We expect PayPal Holdings, Inc. (NASDAQ:PYPL) to beat expectations when it reports second-quarter 2017 results on Jul 26.

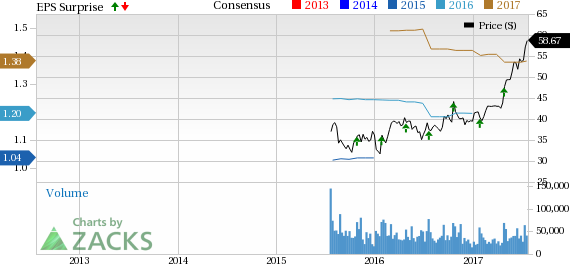

Last quarter, earnings of 36 cents per share surpassed the Zacks Consensus Estimate of 33 cents. Also, earnings were up 12.5% year over year. The company has a decent earnings track record. In the trailing four quarters, the stock surpassed the Zacks Consensus Estimate twice while matching the same on the other two occasions, delivering an average positive surprise of 4.13%.

In the first quarter, the company’s revenues of $2.98 billion were up 16.9% on a year-over-year basis (up 19% on an Fx-neutral basis) and beat Zacks Consensus Estimate of $2.93 billion.

Its shares have massively outperformed the S&P 500 on a year-to-date basis. While the index gained 10.7%, the stock returned 48.6%. We believe that the company’s strong performance in global payments, both online and mobile, and an increase in strategic partnerships are growth drivers.

Let's see how things are shaping up for this announcement.

Why a Likely Positive Surprise?

Our proven model shows that PayPal is likely to beat on earnings because it has the right combination of the two key components.

Zacks ESP: PayPal currently has an Earnings ESP of +3.13%. This is because the Most Accurate estimate stands at 33 cents per share, while the Zacks Consensus Estimate is pegged a penny lower at 32 cents per share. A favorable Earnings ESP serves as a meaningful and leading indicator of a likely positive earnings surprise. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: PayPal currently carries a Zacks Rank #2 (Buy). It should be noted that stocks with a Zacks Rank #1 (Strong Buy), 2 or 3 (Hold) have a significantly higher chance of beating earnings. Conversely, stocks with a Zacks Rank #4 or 5 (Sell rated) should never be considered going into an earnings announcement.

The combination of PayPal’s Zacks Rank #2 and a positive ESP make us reasonably confident of an earnings beat.

What's Driving the Better-than-Expected Earnings?

PayPal’s strong product portfolio that includes solutions like Venmo, One Touch and Xoom are helping the company acquire customers on a regular basis.

Notably, the company’s One Touch solution gained 53 million consumers in the last reported quarter. Moreover, Wells Fargo’s (NYSE:WFC) decision to support in-store transactions indicates the growing clout of the company in the financial transaction market. Also, PayPal’s social P2P payment platform– Venmo– is likely to boost its customer base due to its new features in the to- be-reported quarter.

PayPal is a two-sided platform, which provides it with a significant competitive advantage. Moreover, it expands its total addressable market as the company focuses on bringing more customers who are using online payments option. This is evident from the fact that net new active accounts grew 6 million in the first quarter to 203 million active accounts.

Additionally, strategic partnerships with multiple original equipment manufacturers (OEM), technology companies, mobile-carriers, retailers and financial institutions are a positive.

Other Stocks Worth Considering

Here are a few companies that you may also want to consider as our model shows that these have the right combination of elements to post an earnings beat in their upcoming release:

IPG Photonics Corporation (NASDAQ:IPGP) with an Earnings ESP of +3.07% and Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Kemet Corporation (NYSE:KEM) with an Earnings ESP of +11.11% and a Zacks Rank #1.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

Wells Fargo & Company (WFC): Free Stock Analysis Report

PayPal Holdings, Inc. (PYPL): Free Stock Analysis Report

Kemet Corporation (KEM): Free Stock Analysis Report

IPG Photonics Corporation (IPGP): Free Stock Analysis Report

Original post

Zacks Investment Research