Last week's reports from the big U.S. banks, the first major group of companies to report fourth-quarter earnings, were a decidedly mixed bag. While JP Morgan Chase (NYSE:JPM) and Morgan Stanley (NYSE:MS) both posted weaker-than-expected quarterly profits, Goldman Sachs (NYSE:GS), Bank of America (NYSE:BAC) and Citigroup (NYSE:C) all reported forecast-beating results.

Rounding out the list of financial institutions reporting last week, Wells Fargo's (NYSE:WFC) earnings beat estimates, but its revenue missed amid declines in its three key businesses.

Now that the dust has settled, we're taking a closer look at the two biggest disappointments as well as the one big winner from last week's results.

Morgan Stanley: Biggest Trading Desk Shortfall

Overall, trading desks for the big banks ended 2018 with a whimper. And no institution disclosed as much of a shortfall as Morgan Stanley.

The New York-based firm's fixed-income trading revenue sank 30%, to $564 million, the worst bond trading performance among the big five Wall Street investment banks. Morgan Stanley's equities desk—Wall Street's biggest stock trading shop—was also the only group not to show double-digit revenue gains in the quarter.

The bank had pledged that its expansion into wealth management over the past decade would help deliver more stable results. But the unit, which accounts for roughly half of Morgan Stanley's revenue, was not immune from year-end market volatility that drove traders to the sidelines.

"2018 was a great year that finished on a disappointing note," Morgan Stanley CEO James Gorman said in the bank's post-earnings conference call on January 17. "The last six weeks of the year in particular were obviously difficult."

Indeed, investors punished Morgan Stanley, sending its shares down more than 4% in the wake of its earnings miss, to $41.61. The stock closed yesterday at $42.41, bouncing slightly off its post-earnings low.

From a technical standpoint, while shares appeared to have bottomed in December, they are still well below their 200-day moving average (DMA). This usually signals that sellers are in control. A break above the $47.72-level would convince us otherwise.

During the past twelve months, Morgan Stanley's stock has fallen nearly 26%, versus a 12.7% decline in the S&P 500 Banks index (SPSY) and a 7% drop in the S&P 500 index over the same period.

JP Morgan Chase: First Earnings Miss in 15 Quarters

Fourth quarter results from JP Morgan disappointed when they reported on January 15. It was the first earnings miss for the global financial institution in 15 quarters, as the lender posted declines in revenue in three of its four main businesses.

The bank generated $1.98 per share in profit for the fourth quarter of 2018, missing analysts' average estimate of $2.20 per share. Revenue was $26.8 billion, just shy of the average expectation of $26.84 billion.

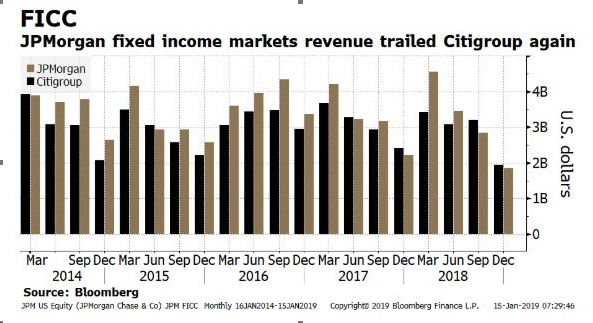

The largest U.S. bank by assets reported an 18% drop in fixed income trading revenue as investors fled commodities and credit trading markets due to spikes in volatility toward the end of 2018. The division produced $1.86 billion in revenue, compared with the $2.2 billion estimate.

The bank raised some concern on its post-earnings conference call when it said it had set aside $1.55 billion for credit losses, an 18% increase from a year earlier and $250 million more than analysts' $1.3 billion estimate.

Shares of JP Morgan fell around 10% over the last 12 months. That's a better showing than the 12.7% decline in the S&P 500 Banks index. The stock closed yesterday at $102.94.

From a technical standpoint, last Friday, JPM closed above its 50-DMA for the first time since November 30, only to fall back below it during Tuesday's session. The stock next needs to successfully defend that level in the near-term to show that selling pressure has been exhausted.

Goldman Sachs: Only Wall Street Bank To Show Q4 Trading Revenue Growth

This earnings season's big winner among banks was Goldman Sachs. Wall Street's biggest investment bank had its best one-day gain in 10 years on January 16, when shares surged 9.5% after it reported stronger-than-expected results across the board.

The bank posted earnings of $6.04 a share, compared with analyst expectations of $4.53 a share. It was the first quarter of results for the firm's new CEO, David Solomon.

Revenue came in at $8.1 billion, beating expectations for $7.5 billion, as stronger equities trading profit cushioned bond trading losses, making it the only Wall Street bank to show growth in Q4 trading revenue. Overall trading revenue rose 2% in the three months ended December.

Another bright spot in the bank’s results was its M&A advisory business, which delivered a 41% increase in revenue.

"We are pleased with our performance for the year, achieving stronger top- and bottom-line results despite a challenging backdrop for our market-making businesses in the second half," Solomon said in the earnings release.

While Goldman enjoyed a solid fourth-quarter, a note of caution is likely to set in as the company is expected to be the focus of investigations into the alleged plundering of 1MDB, a Malaysian state investment fund. Its shares have fallen 24.4% over the last 12 months. The stock closed yesterday at $197.68.

From a technical standpoint, Goldman's stock, which has shown indications of bottoming, made a strong push above its 50-DMA at the $185.50-level. It is now knocking on the door of its 100DMA, near $206.25. A close above that level will likely lead to a test of its 200DMA, which hasn't been breached since April 23, 2018.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI