Our previous advice

Regular readers of the blog should remember that back in early July we warned that the probability of safe haven assets correcting was very high. This included various bonds (especially long duration), commercial real estate, minimum volatility / high dividend paying stocks and of course the precious metals sector.

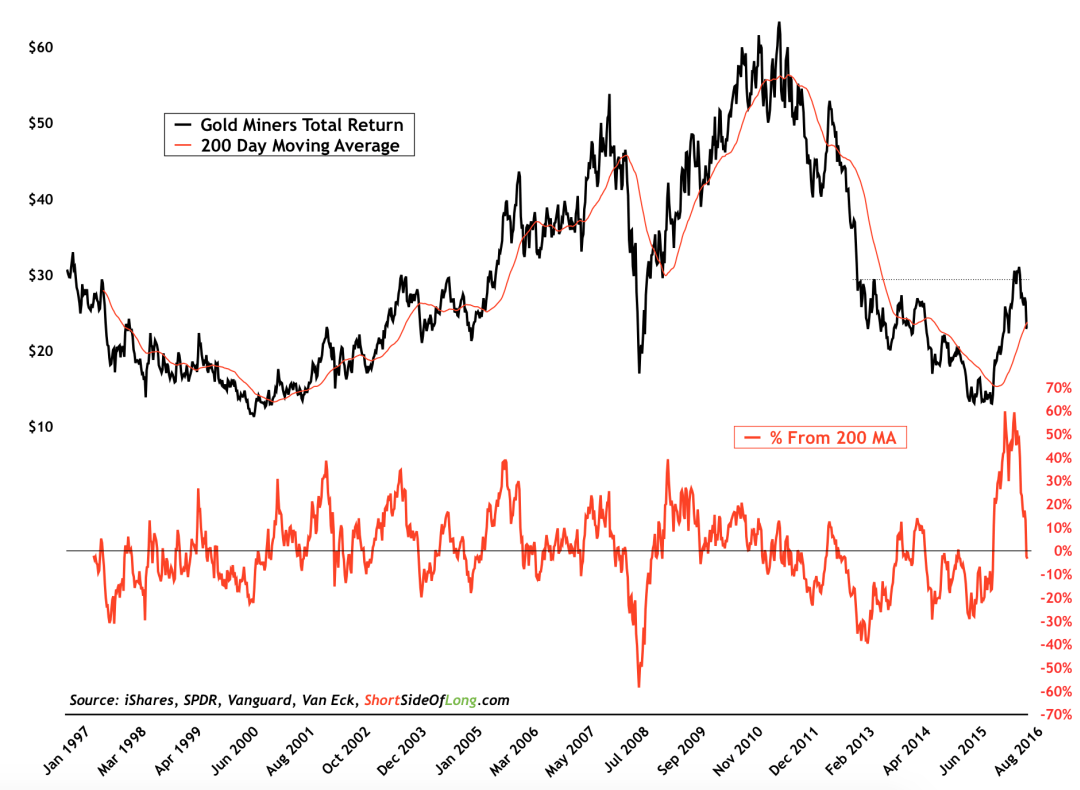

There has been some serious selling in the Precious Metals market throughout the month of October, with Gold falling 4.5% so far. More speculative assets within the sector such as Platinum, Silver and Gold Mining equities have declined even more. The chart above presents the Gold Mining index together with its 200 day moving average mean (a standard industry measure of trend).

The red indicator in our chart indicated that the index of precious metals companies traded as much as 60% above the mean, an extremely overbought condition. Consequently, the miners have now experienced almost a 30% drop over the last two months alone.

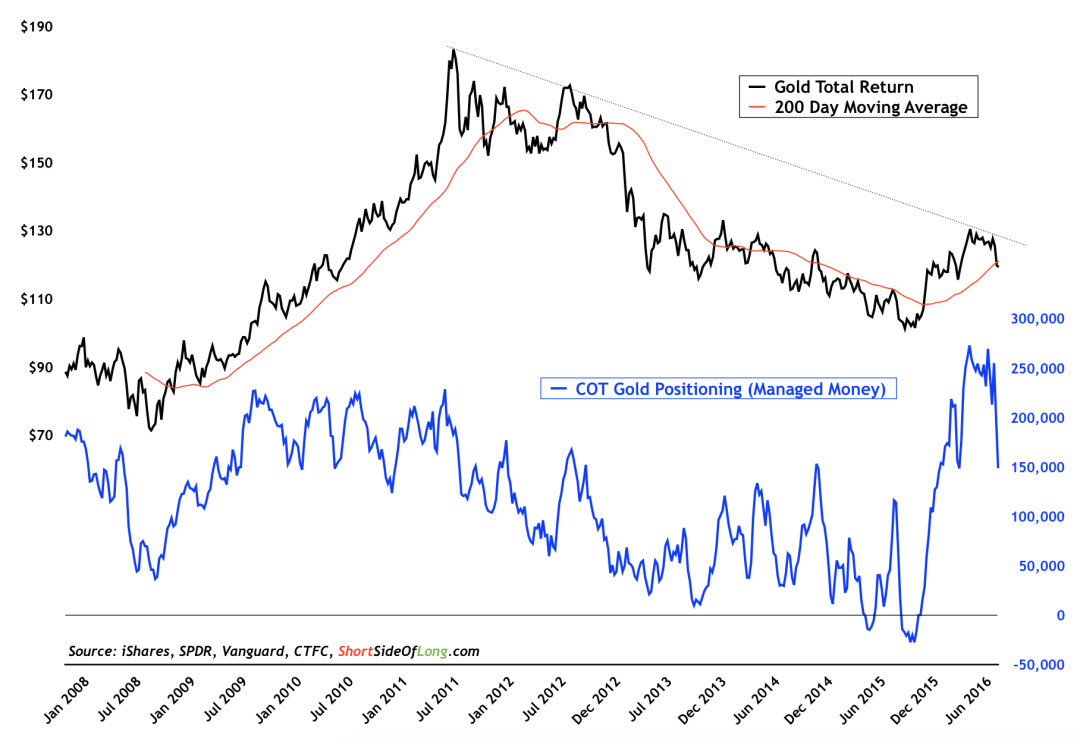

It is always wise to dig through the Commitment of Traders report, just to understand how other market participants such as hedge funds are positioning themselves. By observing the second chart, we can clearly see that hedge funds and other speculators held record net long positions just as the price of Gold was testing a very important downtrend line (and the mining companies were overstretched on the upside). Therefore, whenever optimistic sentiment reaches nose bleed levels, it should not come as a surprise to investors that a shake-out period might be just around the corner. Those who bought Gold, and other precious metal assets, late in the game are now being forced to sell.

Where to from here?

Last week's Gold and Silver COT reports showed a very large unwind of these long positions. However, sentiment hasn’t become so bad that its actually good from the contrarian perspective (just yet). We would like to see more consolidating, which sequentially should create a further unwinding of bullish bets.

This will definitely make us more interested to slowly start adding to our positions. However our Gold positions will have our undivided attention only if and when hedge funds turn net short again (like they did very late in 2015).