Doha Disappointment:

Last week, we spent most of our time questioning whether oil had gone too far, and how we could possibly take advantage of the mismatch between market expectations and what a realistic outcome may be.

From last week’s Commodities Soaring post:

“I might sound like a broken record talking about oil this week, but I really do see it as an excellent trading opportunity. Anyone reading this blog knows that I like to look for trading opportunities where market expectation has a chance to disappoint, and who better to rely on for market disappointment than Saudi Arabia and Iran talking oil!”

“No matter how I look at it, I just can’t see any sort of positive surprise from the talks. The oil market has essentially set itself up to be disappointed no matter the outcome.”

After talks that dragged on for ten hours over their scheduled conclusion, Saudi Arabia, Russia, Iran and friends were unable to come up with anything even remotely resembling a solution that would limit supply to support the price of oil.

That above Bloomberg article I’ve linked to is well worth the read, but the bottom line is that this is purely political jostling between nations with more pride than monetary sense. Iran won't budge on any production freeze until they reclaim their pre-sanction market share. To them, the price they are selling at really just doesn’t matter right now.

Add in Saudi Arabia who don’t want to be seen as letting their neighbour gain any sort of political upper hand won't put pen to paper in response. That’s just how it is, and where trading opportunity was presented to us.

For myself, this was a frustrating one because the scenario I wanted actually played out, but there’s no way I was holding any sort of oil short over the weekend and in the end we just ran out of time and candles.

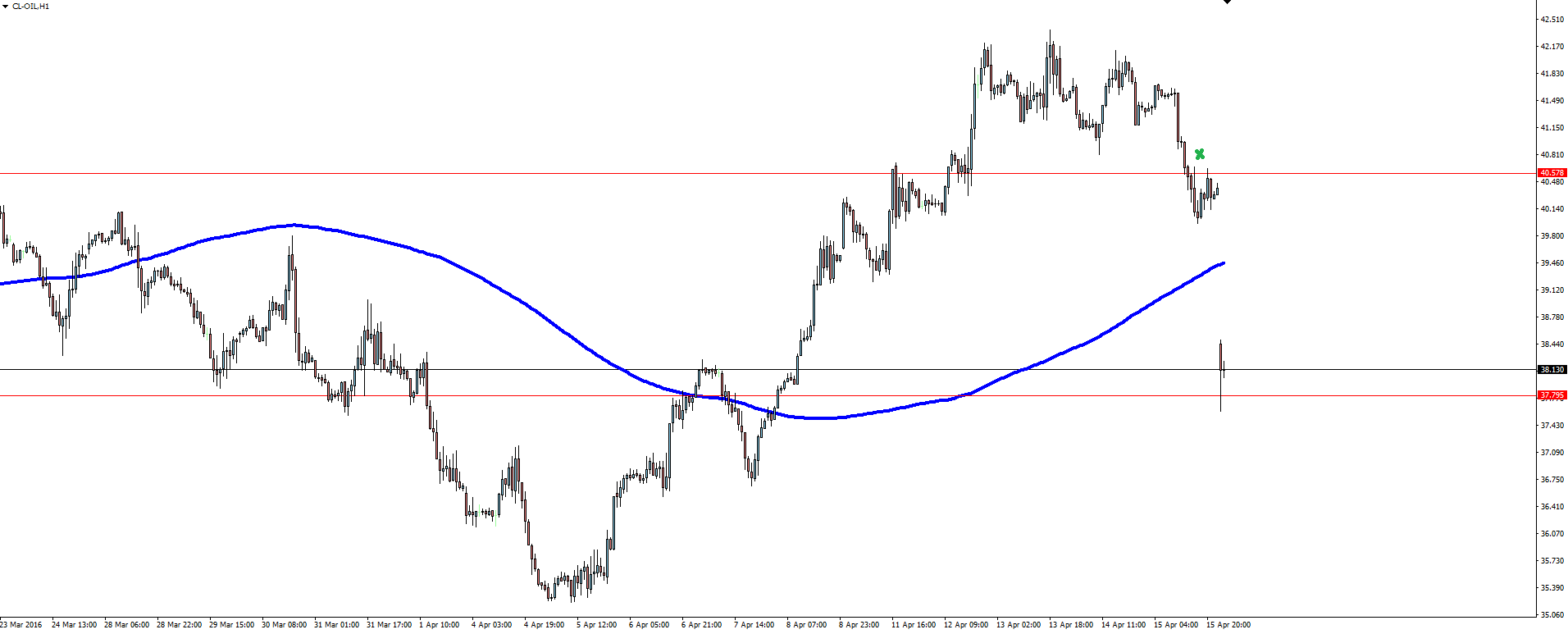

We got the failure at the higher time frame resistance level, the re-test at a lower time frame support/resistance level, then finally the weekend and the huge gap down which represented the re-pricing between market expectations and reality that has now set in.

