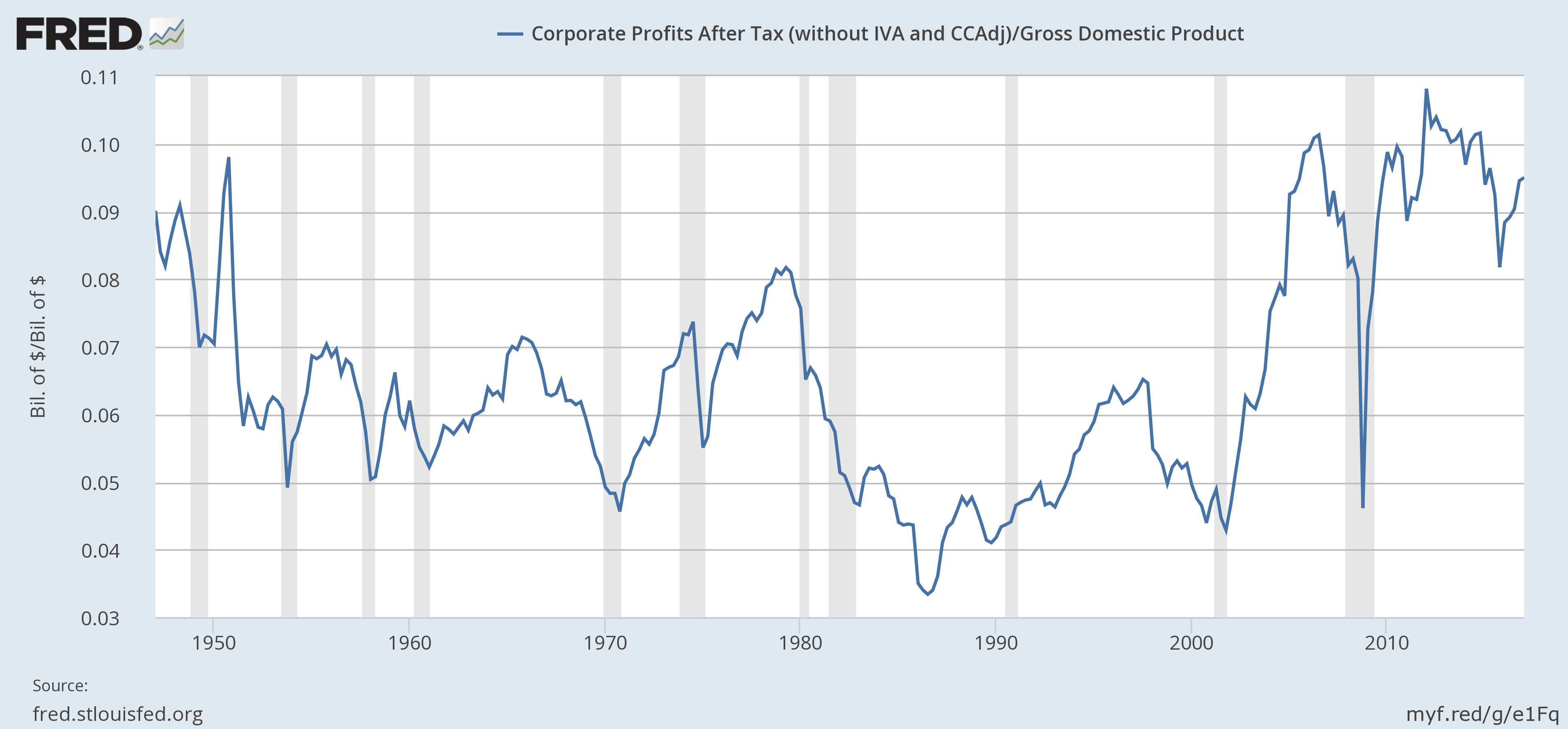

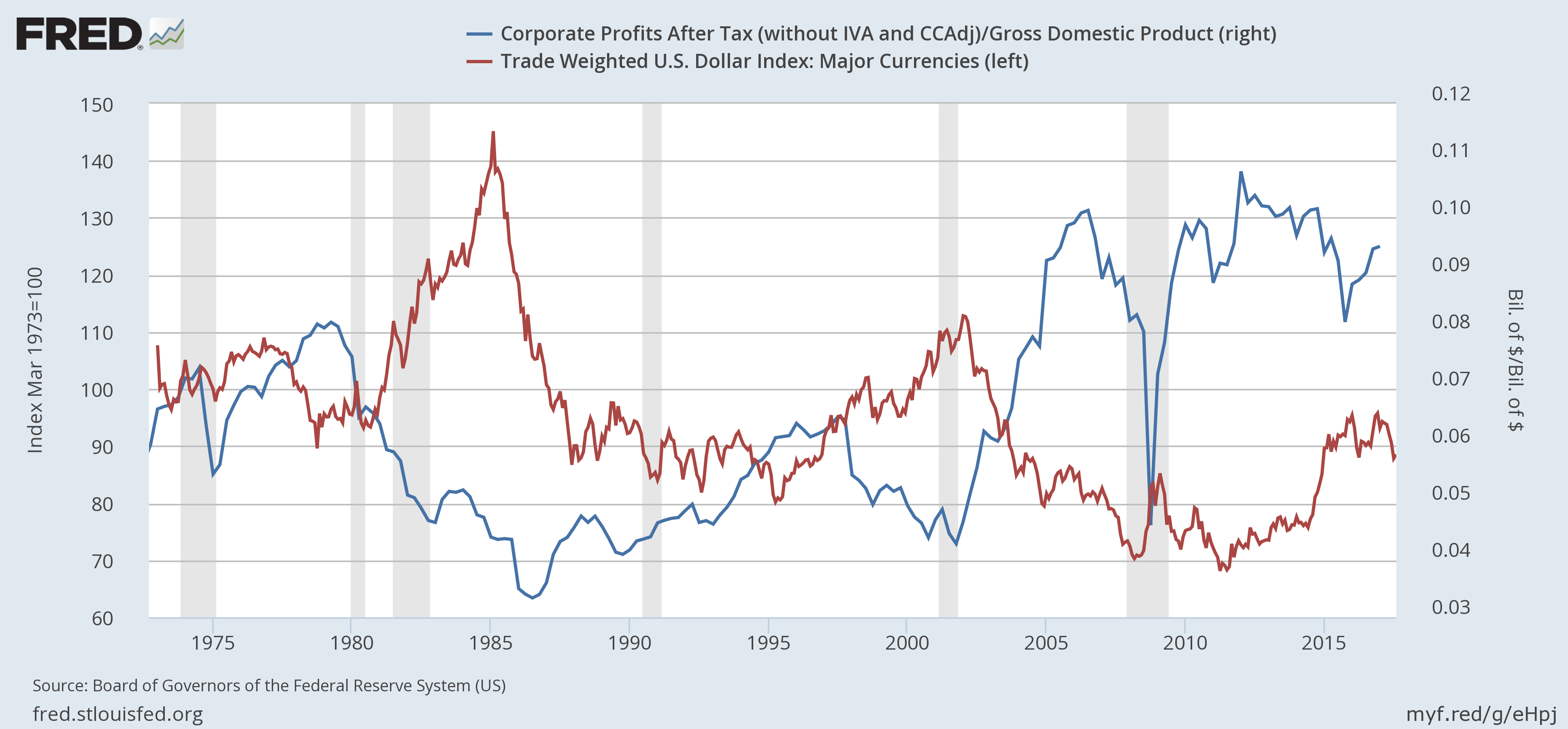

Why are profit margins persistently high? With decent earnings this quarter, corporate profits as a % of GDP will approach (maybe exceed) 10% again. That is abnormally high compared to the period 1960 to 2000.

Margins actually started to rise in the mid-80s but really accelerated after 2000 and outside of the 2008 crisis have remained high. Why? What changed in 2000 to elevate corporate profits so much? Is this just money illusion?

That might be part of the explanation but I think there is more going on here. High margins should not persist in a capitalist system; they should be competed away. Have we systematically reduced competition somehow? Is anti-trust enforcement too lax? What about the rise of indexing?

There has been a theory floating around for some time that indexing reduces competition. If you own a piece of every company in the S&P 500 theoretically you would be better off if these companies colluded to keep margins and profits high. Is that really reasonable though? Or is it possible that it is happening in a non-coordinated way? How?

Are shale oil fields depleting faster than thought?

Is it possible that the shale oil revolution has a short, finite life? We know that production from a shale well has a much different profile than a standard well. It starts off very high but depletes much quicker than a standard well. That’s just a function of how the oil is trapped in the shale rock. Once it is fracked – the rock fractured and the oil released – the oil is recovered fairly quickly. Then you need to fracture more rock to get more oil.

The question has always been how much oil is actually in that rock and how much can be recovered. And today we are starting to see signs that the answer to that question is maybe not as much as everyone thought. Gas/oil ratios are rising in all of these fields which might be an indication that the oil is depleting more rapidly than initially thought. So far, companies are touting this as a positive by-product but the higher that ratio rises the harder that will be to sell to their bankers. There is no shortage of gas in this country for sure. Could the current oil glut turn into a shortage?

