Last week, we discussed “Navigating What Happens Next,” and set out to answer 3-important questions:

- Is the correction over?

- Is this a buying opportunity?

- Has the decade long bull market ended?

We also included a set of “rules to follow,” based on our analysis. You will find them posted again at the bottom of this piece.

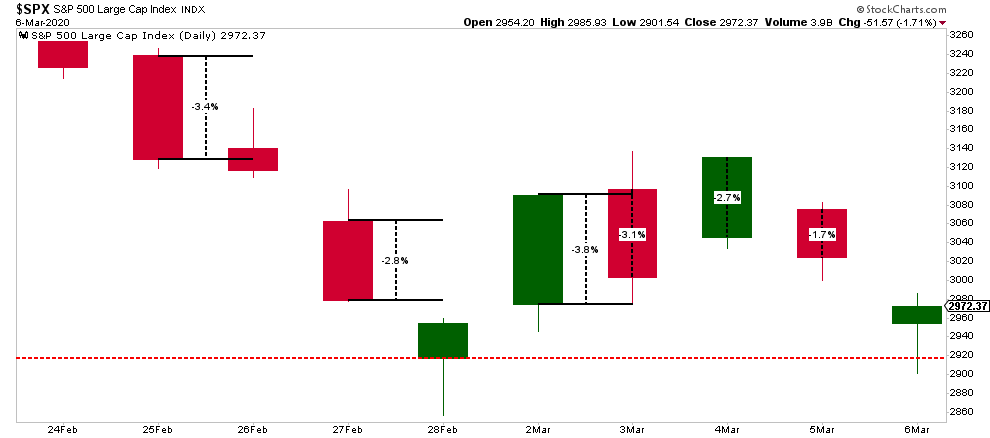

Importantly, while we have adhered to our investment process and discipline, to protect capital while participating in the markets, the volatility over the last couple of weeks has been unnerving to say the least. The S&P 500 chart below shows the daily percentage swings.

With markets swinging wildly by 2-3% daily, it has been more nauseating than the 418-foot drop of the Kingda Ka roller coaster in Jackson, NJ. While it seems like last week was another “horrible” week for the market, it actually ended slightly above where we ended last week.

It’s important to keep some perspective with respect to your portfolio management, particularly when volatility surges. Emotions are the biggest risk to your investments, and capital, over time.

We Really Don’t Know

While we laid out a fairly detailed game plan last week, looking a daily, weekly, and monthly indicators, the reality is that we don’t know with any certainty what happens next, particularly when you have an exogenous situation like “COVID-19.”

However, we agree with Carl Swenlin that you can’t rule out a “bear market” has now started, like we saw in 2018, and the highs of the year are in.

“Even though it is not officially a bear market, I think we should begin to interpret charts and indicators in the context of a bear market template.”

We agree, particularly within the scope of the comments made by my colleague Doug Kass on Friday morning:

“The proximate cause for the precipitous drop in yields is the spread of the coronavirus – which is delivering a body blow to global economic growth (which will come to a standstill in the months ahead).

In all likelihood, world GDP growth will likely be flat over the next few months – to unnaturally low levels of activity. To be sure some segments of the economy (in this reset) will not recoup sales and will have a permanent loss, i.e., hotels, travel, etc.

However, other segments of the economy – like technology – will likely recoup almost all the growth delayed by the coronavirus shock.

The next few months will be challenging from an economic standpoint and volatile from a stock market perspective. Moreover, evolving market structure issues will introduce more uncertainty – and likely deliver a continuation of the extreme volatility seen since mid-February.”

We agree with Doug’s view and have spent the last month moving OUT of areas like Basic Materials, Industrials, Discretionary, Energy, Transports, and Financials.

While financials don’t have as much direct “virus” related risk, the risk to major banks is two-fold:

- The collapse in “net interest margins” as the Fed cuts rates; and

- Potential for a wave of corporate-debt defaults coming from the economic slowdown/recession, particularly in the Energy sector.

The second point was noted by Mish Shedlock on Friday:

“There is a credit implosion coming up. A lot of leveraged drillers and crude suppliers dependent on prices above $50/bbl are going to facing credit defaults.

This will lead to a deflationary outcome. But you can blame the Fed.

Deflation is not really about prices. It’s about the value of debt on the books of banks that cannot be paid back by zombie corporations and individuals.”

