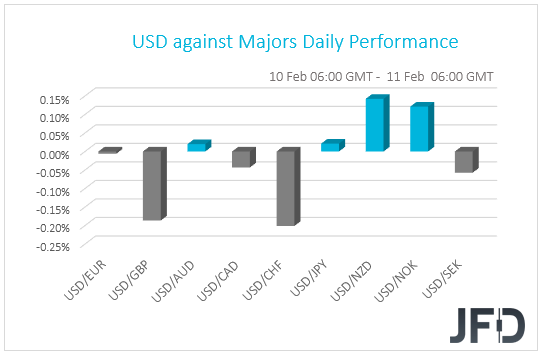

Yesterday was an eventful day economic data wise. Several countries, including China, Germany, Norway and the US, reported their inflation numbers for the previous month. Investors were keeping an eye on the US CPI figures, both core and headline ones. The core MoM and YoY CPIs showed slightly below their initial forecasts. The MoM one came out not only below the forecasted +0.2%, but also below the previous +0.1%, showing up at 0.0%. The YoY one came out at +1.4%, which is not a bad result, but still below the previous and the expected numbers. The core figure excludes food and energy prices, and last time the number was below +1.4%, was back in May and June, 2020. In regards to the headline readings, the MoM figure showed up as expected, at +0.3%. However, the YoY one failed to meet its forecast by a tenth of a percent, coming out at +1.4%. That said, the number was still better than the previous +1.3%.

The Federal Reserve is still hoping to see inflation around +2.0% over the longer run. As per the FOMC’s most recent statement:

“With inflation running persistently below this longer-run goal, the Committee will aim to achieve inflation moderately above 2 percent for some time so that inflation averages 2 percent over time and longer‑term inflation expectations remain well anchored at 2 percent. The Committee expects to maintain an accommodative stance of monetary policy until these outcomes are achieved.”

Jobs Remain A Big Concern For Powell

In regards to inflation and the FOMC, yesterday, Jerome Powell delivered a speech for the Economic Club of New York. Investors could hear concerns in his words about the state of the economy. Although he understands that higher inflation might become an issue later on, he tried to re-assure that the Fed has the necessary tools to tackle that. His current concern is unemployment. Although last week’s NFP number showed a rise by 49000 and the unemployment number fell to 6.3%, there are still many Americans, who are in desperate need of financial support, due to their lost jobs. He also mentioned that the biggest decline in jobs was seen among lower income workers, as employment among them decreased by around 17% since the pandemic began in March 2020. Employment among high earners over the same period of time fell only about 4%. But Jerome Powell that reassured that the Fed will keep the monetary policy accommodative, in order to support the economy and avoid the mistakes of the past.

