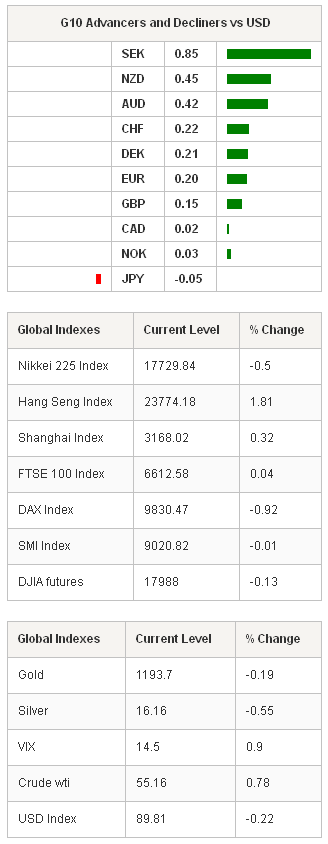

Forex markets are stable with USD weaker, as traders await the result of the presidential vote in Greece. Asia’s regional equity indices were broadly higher reflecting the sessional optimism perhaps more than any real fundamentals (especially considering the going search for the missing Air Asia plane). That’s said, positive US data and easing worries over the pace of the Feds tightening path pushed the Dow and the S&P 500 to new closing highs on Friday, confidence which is now spilling over into Asian markets. The Nikkei fell -0.50% while the Hang Seng rose 1.82% and Shanghai composite climbed 0.33%. EURUSD is bouncing near the lows at 1.2190 as Greece votes. The Greek presidential vote will decide whether the country will move towards a snap general elections.

Voting will start around 10:00gmt and the results will be released around an hour later. Its widely believed that a general election will bring the leftwing Syriza party to power. Syriza is a firm anti-Europe party and would be expected to demand a renegotiation of the current bailout terms. News of a general election will be profoundly EUR negative, and considering the markets low participation level and thin volumes we would expected the EUR/USD to easily move below the current support at 1.2165. USDJPY remains range-bound around the 120.30 handle with most real money traders still on holidays. A Reuters poll of the weekend indicates that major Japanese firms plan to distribute excess cash to shareholder rather than spend it on wages increases. This would be a step backwards for Prime Minister Shinzo Abe's who is looking for employers to increase wages to help generate inflation and confidence.

Elsewhere in Japan, there is news that Abe cabinet approved 3.5trn yen emergency stimulus to support weakening local economies. In the FX markets, Sweden’s SEK was the big mover as the government reached an agreement with the opposition to avert a snap election. The accord also helps limit the anti-immigration Sweden Democrats current role in government. In commodities news, oil rose slightly as escalating clashing in Libya has increased supply concerns. The OPEC member has been unstable in react weeks as a fire caused by fighting at one of Libya’s primary exports terminals has destroyed two day of outputs (nearly 800,00 barrels of crude).

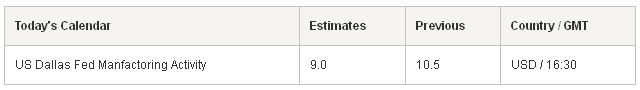

Oil currencies in NOK, CAD, MXN are all higher verse the USD. Early in the Asian session, AUDUSD was under some selling pressure to 0.8110 as AUDNZD traded to a fresh 9-year low at 1.0446. Chatter of decent option related buying between 0.8090/0.8100 limited attempts lower and sent AUD/USD upwards to 0.8153 in low volumes. NZDUSD started the holiday shortened week at 0.7767, and has been confined to a marginal 0.7745-0.77770 range as limited participants look unlike to make any real bets till next Monday. The only first tier data scheduled today will be the Italian Dec Consumer Confidence Forecast 100.51 prior 100.2 and US Dallas Fed Manufacturing activity expected to come in at 9.0 vs 10.5 Nov read.

Currency Tech

EURUSD

R 2: 1.2351

R 1: 1.2300

CURRENT: 1.2189

S 1: 1.2134

S 2: 1.2043

GBPUSD

R 2: 1.5786

R 1: 1.5682

CURRENT: 1.5547

S 1: 1.5500

S 2: 1.5423

USDJPY

R 2: 121.85

R 1: 121.00

CURRENT: 120.43

S 1: 119.32

S 2: 118.26

USDCHF

R 2: 0.9972

R 1: 0.9900

CURRENT: 0.9867

S 1: 0.9785

S 2: 0.9723