UK Treasury Chief, George Osborne hit the newswires last night with quotes warning that a British exit from the European Union could have potentially catastrophic economic consequences to not only business, but by making regular households poorer.

When you start going down the ‘Mums and Dads’ path, the lines between politics and fact get a little blurry and while his interpretation of the numbers could well be correct, the Brexit campaigners have jumped all over the comments with this blurry argument.

Following new government analysis, Osborne has said that the UK economy could well be about 6% smaller by the year 2030 if Britain was no longer a member of the EU and lost the free trade benefits that come with it.

“That is a loss of income equivalent to GBP4,300 a year for every British household.”

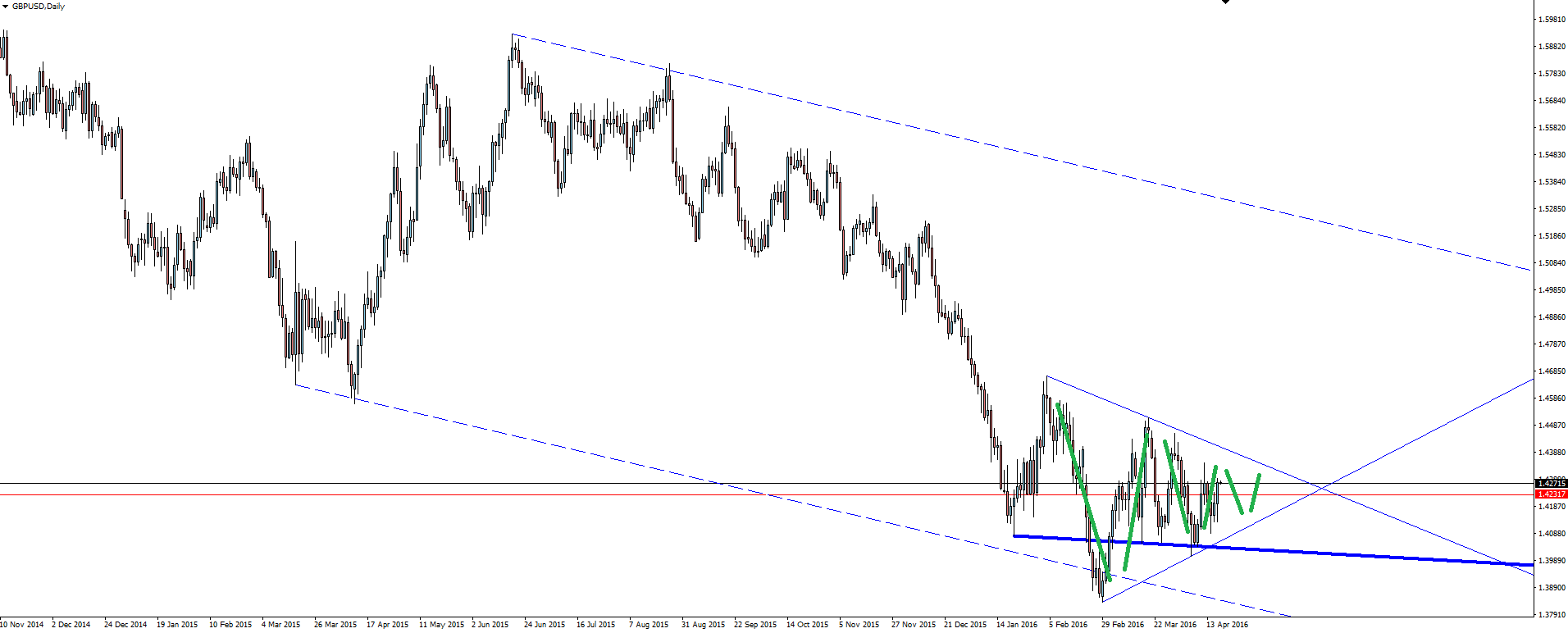

GBP/USD Daily:

Just massive indecision when you look at where cable is sitting on the daily. How do you even begin to pick a direction out of this chart…

You can make an argument that this is possibly a bounce off channel support and a possible trend change is in progress, but in a long term bearish trend and with the political and economic uncertainty of a Brexit hanging over the pair, it’s drawing quite a long bow.

