All we heard about in 2019 was slowing global growth, trade wars, contracting manufacturing PMIs, yield curve inversion, and of course, recession fears. That will not be the case in 2020.

The US never even got close to reaching recessionary levels in 2019, with GDP growing at 3.1% in 1Q, 2% in 2Q, and 2.1% in 3Q. Hey, even the fourth quarter suggesting a recession, with the Atlanta Fed GDPNow tracking at 1.7%. Making all those fears a giant waste of time. Even Germany never went into recession, it was close, but no recession.

Hey, but it got the Fed to hold off from raising rate, and even cutting them three times, as yields plunged.

Now, as 2019 draws to a close, there are signs that PMIs are bottoming. Also, the global markets are acting as if global growth is about to come roaring back to life in 2020. The all-word iShares MSCI ACWI ETF (NASDAQ:ACWI) has moved back to its all-time highs and is on the cusp of breaking out.

Key export economy stock markets such as Germany have seen its DAX index climb back to its all-time highs.

Meanwhile, Japan has seen a significant recovery as well, and could soon reach levels not seen since the early 1990s.

Then, of course, there are vital semiconductors stocks such as Taiwan semi that have rocketed to all-time highs, breaking free of a nearly 2-year period of consolidation.

Of course, there is also the all-important S&P 500, which has rocketed to record levels.

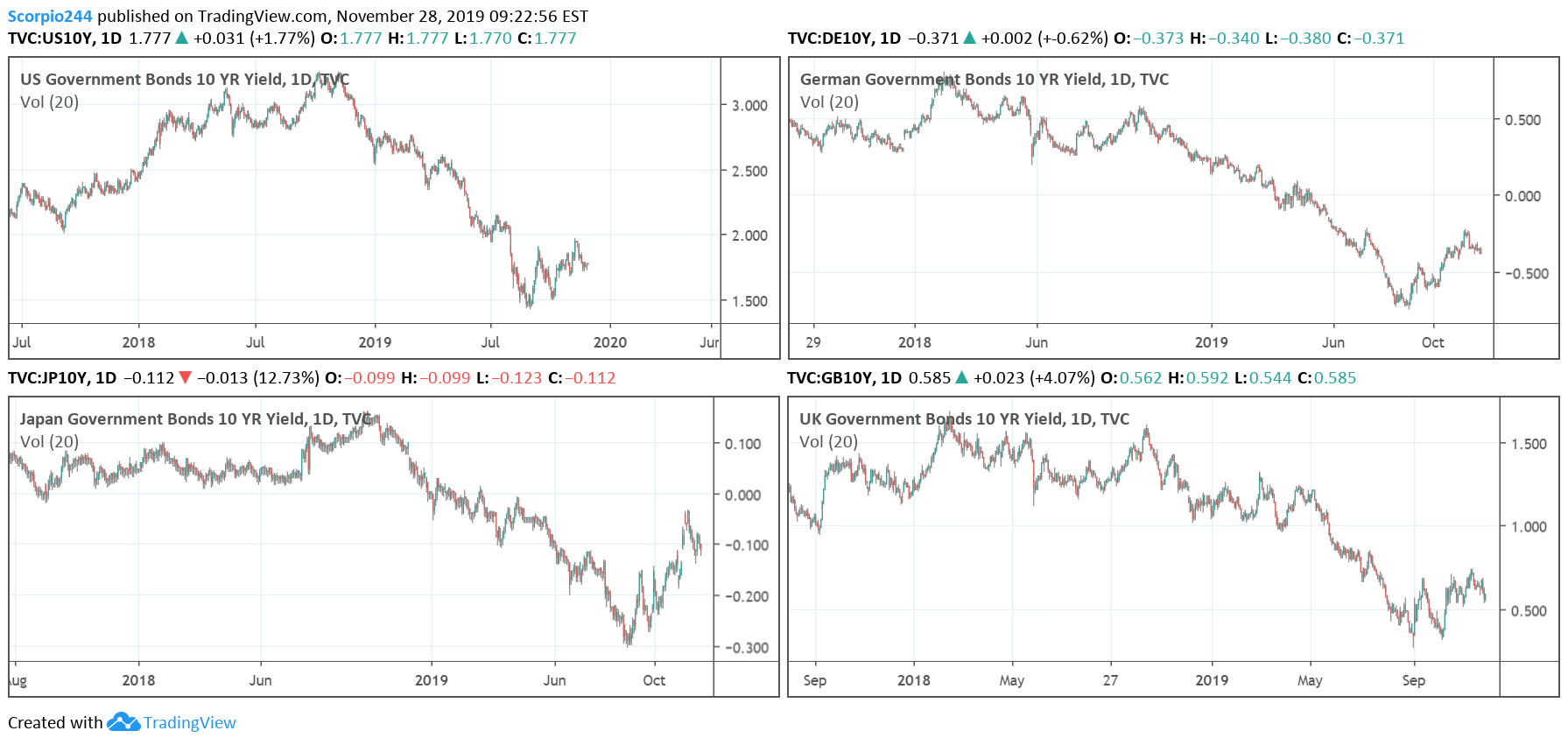

Even United States 10-Year yields have ticked higher off their lows in recent months, suggesting that perhaps the worse of the global slow down is behind us.

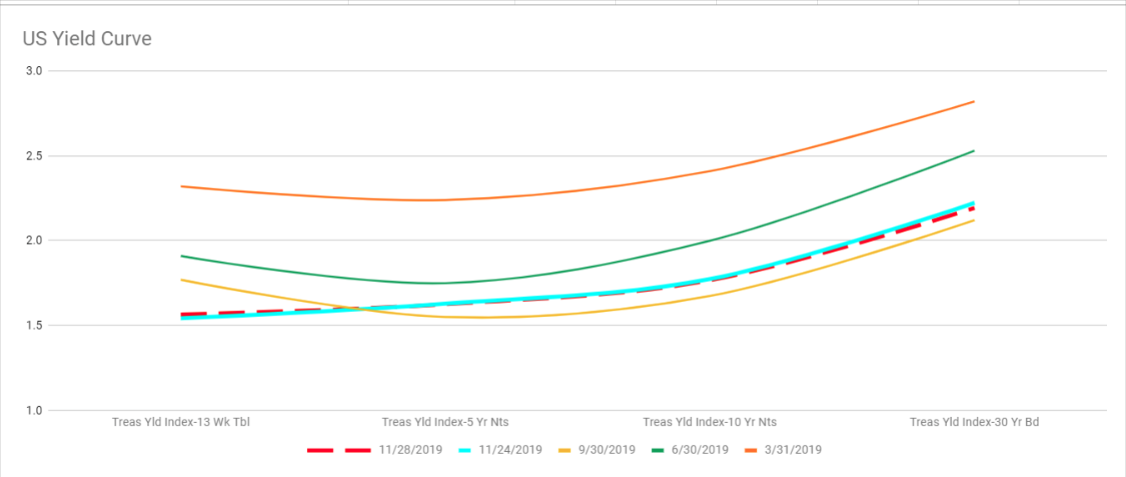

Meanwhile, that is allowing the US Yield curve to normalize and begin to steepen.

The market is sending a loud message, and it is telling me that prediction number 10 is a return to global growth in 2020.