Hey, hey, hey, hey

Beat is gettin' stronger

Music is getting' longer, too

Music is a-flashin' me

I want to, I want to, I want to take you higher

I wanna take you higher

Baby, baby, baby, light my fire

I wanna take you higher

- Song by Sly & The Family Stone

I suppose it is possible that Jay Powell, Chairman of the Federal Reserve, may have been singing this song as he approached the podium this past Wednesday afternoon to announce that the Federal Reserve Open Market Committee (FOMC) had decided to raise the Fed overnight lending rate by another 0.75% to a range we have not seen since 2008.

This is the third 75 basis point raise. He also indicated they would raise another 1.25%, which would bring the Fed Funds rate to 4.2% by year-end. Then expect another raise in 2023 to 4.6% before moderating to 3.9% in 2024.

Forecasting Pain

After announcing their current action, Powell commented on the need to raise borrowing costs and that central banks across the developed world were hoping these actions would cool an inflation rate that is running at 40-year highs.

He then commented, "I wish there were a painless way to do that," meaning cool the persistent and punishing inflation rate here at home. "There isn't."

The Fed now sees unemployment rising to 4.4% next year, up from 3.7%. Many economists and investment banks followed the news conference with announcements that this action will surely lead us into a recession, and we should see a host of companies (especially in technology) begin layoffs sooner than later.

Nomura Securities stated shortly after the announcement that they expect the U.S. to enter a recession this year. We have commented in this column several times over the past few months that we may already be in one.

Powell's actions and "painless" comments triggered a widespread sell-off in risky assets afterward. We have now had two back-to-back 5% losing weeks in the S&P 500 and 9 of the last 10 trading days have been down.

The S&P 500 is sitting approximately 1% above its June lows.

S&P 500

However, on Friday, the all-important 30-stock Dow Jones Industrial Average slipped below the earlier 2022 lows hit in June and is now in new territory. See the chart below.

DJIA

We have had a few powerful sell-offs in 2022, but Friday was the first time the VIX rose above 30 since the market lows previously hit in June. The fear that this downdraft has created finally showed up in the VIX charts.

The 3 Main Drivers of Lower Stock Prices

1. Anytime there are higher operating (borrowing) costs and purposeful intent to slow down consumption and the economy, there will be a readjustment of stock prices.

Many analysts on Wall Street use sophisticated forecasting tools to gauge future earnings expectations. Higher interest rates are one of the main drivers that cause earnings to slow or decline. Their formulas immediately adjust for an expected decline in earnings growth and a contraction of the multiples (i.e. P.E.) investors will be willing to pay. Both of these revisions put downward pressure on stock prices.

The stock market is beginning to reflect analysts' downward revision of earnings growth and the expected multiple contraction.

The Fed also adjusted its estimation for GDP growth this quarter from 1.2% to zero growth. This led the analysts to adjust their expectations for growth, and immediately sent the bear market lower.

2. Interest rates have soared almost parabolically.

This began the day that Jerome Powell gave his brief breakfast speech at Jackson Hole. He made it abundantly clear that the Federal Reserve acknowledges that inflation is persistent, "out of control," and needs to be attacked with higher borrowing costs to bring it under control.

As you may recall, that brief breakfast speech stopped a remarkable rally in stocks dead in its tracks.

When interest rates on the 2-year U.S. Treasuries went from 3.7% to 4.2% last week, they began to attract significant money from around the world, seeking higher yields and better returns than the volatile global stock market.

The 10-year U.S. Treasury also soared to 3.7% from 3.4% last week and added a longer-term attractive risk-free rate of return for the moment. See the charts below.

2-Year Treasury Yield

10-Year Treasury Yield

Looking back on a decade of low(er) interest rates, it has been since early 2010 that we have seen the 10-year U.S. Treasury near these levels.

It also speaks loudly about the accommodative and loose monetary policy we have had since then. This has helped push stock prices up each year. Now the Fed is taking the punch bowl away!

