End of Day Analysis

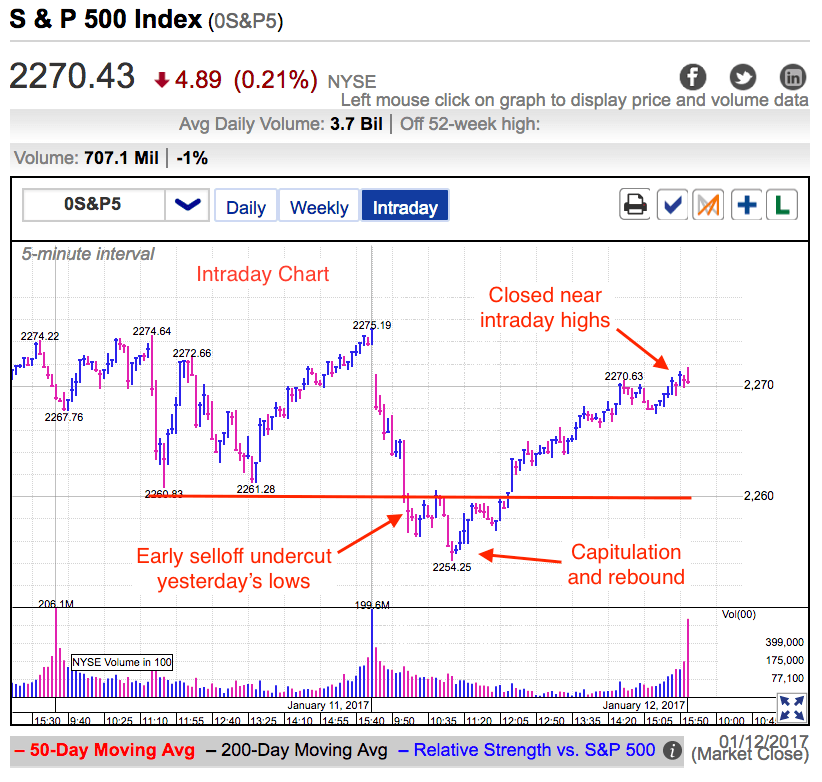

Thursday was another seesaw session for the S&P 500 when early losses rebounded in afternoon trade. Even though we closed in the red, finishing well off the intraday lows turned this into a bullish day. Volume was near average, but less than Wednesday’s levels. While most money managers have returned from vacation, the modestly muted volumes tell us they are not fully engaged in this market yet.

The early losses were primarily fueled by an echo from Trump’s first press conference the previous day. While nothing new was revealed Wednesday morning, it didn’t take much to convince anxious owners to lock-in profits. But these defensive minded traders were in the minority because not long after undercutting Wednesday’s lows, supply dried up and we rallied into the close.

Bull markets are typified by weak opens and strong closes. Cynics are always trying to pick a top and their selling pressures the market early in the day. But big money, underweight stocks and desperately trying to catch up, uses this weakness as an opportunity to buy at a discount. Late day strength signals institutional accumulation and is why the market axiom tells us it’s not how you open, but how you close that matters.

This is the seventh session in a row the S&P 500 closed above 2,260. Markets collapse from unsustainable levels quickly and holding support for this long tells us we are standing on solid ground. Everyone is looking toward Dow 20,000 and S&P 2,300, but like a watched pot, the market is being stubborn about breaking these psychologically significant levels. While many traders are getting impatient, the longer we hold near the highs, the more inevitable it becomes that we will poke our head above this level.

The question isn’t if we will break 20k/2,300, but what happens after we do. Demand has been a real issue for this market. It’s not because people are afraid of stocks, but because the crowd finally believes in the market and is finally fully invested. Long gone are the days of predictions of doom-and-gloom around every corner. Now the crowd is giddy over the business friendly policies the GOP is going to implement. While these are great developments and will no doubt boost the economy, the problem is stocks are struggling to rally on this optimism. I love to buy stocks that stop going down on bad news and fear stocks that cannot rally on good news.

Over the near-term I expect us to break 20k/2,300, but I’m less optimistic about what happens after that. Most likely that will be the final hurrah of the post-election rally before we fall into a much needed step-back to support. Two-steps forward, one-step back. Everyone knows the market moves this way, but somehow they continue to be surprised by it every time it happens.