Chart of the Day:

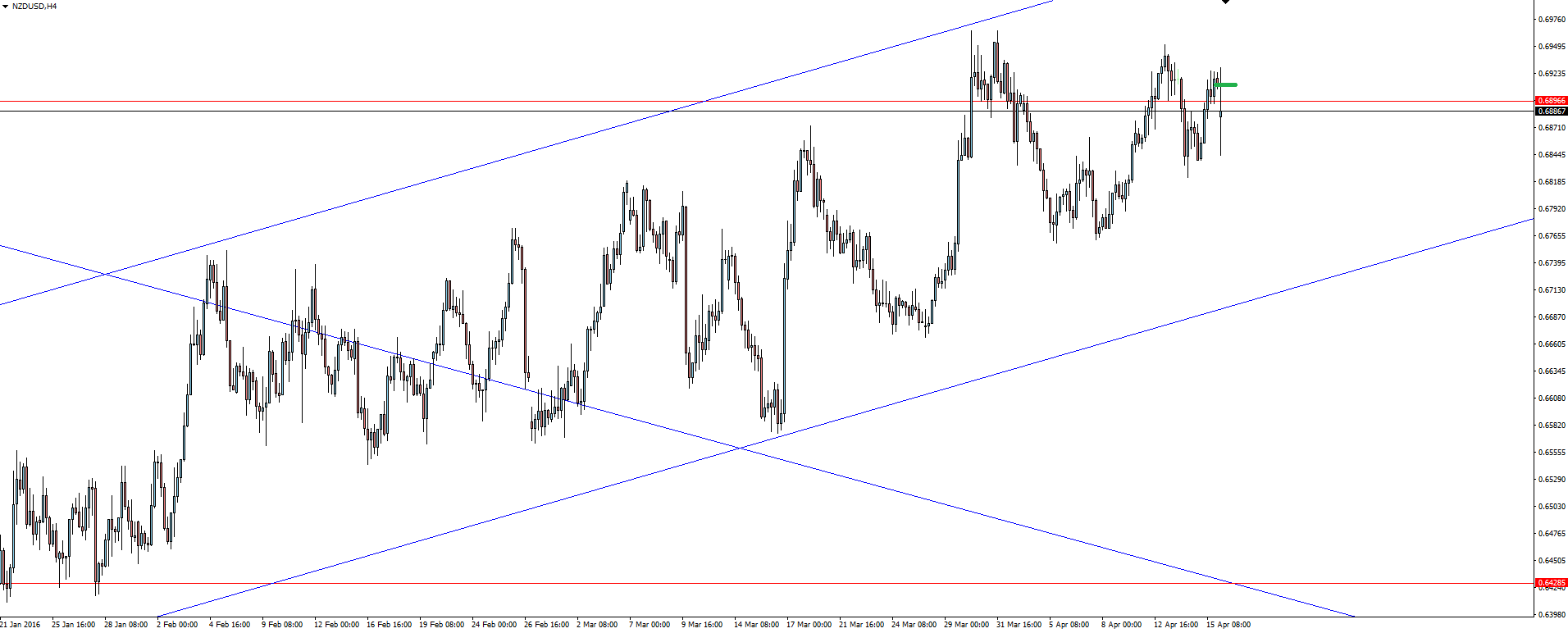

It’s gap city wherever you look across forex markets too, but with early Monday kiwi inflation data beating expectation, NZD/USD is one that has already filled itself in.

I’ve included the 4 hourly chart here as price is channelling up nicely, but is stalling at the horizontal zone top we have drawn in on the daily chart.

This channel could easily be perceived as a higher time frame bear flag rather than the bullish channel that it looks when you zoom in, so this 0.69000 level is hugely significant for the direction in which we want to continue trading this pair in.

On the Calendar Monday:

NZD CPI q/q (0.2% v 0.1% expected)

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, prices or other information is provided as general news and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness, and Australian Forex Broker Vantage FX on the MT4 Forex platform, shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.