Collapsing yields, oil prices, and “emergency rate cuts,” are signs which suggest something has “broken” in the economy. These ramifications are not inconsequential. My friend Eric Hickman, of Kessler Investment Advisors, sent me an excellent note on Friday:

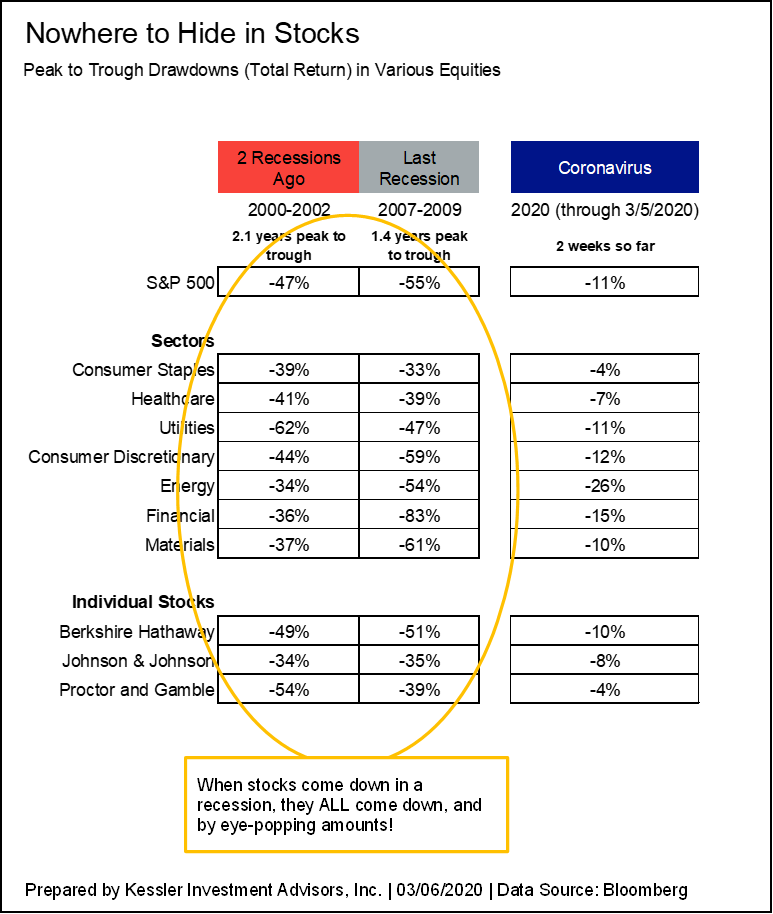

“Unsurprisingly, I think that the Coronavirus is the catalyst to tip the U.S. into a recession. We all know that recessions are not good for stocks, but by how much, and which ones?

The last two recessions hit all sectors of the S&P 500 significantly. Even so-called “defensive sectors” like consumer staples and healthcare got hit by at least a third of their value (33%). We are just two weeks, and 11% away from an all-time high in the S&P 500. There is plenty of downside left.”

He is right.

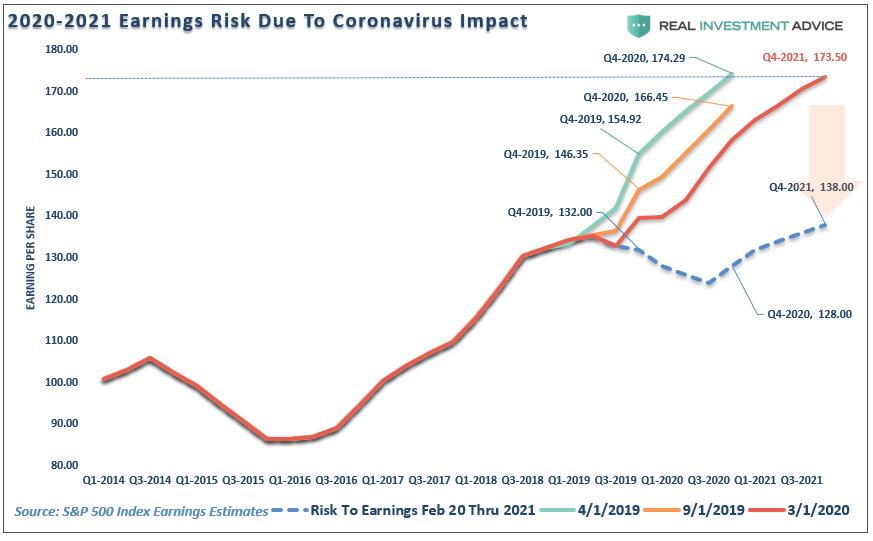

What we know, with almost absolute certainty, is that we will be in an economic recession within the next couple of quarters. We also know that earnings estimates are still way too elevated to account for the disruption coming from the COVID-19.

