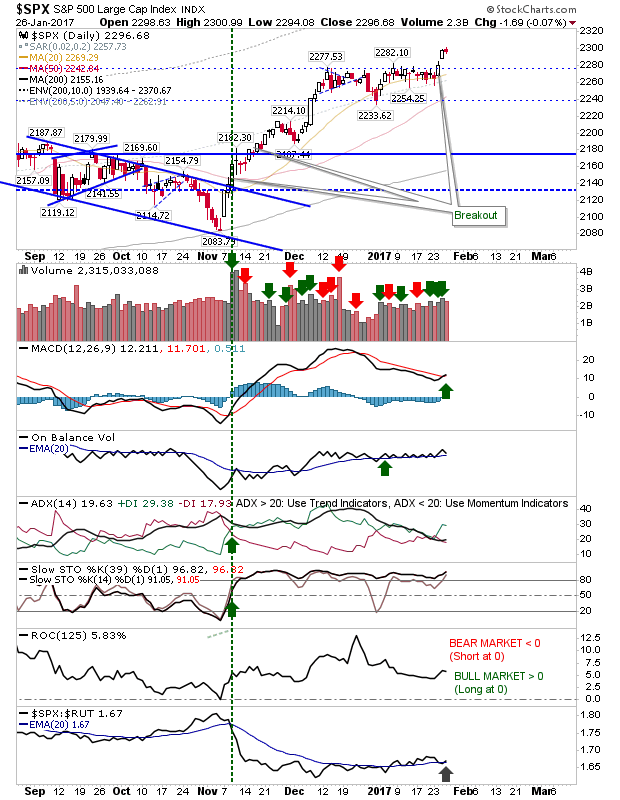

After two days of gains delivering broad breakouts, Thursday saw markets stall a little as those gains were digested. Despite this, the S&P was still able to offer a MACD trigger 'buy'. Relative performance also got a little uptick against the Russell 2000. With technicals all in the green any additional weakness will likely be viewed as a pullback buying opportunity.

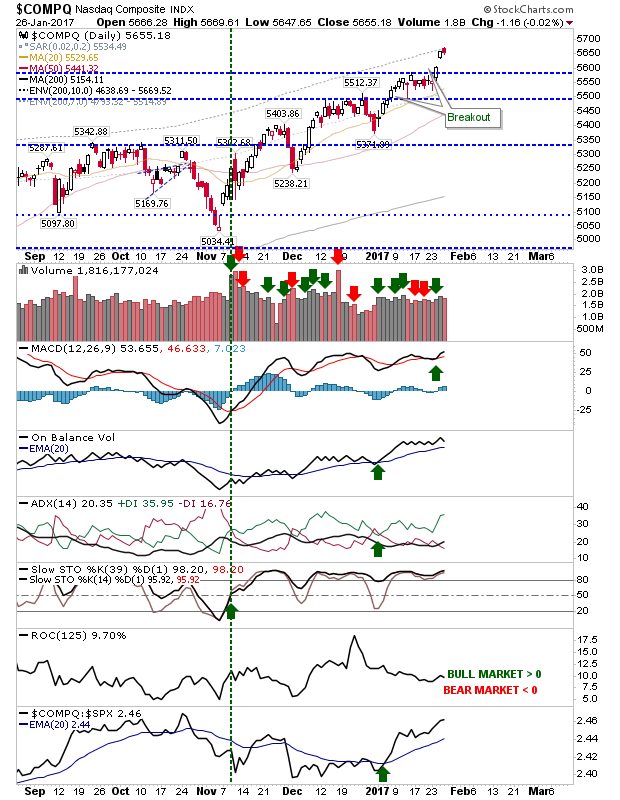

The NASDAQ experienced a bearish cloud cover, but not enough to suggest bears will get some follow through on Friday. Selling volume was down on yesterday, so no real encouragement for longs to sell or shorts to become more aggressive. Those shorts who are aggressive may look to attack with short stops placed just above Thursday's high (5,670).

The Russell 2000 came closest to delivering the two-bar reversal I talked about on Wednesday, but in the end it couldn't do it. The consolidation breakout is still intact, despite failing to (as yet) negate the January 'bull trap'.

For Friday, longs will want to see some kick on higher. Shorts need Thursday's weakness to expand – particularly for the Russell 2000.