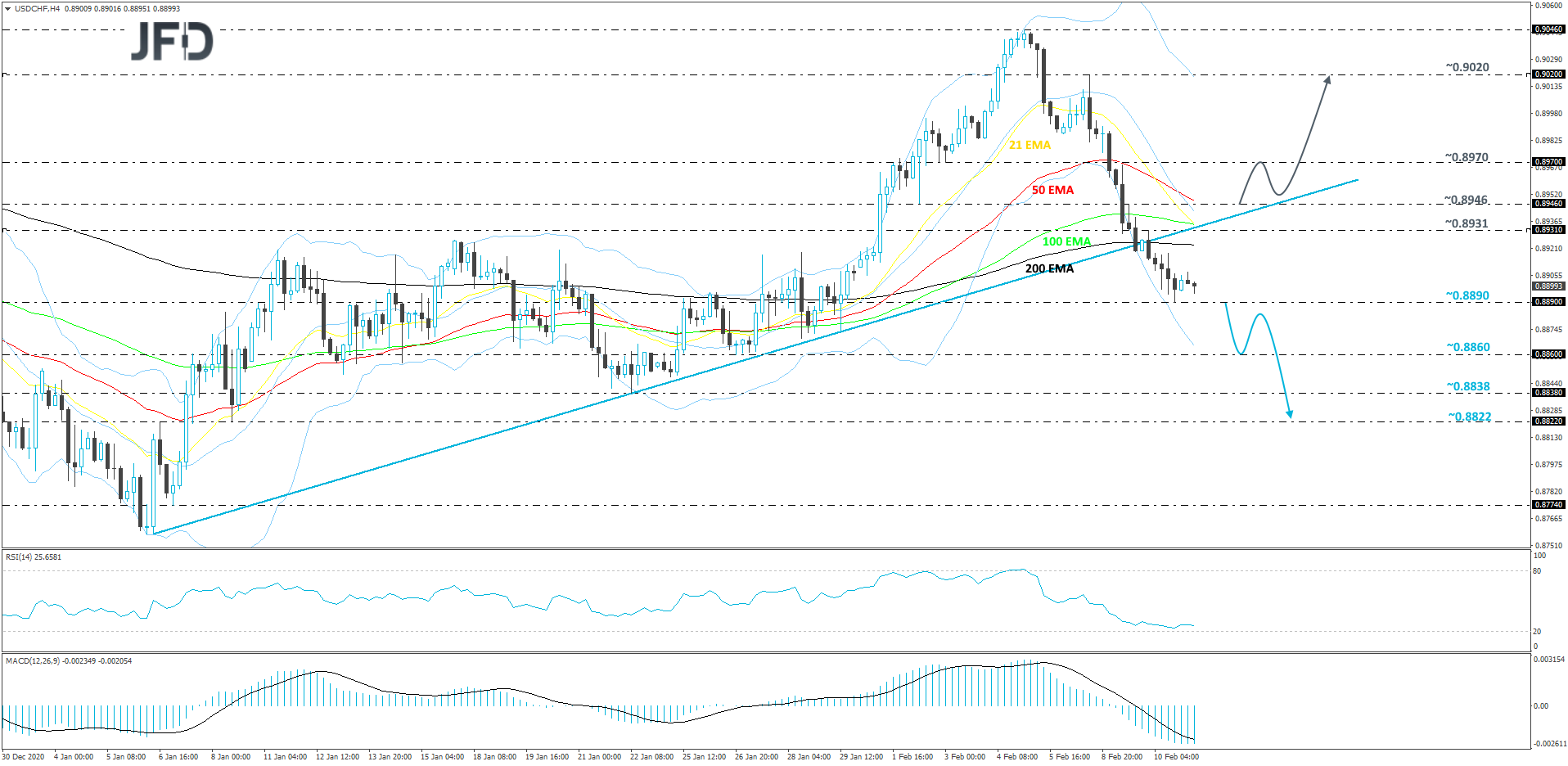

USD/CHF – Technical Outlook

From the end of last week, USD/CHF has been drifting lower and after breaking its short-term upside support line taken from the low of Jan. 6, the pair has turned red for the month. If the rate remains below that upside line and below all EMAs on the 4-hour chart, the near-term outlook could stay bearish for a while more.

If USD/CHF goes ahead and falls below the low of last week, at 0.8890, this will confirm a forthcoming lower low, potentially clearing the way towards the 0.8860 hurdle, marked by the low of Jan. 26. The rate might stall there for a bit, or even correct slightly higher. However, if the pair fails to climb back above the aforementioned upside line, this could result in another slide. If this time USD/CHF is able to break the 0.8860 obstacle, the next possible target may be the 0.8838 zone, or the 0.8822 level, marked by the lows of Jan. 22 and 8.

Alternatively, if USD/CHF climbs back above the aforementioned upside line and also moves above the 0.8946 barrier, marked by the low of Feb. 2 and an intraday swing high of Feb. 9, that might attract more buyers into the game. The rate could rise to the 0.8970 obstacle, a break of which may set the stage for a further push north, possibly aiming for the 0.9020 level, marked by the high of Feb. 8.