Interestingly, one phone based poll from the Guardian phone has shown ‘Remain’ having an eight-point lead over ‘Leave’, while another online poll also for the same paper has shown Remain and Leave neck and neck. Is that a representation of the generational difference in voting?

While the pair is in the news, and I still have an inkling that fundamentally we’re going to continue to drift lower, there are probably much better trading opportunities across the majors elsewhere.

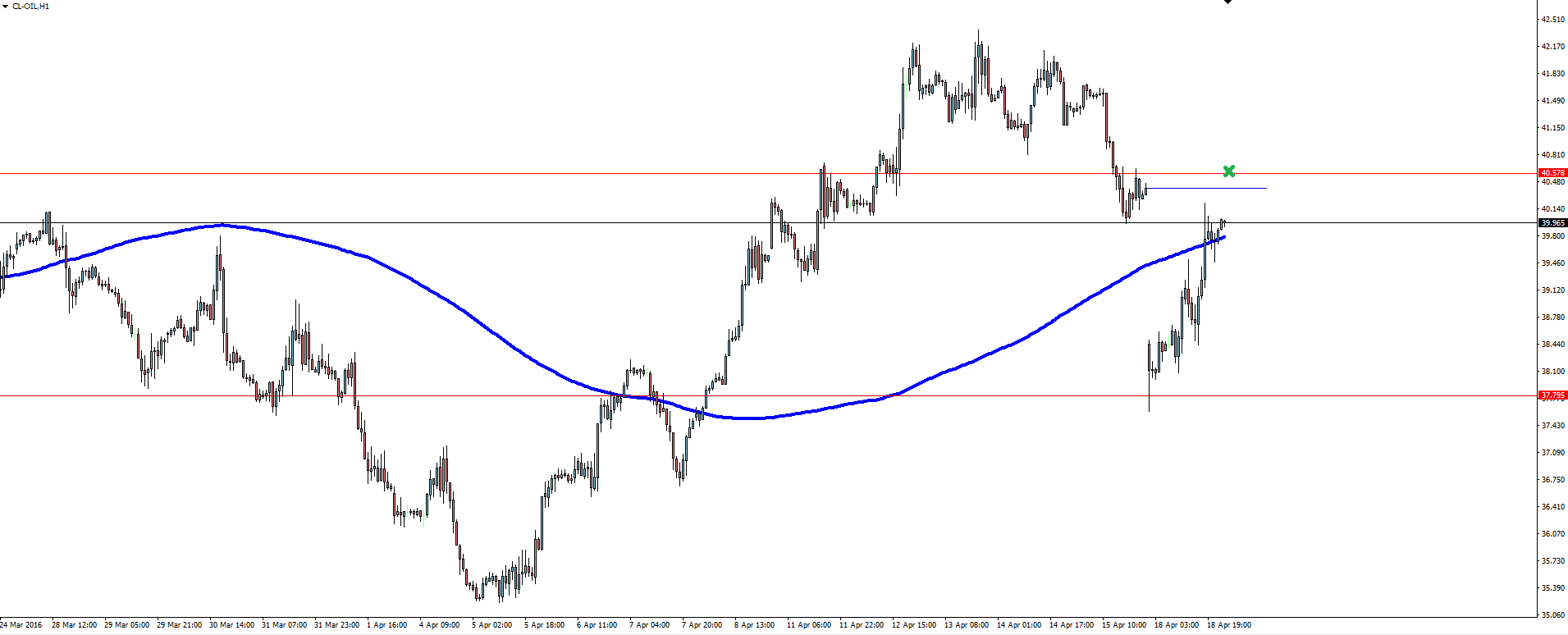

Chart of the Day:

We yesterday talked about the gap down in oil and how we really ran out of time and candles to get into a short position.

Oil Hourly:

Looking at our charts today and price has come back to almost close to the gap. The gap that just happens to coincide with the 200 SMA resistance on the daily chart and area where we were looking for a retest to get short off of anyway.