How much money will Silicon Valley waste in Hollywood?

It was reported last week that Apple (NASDAQ:AAPL) is setting aside $1 billion for original programming. They join Netflix (NASDAQ:NFLX), Hulu, Amazon (NASDAQ:AMZN), Facebook (NASDAQ:FB) and YouTube as Hollywood neophytes in the original programming business. What are the odds that Silicon Valley actually understands what it takes to produce good content that people will actually watch? Will they just be the latest outsider to ride into Tinseltown with a fat wallet and leave with a much thinner one? It isn’t easy making money producing content. Just ask Sony.

Will President Trump serve a full term?

I don’t like to get into politics much on this blog but there are times when it becomes necessary. Given the current political climate one must consider the possibility that we are in for a full blown political crisis. What happens to the economy and markets if a serious effort is made to impeach Trump? Or convince him to resign?

I don’t know if incompetence is sufficient for impeachment so maybe that would depend on what Mueller turns up. But I could definitely see a group of elder statesmen Republicans heading down to the White House for a meeting.

Would they be successful? I have my doubts. The market was said to have sold off last week because of rumors that Gary Cohn was about to resign. So consider that for a minute. If Cohn did resign who would be willing to take his place? Yeah, I can’t think of anyone either. There are already a lot of unfilled positions in DC but there could be a lot more to come. What is the impact on the country – not to mention the dollar, the Treasury market, stocks – if there is a complete vacuum in the Executive Branch?