The recent run up to new highs in both the S&P 500 and the NASDAQ 100 came to an abrupt halt last week, and our Risk Gauges flipped negative in short order. It is also important to note the selloff in the SPY was not overdone and has a lot more potential downside.

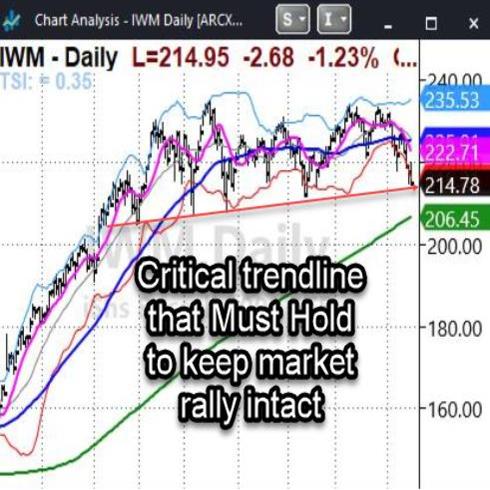

Even more critically, IWM looked extremely vulnerable, which was testing a well-formed valid 6-month trendline that has helped keep the rally intact. If it breaks, there is a good chance that it will drag the other key benchmarks down along with it.

Weak seasonals around presidential cycles are also kicking in right now, yet another headwind.

Also, our reliable TSI (Trend Strength Indicator) is on the verge of flipping negative on IWM, yet another major warning.

Only two sectors were positive on the week, and both were risk-off plays; Utilities (XLU) and Consumer Staples (XLP), yet another major warning.

Soft commodities (DBA), and gold (GLD) also bucked the selloff while (KRE (Prodigal Son/Regional Banks), which likes higher margins on higher rates fell, indicating a dovish Fed despite inflationary pressure.

All this shows that the Fed is ignoring the recent inflation numbers and hoping that “transitory inflation” is underway, unlike the 1970’s.

Considering the Virus is still NOT under control, it’s NOT a shocker that Risk-off has been tripped, and stagflation could be rearing its ugly head.

At any rate, that is how we are reading the tea leaves at the moment.

Last Week’s Highlights

- Risk Gauges reversed to Risk-Off in quick order

- All key benchmarks closed down on the week led by Grandpa Russel (IWM), down -5.2%

- Prior positive volume patterns reversed across the board, with IWM now showing zero accumulation days

- Market Internals, which include the McClellan Oscillator, and the 52-week new high/low ratio, continued to languish in bearish territory

- Value (VTV) continued to lag Growth (VUG) which was bullish

- Even with ongoing infrastructure talks, Transportation (IYT) was down again last week

- The only sector in the modern family still in a bullish phase was Biotech led by Moderna (NASDAQ:MRNA), whose vaccine for COVID is most effective

Crypto

- As of Friday, Bitcoin was down 4.4% vs. a 10.7% drawdown in Ethereum over the previous 7 days

- Despite the negative performance of the two crypto market leaders, the volatility of BTC and ETH was decreasing as Bitcoin had traded in a $3,500 range (roughly 11% of spot price) from $31,000 to $34,500, while Ethereum had traded in a $325 range from $1,850 to $2,175 (roughly 16% of spot)

- Volatility gradually decreased over the last two months as blockchain data indicates that whale investors continued to keep these markets somewhat stable. As selling increases from small holders and short-term sellers increases, whales continue to gobble up the liquidity from decentralized exchanges like Coinbase (NASDAQ:COIN)

- On-Chain metrics indicate that miners are accumulating Bitcoin at an increasing rate as global mining concentration continues to be relocated from China

- There was a sharp uptick in the number of coins being moved off of exchanges into personal wallets, indicating a trend that accumulation is ramping up…Decreased supply on exchanges, and a growing rate of both institutional and retail investors may spell a bullish reversal from recent lows in the future