Forex News and Events

Crude oil prices rise on foggy outlook

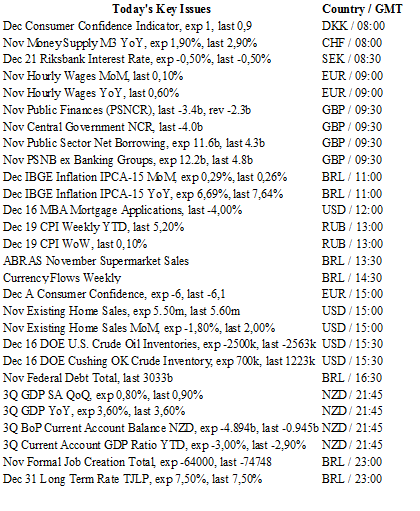

The West Texas Intermediate surged to $53.60 a barrel on Wednesday as the API weekly report was anticipated to show a drop of 4.15 million barrels, while the EIA report due later today is expected to show a contraction of 2.5 million barrel in US crude stockpile. According to the EIA, US inventories shrank during the past four weeks by a total of 7 million barrels. With the OPEC output cut deal in the pipeline and a broad willingness amongst oil producers to shore up prices, we do not exclude further improvement in crude oil prices.

However, the downside risk is quite significant, as most recent oil gains are based on an optimistic outlook. Indeed, OPEC crude oil production reached an all-time high in November, while Libya reopened two of its biggest oil fields which are expected to lift the country’s output to 270k barrels a day within the next few months, compared to 175k currently.

According to Baker Hughes, the US oil and gas rig count increased by 12 sites last week which brings the total to 610, compared to 316 in late May this year. Finally, according to the CFTC, net speculative positioning has exceeded 300k contracts on the NYMEX, the highest level since July 2014.

All in all, if everything goes according to the plan, we may see further crude oil gains. Nevertheless, the market positioning together with the upside in production levels mean that the downside risk in crude oil prices is quite significant. Investors should remain open to all possibilities, especially a debasement of prices.

US housing to provide early signal

The US will report existing home sales which are expected to soften slightly to 5.50m after surging to the highest levels since 2007. Higher mortgage rates (since Oct 30-yr fixed rate mortgages are up 85bp to 4.18), driven by the steeper Fed normalization path will continue to cool the housing market. This should represent the last of sideline buyers entering the era of historically low interest rates. We currently view the markets as all inexplicably drinking the same Kool-Aid.

Trump fiscal spends and tax reforms have had near magical effects in convincing markets that the end of monetary support will be a smooth transition and actually enhancing global growth and therefore corporate profits. With the Dow rallying to new all-times highs the US consumer has been lulled into a false sense of wealth (and well-being). Broader US economic data has failed to convince us of anything more than a temporary upswing in a larger cyclical downturn.

We remain skeptical that President Trump will accomplish anything close to the miracle growth rhetoric he has been supplying. Faltering in stocks, US economic data and political inaction will take Fed “dots” off the chart. Given the significantly overbought USD positioning (IMM data) we anticipate a correction heading towards Jan 20th. With US short-end yields upside stalled watch for a retracement of USD/JPY to 114.74 near term support.

Consumer Confidence set to improve

Today, Eurozone consumer confidence is set to continue to increase after the recent surge in November from -7.8 to -6.1. This year, despite the several risk events that occurred, including Brexit and the Italian referendum, the indicator has been resilient and should show improved confidence for the general economic situation and the future employment outlook.

In our view, we remain cautious as Eurozone fundamental data remains mixed, in particular labour data. The unemployment rate remains elevated and is around 10% and inflation is still weak. ECB QE has so far failed to underpin sustainable growth and inflation.

In terms of currency, the EUR/USD is mostly driven by the greenback as markets expect several rate hikes for next year. Moreover, there is not market anticipation regarding the ECB and its loose monetary policy which is expanding. Markets are now waiting for any further pick-up in inflation.

EUR/GBP - Slow Increase.

The Risk Today

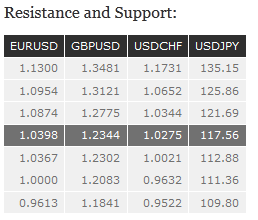

EUR/USD remains below 1.0500. Hourly support at 1.0367 (15/12/2016 low) has been broken. Hourly resistance can be found at 1.0480 (19/12/2016 high). Stronger resistance is given at 1.0670 (14/12/2016 high). Expected to further weaken. In the longer term, the death cross late October indicated a further bearish bias. The pair has broken key support given at 1.0458 (16/03/2015 low). Key resistance holds at 1.1714 (24/08/2015 high). Expected to head towards parity.

GBP/USD is trading below former uptrend channel. Strong support can be found at 1.2302 (18/11/2016 low) while resistance lies at 1.2509 (16/12/2016 high). The technical structure suggests further weakness towards support at 1.2302. The long-term technical pattern is even more negative since the Brexit vote has paved the way for further decline. Long-term support given at 1.0520 (01/03/85) represents a decent target. Long-term resistance is given at 1.5018 (24/06/2015) and would indicate a long-term reversal in the negative trend. Yet, it is very unlikely at the moment.

USD/JPY's bullish pressures are still very strong despite some bearish retracements. The pair is heading towards the 120.00 level. Hourly support can be found at 116.56 (19/12/2016 low). Stronger support lies at 114.74 (12/12/2016 low). The technical structure suggests further strengthening. We favor a long-term bearish bias. Support is now given at 96.57 (10/08/2013 low). A gradual rise towards the major resistance at 135.15 (01/02/2002 high) seems absolutely unlikely. Expected to decline further support at 93.79 (13/06/2013 low).

USD/CHF is heading towards 1.0300. Hourly resistance is given at 1.0344 (15/12/2016 high). Key support is given at the parity. Expected to further consolidate towards former resistance area around 1.0205. In the long-term, the pair is still trading in range since 2011 despite some turmoil when the SNB unpegged the CHF. Key support can be found 0.8986 (30/01/2015 low). The technical structure favours nonetheless a long term bullish bias since the unpeg in January 2015.