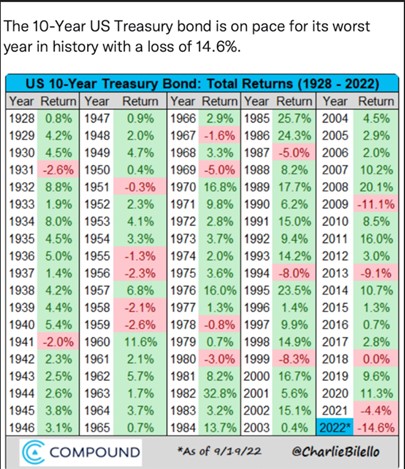

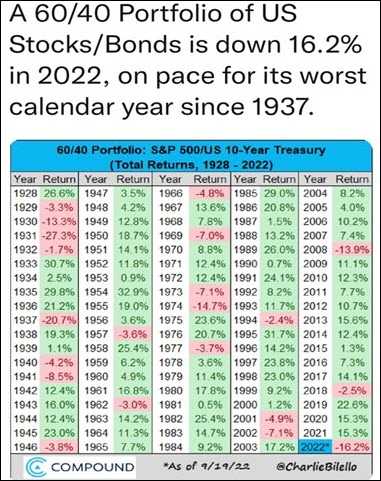

The stock market is not alone in this bear market!

The bond market (and most bond funds that almost every investor in a 401k owns) are down from 10-20%. This has been the worst year for fixed income returns in a very long time.

The combination of stocks and bonds is prevalent in the U.S., especially with investors who hold the typical 60/40 portfolio. 60% of the money is allocated to stocks for long-term growth, and 40% is allocated to fixed income securities for stability and to mitigate the volatility and drawdowns of the stock market.

Unfortunately, since both stocks and bonds are down significantly this year, the 60/40 portfolio is not only losing ground but having the worst year since 1937. See the chart below. The chart is thru last Wednesday and is a bit worse since then.

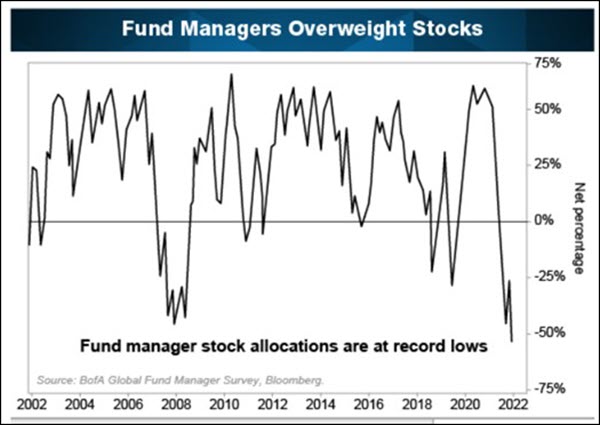

Fund Managers are playing defense

Large institutional managers are monitored closely by the investment community. Their point of view is often utilized as a benchmark on whether big money is bullish, bearish, or somewhere in between. They are currently heavily defensive and hold their lowest allocation to equities (stocks) in quite some time.

3. The U.S. Dollar has soared.

The U.S. is not the only country grappling with elevated inflation, lower stock prices, and increasing interest rates. Most developed countries have been raising their short-term lending rates to stem persistent inflation. Most other countries' stock markets are lower today than at the start of the year. Many of their economies have also slowed much faster than ours, especially in Europe, where they are also plagued with an energy crisis due to the Russian-Ukraine incursion.

Because of global growth concerns and our higher-yielding fixed income instruments, money from around the world is being parked in our short-term instruments (cash) and U.S. Treasury bonds. This has caused the U.S. dollar to rise in value by 30% this year to levels we have not seen in 25 years.

Shouldn't this be good for our markets?

Yes and No.

We always want to have a strong and stable U.S. Dollar. Having an influx of money flowing into the U.S. dollars at these levels has helped bring down the costs of many of the commodities we use in this country, including energy, lumber, copper, and basic materials. Our dollar is worth more, and if we are purchasing from overseas sellers, then it takes fewer dollars to make the purchase. This is good.

However, the U.S. companies selling their goods overseas (exporters) have to charge more to receive comparable payments using devalued overseas currencies. Many of the largest American companies (like Microsoft (NASDAQ:MSFT) or Apple (NASDAQ:AAPL)) may receive as much as 50% of their revenue abroad. They are being hurt by a slowdown in sales because of the drag in pricing due to the currency differential now occurring.

This is beginning to have a detrimental effect on earnings as more multinational companies include this in their quarterly earnings calls with analysts. Earnings expectations for many of these companies are beginning to factor into their stock prices.