Is this a coincidence? Could be our chance to get short here.

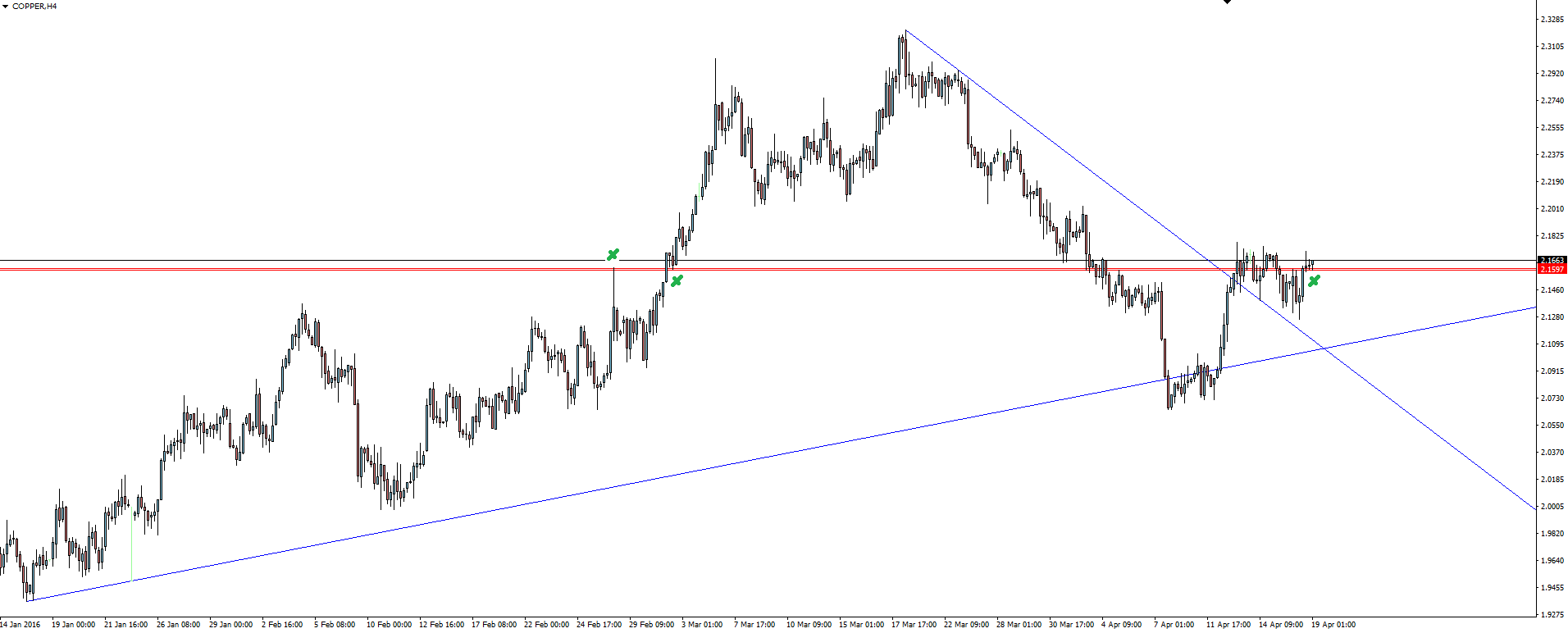

Copper 4 Hourly:

With commodities in focus recently, copper is currently sitting at a significant level that has seen reaction in the past. I really like the price action where we have had a momentum move through the level, then a retest with yet more momentum straight out of the broken level again.

Are you a commodities trader who trades some of the less loved markets such as these?

On the Forex Calendar Tuesday:

AUD Monetary Policy Meeting Minutes

EUR German ZEW Economic Sentiment

USD Building Permits

AUD RBA Gov Stevens Speaks

GBP BOE Gov Carney Speaks

CAD BOC Gov Poloz Speaks

NZD GDT Price Index

DISCLAIMER: In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, Forex news, research, prices or other information is provided as general news and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness, Vantage FX RAW ECN broker shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.