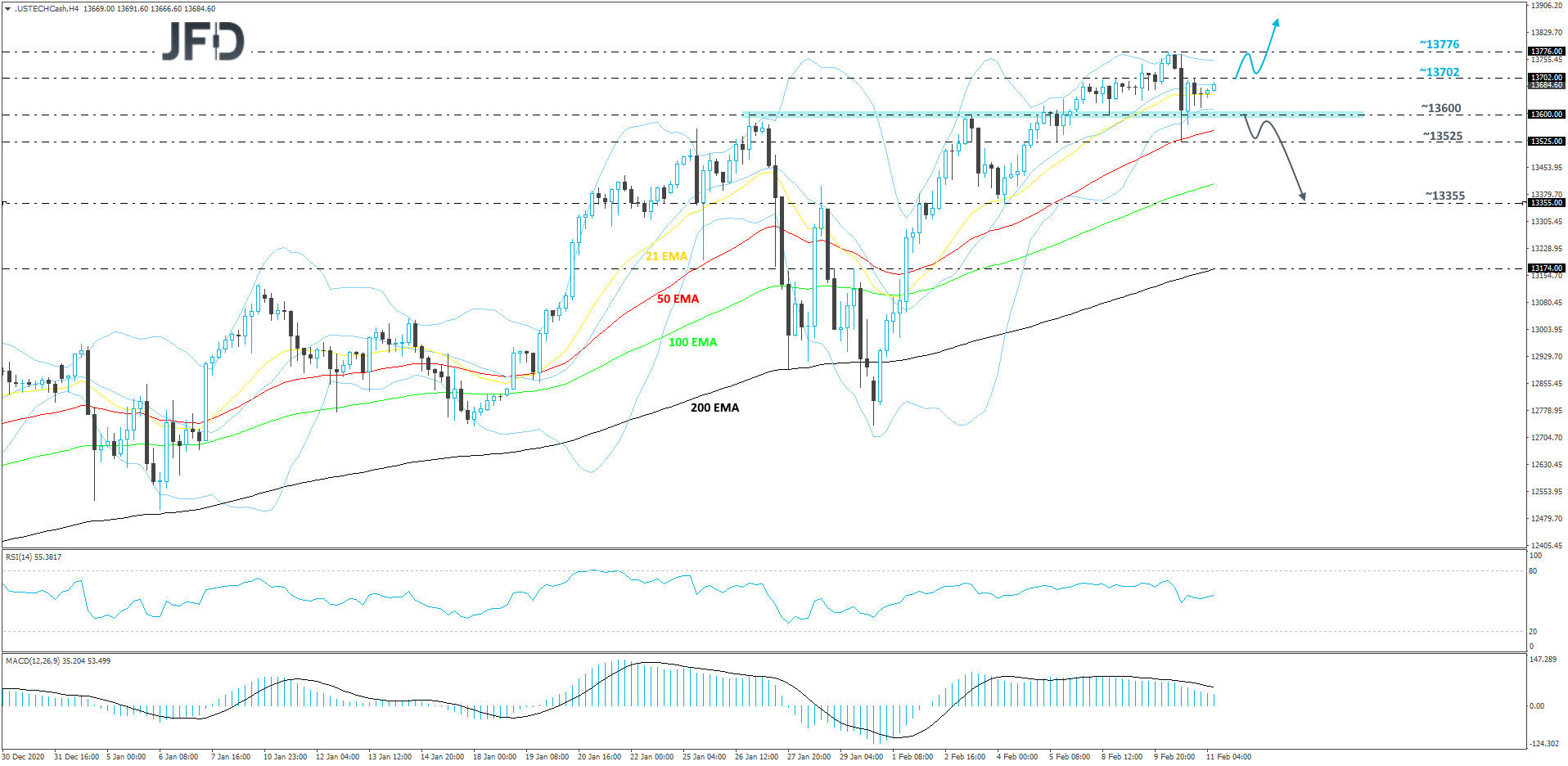

NASDAQ 100 – Technical Outlook

Despite declining yesterday, NASDAQ 100 remained above one of its key support areas, at 13600, which is marked near the highest point of January and the inside swing low of Feb. 8. However, given the slight weakness seen recently, we will wait for a clearer move above one of our resistance barriers, before targeting the upside again.

If the index pushes back above the 13702 barrier, marked by yesterday’s intraday swing high, that may invite a few more buyers back into the game, possibly clearing the way towards the current all-time high. That area is near the 13776 hurdle, which could provide a temporary hold-up. That said, if the buyers are still feeling comfortable, a break of that hurdle would confirm a forthcoming higher high and once again place the price in uncharted territory.

On the downside, if the price falls below the aforementioned key support area, at 13600, that might temporarily spook the bulls from the field. Nasdaq 100 could then slide to the 13525 zone, a break of which might set the stage for a move towards the 13355 level, marked by the low of Feb. 4.

As For The Rest Of Today’s Events

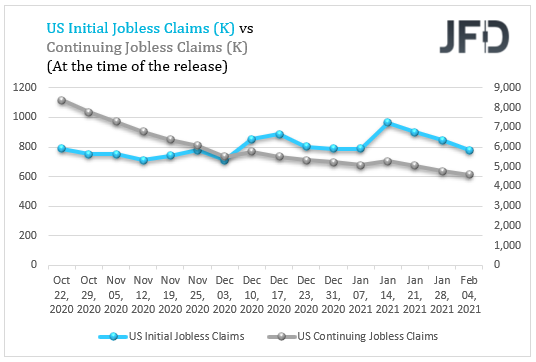

Today, investors will mainly monitor the data from the US, as we will be getting the jobless claims numbers for the previous week. The initial ones are forecasted to have declined fractionally, going from 779k to 775k. At the time of writing, there are no expectations for that indicator, but the number has been declining steadily.

Also, we will receive the Fed’s Monetary Policy Report, which is a semi-annual report submitted to the Senate Committee on Banking, Housing, and Urban Affairs and to the House Committee on Financial Services, along with testimony from the Federal Reserve Board Chair. In the previous report, delivered in June 2020, the Fed estimated that there will be an improvement of the real GDP in 2021. That said, the number would deteriorate over time going forward. However, the unemployment rate is expected to improve and by 2022 should be around 5%. PCE inflation should also improve and eventually stabilize near +2.0%. The Fed funds rate should remain within its current range, between 0 and 25 bps, all the way till the end of 2021. But in the previous report it showed that the range is widening, meaning that changes could be expected.

Japanese and Chinese markets will be closed on Thursday. Japan will celebrate National Day and China will celebrate the Chinese New Year.