I usually reserve these updates for those who subscribe to the newsletter only, but today I posted it on the blog as well.

Chart 1: Recent purchases include Silver and Chinese equities

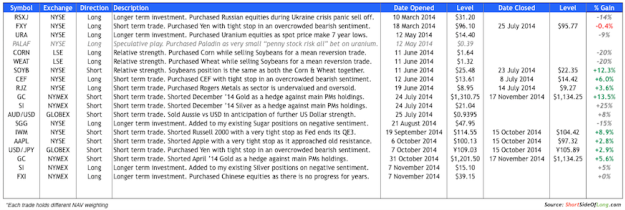

Here is a quick update on the recent changes to this portfolio as well as new purchases as of Friday's US trading times. As already explained in the previous portfolio update as well as this post from 16th of October , I covered all of my equity market shorts (Russell 2000 and Apple (NASDAQ:AAPL) while closing out a Japanese yen long. Since I’ve already reviewed the small caps shorts, I won’t go into it here. I will say that I was particularly amazed at the relative strength of Apple, as its tape refused to go down while the whole S&P 500 fell almost 10% and the VIX jumped above 30.

To me, it was a one of the major signals that the stock (as well as the market) wanted to go higher. it seems that bears missed this hint. Fortunately, I was smart enough to cover my shorts but wasn’t exceptionally smart to buy Apple. As Jesse Livermore famously said, if it doesn’t want to go down, most likely it will go up. Well, Apple's currently up more then 10% since I covered.

Chart 2: While hedge funds hold shorts, I’m adding to existing holdings

Regularly readers will remember that I opened shorts on gold and hedges on silver during July of this year at $1310 and $21 per ounce, respectively. I also did a quick update on the blog, notifying readers that I opened up yet another short on gold at $1201 at the beginning of the month, in anticipation of prices breaking to new lows.

Prices have been in a mini-liquidation phase as of late, where I’ve discussed incredibly oversold conditions as well as extreme bullish sentiment on the Dollar. I alerted readers yesterday via a chart that Silver has an important support level at $15. Therefore, I placed my own buy orders at $15.00 as well as $15.10. While the first didn’t get triggered, the second did.

At the same time, I decided to cut all of my gold shorts, while still holding silver hedges from July of this year. As stated before, I will only take away that hedge once I am 100% certain silver has bottomed properly and is restarting a new bull run. At this moment, I still believe that after a rebound (which is in progress now), there could be more downside left in the PMs sector.

Chart 3: In anticipation of a possible breakout, I’ve started buying China

I’ve also been discussing Emerging Market equities for a while now. I am attracted to them because, unlike the S&P 500, they have dramatically under-performed over the last 5 to 7 years. Furthermore, unlike the Eurozone, which has also under-performed as well, Emerging Markets have the potential for very strong growth rates in coming years and even decades.In particular, readers might remember that I discussed China in early September of this year, including its extremely cheap valuations.

I’m not an expert trader, but to me the tape is signalling that there is a very good probability of an upside breakout in the MSCI China (refer to Chart 3). We have an overhead resistance and a series of higher lows, which look like accumulation. Prices have gone sideways since middle of 2009, so a major move could be in the cards soon. My stop loss is below the triangle pattern, so if the price was to break down from current levels, I would most likely close the trade and step aside until I am ready to buy again.