What we DON’T KNOW is where the ultimate bottom for the market is. All we can do is navigate the volatility to the best of our ability and recalibrate portfolio risk to adjust for downside risk without sacrificing the portfolio’s ability to quickly adjust for a massive “bazooka-style” monetary intervention from global Central Banks if needed.

This is why, over the last 6-weeks, we have been getting more “defensive” by increasing our CASH holdings to 15% of the portfolio, with our 40% in bonds doing the majority of the heavy lifting in mitigating the risk in our remaining equity holdings.

Regardless, of the hedges and cash, the portfolio management process over the last two weeks has not been pretty and has frayed our nerves. (Despite our best efforts, we are still subject to human emotions). However, for the year, the Sector Rotation model is down 1.7% versus 9% for the S&P 500.

That is volatility we can live with.

Back To Selling Rallies

“At market extremes you are trading nothing but psychology. So…is it time to sell panic? Or is the hysteria just beginning? What’s your time frame? What’s your pain threshold? Volatility has exploded as liquidity has vanished. Bid/offer spreads are wide but not deep. Credit spreads are widening. Here are some stats from the past week:

- The 10-year UST yield has dropped from ~1.6% to ~0.8% in just 12 trading sessions.

- Gold is up ~$100,

- WTI is down ~$12 (a 4 year low,)

- S&P is down ~500 points, and

- The U.S. Dollar Index has tumbled from a 2 year high to a 1 year low.

- The CNN Fear/Greed barometer is at 5.“ – Victor Adair, Polar Futures Group

I have been in this business for a long-time and have rarely seen moves this extreme in a two-week period. For the average investor, it is nearly impossible to stomach. It is times like these, which we have repeatedly warned about, that “buy and hold” strategies become “How Do I Get Out?”

Last week, we discussed the risk with our RIAPro Subscribers:

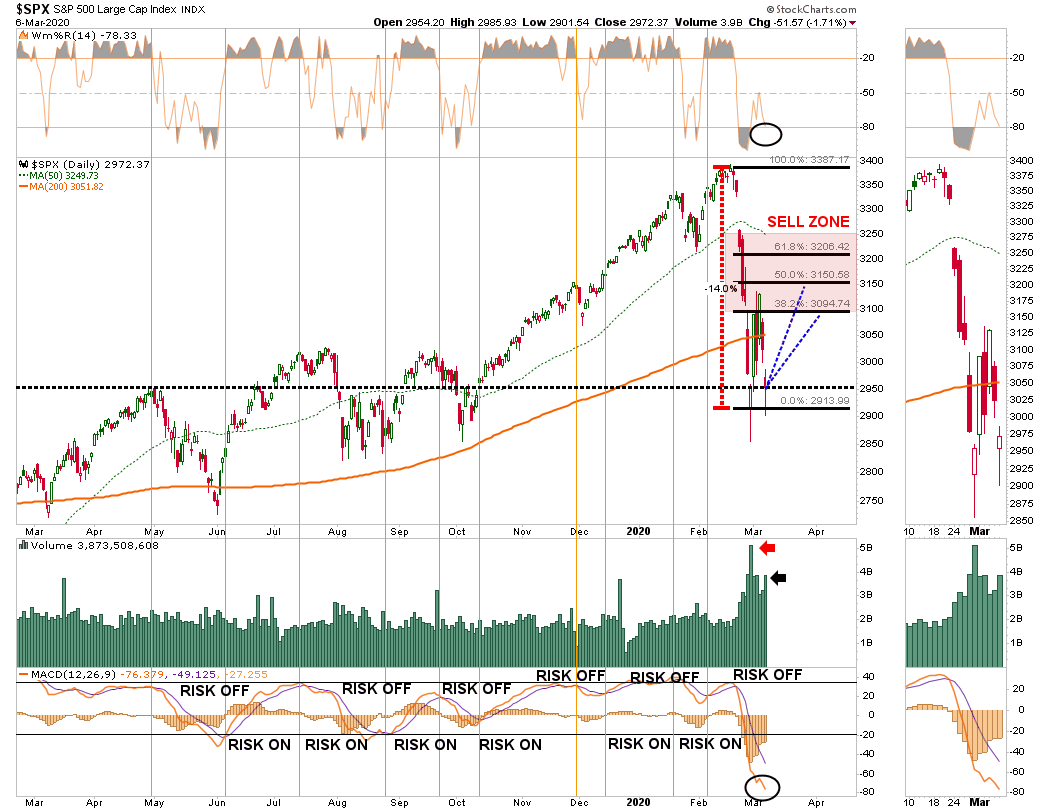

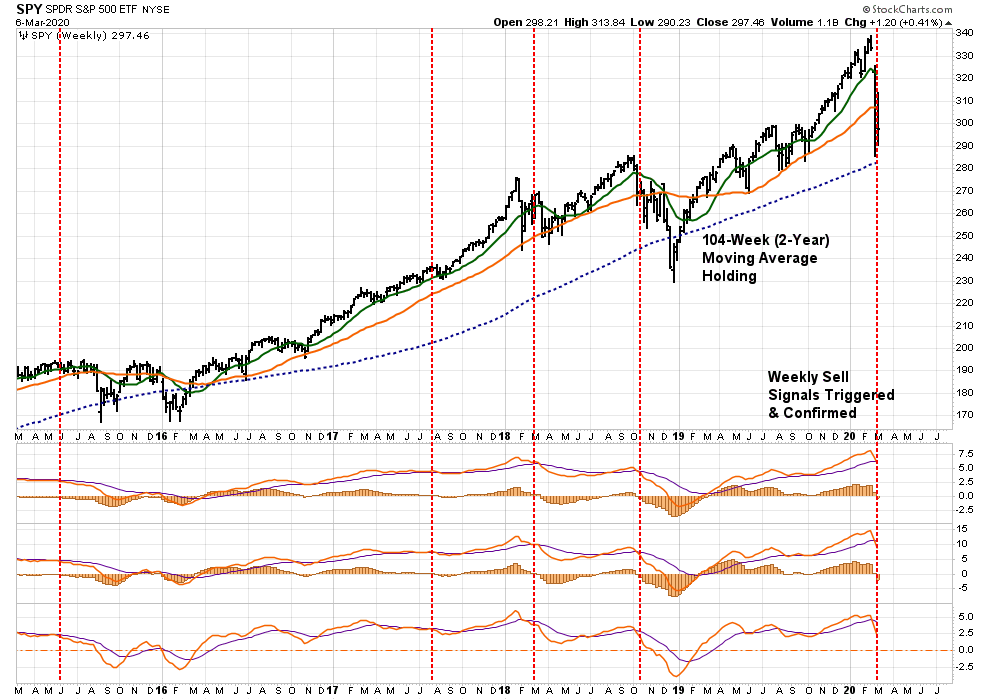

“With the markets extremely extended to the downside so a reflexive rally is likely. However, SPY (NYSE:SPY) will trigger a sell signal in the lower panel suggesting that any initial rally will fail and retest of support is likely.”

That is exactly what happened this past week. While we will likely get another reflexive rally in the next week or so, any advance will be one of your better opportunities to raise cash, and reduce overall equity risk, for the time being.

The “equity exposure” in our portfolio models is driven by a series of “weekly signals” which we use to control risk. Importantly, it requires a “confirmation” of the indicators to adjust risk exposure in portfolios accordingly.

On Friday, the markets confirmed that risk exposure in portfolios should be reduced lower for now. Fortunately, we have been reducing risk over the last 6-weeks, as noted above, but the signals have now confirmed our previous actions were correct. If the market breaks the 2-year moving average, we will need to substantially reduce risk further.

As I said above, I am reprinting our rules from last week to use on any rally into the “sell zone” over the next week.

These are the same rules we use to reduce the risk in our portfolio management process, with the exception of #7.

- Move slowly. There is no rush in making dramatic changes. Doing anything in a moment of “panic” tends to be the wrong thing.

- If you are over-weight equities, DO NOT try and fully adjust your portfolio to your target allocation in one move. Again, after big declines, individuals feel like they “must” do something. Think logically above where you want to be and use the rally to adjust to that level.

- Begin by selling laggards and losers. These positions were dragging on performance as the market rose and they led on the way down.

- Add to sectors, or positions, that are performing with, or outperforming the broader market if you need risk exposure.

- Move “stop-loss” levels up to recent lows for each position. Managing a portfolio without “stop-loss” levels is like driving with your eyes closed.

- Be prepared to sell into the rally and reduce overall portfolio risk. There are a lot of positions you are going to sell at a loss simply because you overpaid for them to begin with. Selling at a loss DOES NOT make you a loser. It just means you made a mistake. Sell it, and move on with managing your portfolio. Not every trade will always be a winner. But keeping a loser will make you a loser of both capital and opportunity.

- If none of this makes any sense to you – please consider hiring someone to manage your portfolio for you. It will be worth the additional expense over the long term.

In the short-term, there is no need to take on exceptional risk. It is time to take precautionary measures and tighten up stops, add non-correlated assets, raise cash levels, and hedge risk opportunistically on any rally.

As noted last week, this just our approach to controlling risk.

The only unacceptable method of managing risk at this juncture is not having a method to begin with.