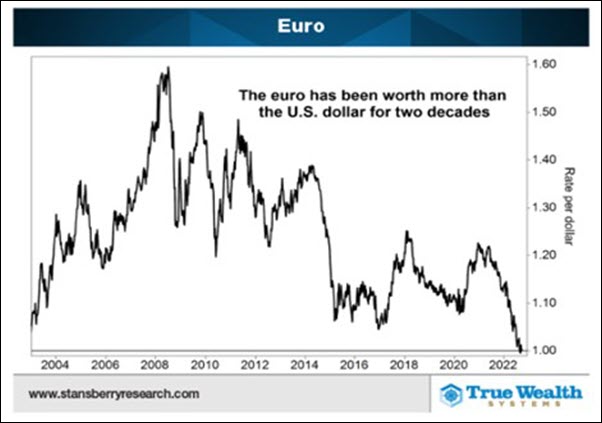

Europe is a huge trading partner of ours. To see the effect of the stronger U.S. Dollar, one need only look at the euro. The euro has been worth far more than the U.S. Dollar for two decades. That all changed this past week when the euro dipped to 98 cents to our dollar.

When might the investing environment be more attractive?

We are getting closer. Here are some ways to help you navigate thru this difficult investing period:

- Use cash. We keep saying this. It is an asset class and will allow you to preserve capital in a bad market. Remember what we said last week "It is not how much you make in a bear market but how much you preserve and have to work with on the next bull market that is important."

- The stock and bond markets are oversold. There will be a bounce. However, remain cautious about going "all in." If you get more invested, make sure you use a trader's mentality. Don't expose yourself to another move down.

Risk Off

- The key U.S. Indices sold off hard and are at or below previous 2022 lows, however, they look to be getting a bit oversold on both price and momentum and are potentially subject to mean reversion on both the daily and weekly charts. (-)

- On a Weekly timeframe, DIA and IWM have already closed below their respective 200-week moving averages, while SPY and QQQ remain just above their own. (-)

- Volume Analysis of the major indices is some of the weakest we've ever seen, with zero accumulation days over the past 2 weeks for SPY, QQQ, and IWM. (-)

- Every sector was down on the week, with risk-off sectors like Consumer Staples (XLP) -2.7% down the least and risk-on sectors like Consumer Discretionary -10% being the worst performers. (-)

- The U.S. Dollar (UUP) remains strong due to sharply rising interest rates. (-)

- Energy got hammered across the board, with Natural Gas (UNG), Solar (TAN), Clean Energy (PBW), and Oil Services (OIH) all down over 10% on the week. (-)

- Market Internals look awful, with the McClellan Oscillator showing multi-year lows for both the S&P 500 and Nasdaq. (-)

- The New Highs / New Lows ratios for both the S&P 500 and Nasdaq composite have also broken down hard and are in deeply bearish territory. (-)

- Risk Gauges are 100% risk-off as markets continue to deteriorate. (-)

- 2 of the 5 key market relationships are about to break down on a longer-term timeframe (SPY vs TLT and SPY vs.GLD. (-)

- Volatility (VIXY) readings broke out of a basing formation and are now back above key moving averages as well as its upper Bollinger band. (-)

- The number of stocks above key moving averages has dropped to some of the lowest levels we've seen in the past year. (-)

- Value stocks (VTV) drastically underperformed Growth stocks (VUG) this week after a major gap down and new multi-year lows, however, neither looks great in the grand scheme of things. (-)

- Every member of Mish's Modern Family is currently in a Bearish phase, but there may be some mean reversion in order as several of the members (SMH, IBB, IYT) are oversold on both price and momentum according to RealMotion. (-)

- Emerging Markets are not faring any better than U.S. Equities as both EEM and EFA continued to sell off throughout the entire week. (-)

- Both Soft Commodities (DBA) and Copper (COPX) had major gap downs this week that put their respective prices in oversold territory, however, underlying momentum according to RealMotion is not oversold for either and leaves more room for further selling next week. (-)

- Gold outperformed SPY this week despite closing on new multi-year lows as well as below its 200-week moving average for the second week in a row. (-)

- Oil (USO) gapped down and made multi-month lows on Friday and is now in a warning phase on a weekly timeframe after closing below its 50-week but above the 200-week moving averages. (-)

Neutral

- Although bonds continue to get beat up, the longer-term 20-year bond (TLT) seems to be taking pause at currently oversold levels for both price and momentum according to RealMotion. (=)