Thursday afternoon was special because that’s when the data for our Fed Spread came out. Considering all the mayhem going on, I was particularly looking forward to it. Spoiler alert: an anti-climax awaits you.

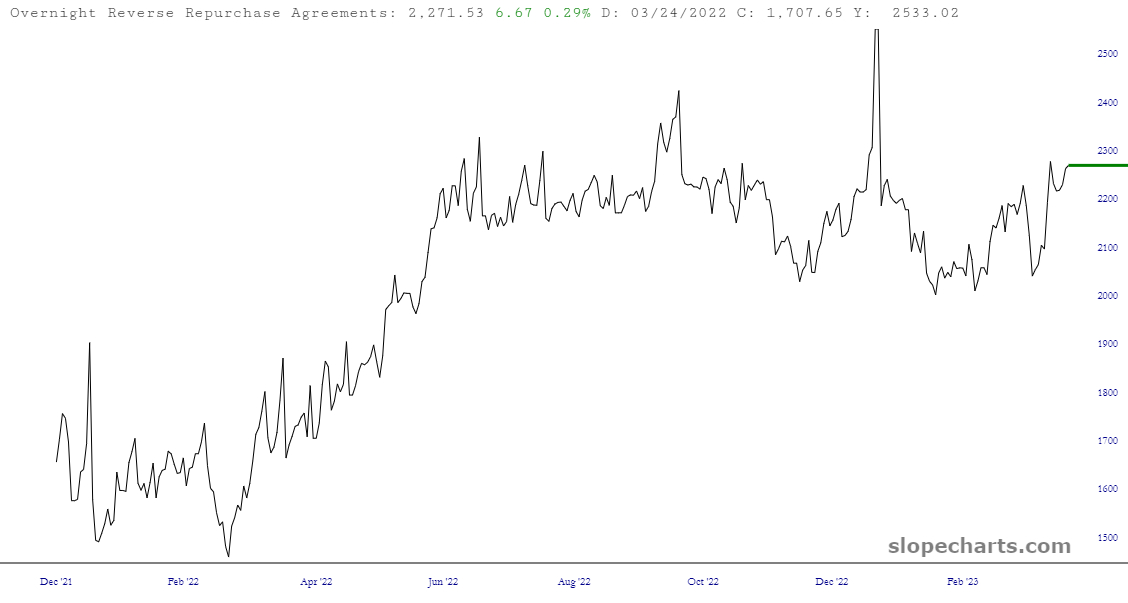

Here’s the reverse repo, which bumped up a hair:

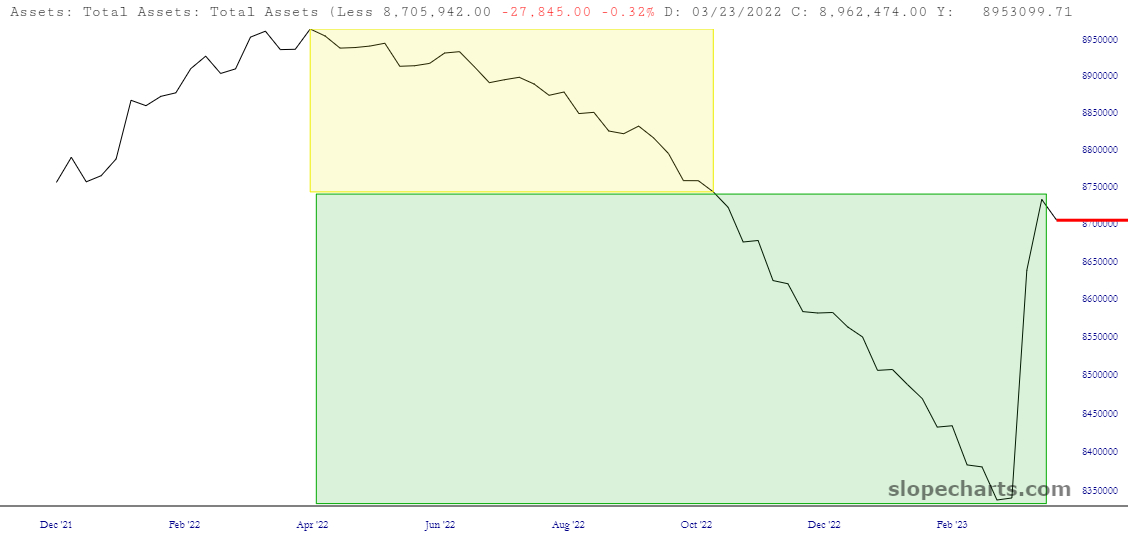

The total assets held declined by almost $28 billion, which means QT has returned in a tiny way for now.

The balance sheet’s plunge accelerated.

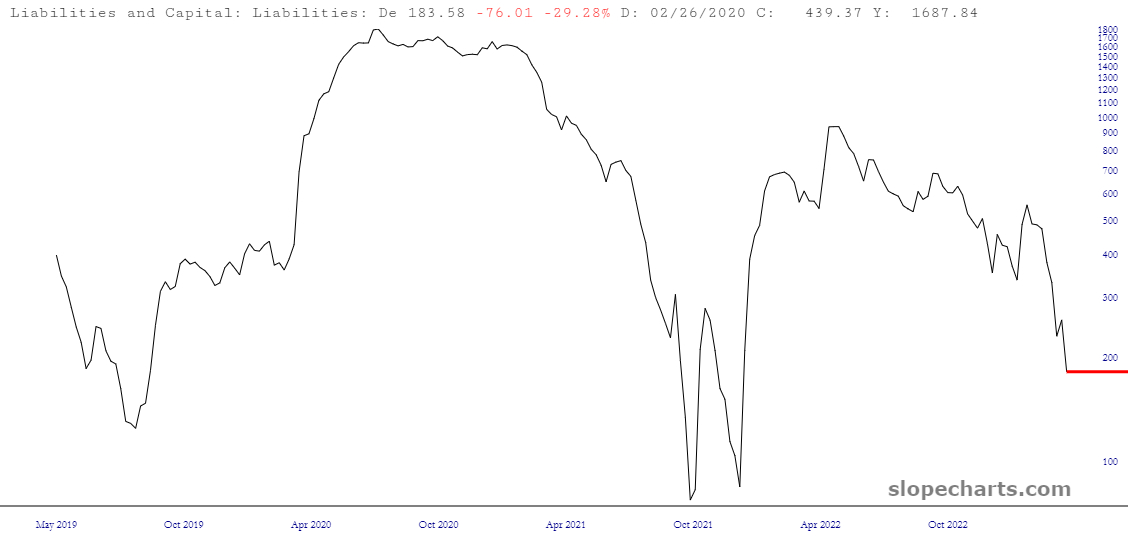

Smash ’em all together, and you get an S&P 500 target 57 points higher than last week at 4063.

And that, folks, is almost PRECISELY where we’re already at. In other words, if we accept the premise that Fed liquidity is now the one and only thing determining the price of this so-called “market,” then we’re in a state of equilibrium. Boring.

So it’s all up to the PCE at this point, which is announced an hour before the opening bell. Come in cold, and the bulls are probably going to launch this market into turbo mode.

Come in hot, and maybe people will decide the Fed’s hands are still tied, and the bears will get a new lease on life.