Momentum investors generally are risk tolerant investors with short time horizons. They are continuously on the lookout for stocks that are displaying certain kind of trends. Interestingly, the momentum investors speculate on the belief that the current trend being dispalyed by the stock is sustainable.

However, this apparently simple momentum investment technique has some drawbacks and lack of proper understanding of the strategy may often lead to short listing of momentum stocks that are a misfit to the portfolio.

An Insight Into Zacks Methodology

Our latest style score system has made the task quite simple. It helps us choose stocks that have a solid performance record and might therefore prove to be a great choice for investors.

Our Momentum Style Score highlights all evaluation metrics and represents them as one score that cautions investors regarding unsuitable momentum picks and helps them find stocks that are displaying favorable trends.

Meanwhile, stocks with a Zacks Rank #1 (Strong Buy) or 2 (Buy) reflects an upward trend in the stock’s earnings estimates. Our research shows that stocks with a Momentum Style Score of A or B when combined with a Zacks Rank #1 or 2 offer the best upside potential.

Based on this, we have identified a candidate Orthofix International N.V. (NASDAQ:OFIX) , with a Zacks Rank #2 and a Momentum Score of B, which may prove to be a solid momentum pick.

What’s Working in Favor of Orthofix?

The company’s estimate revision trend for the current quarter has also been positive. In the past 30 days, two analysts moved their estimates northwards, with no movement in the opposite direction. The magnitude of estimate revision for earnings rose around 5.1% to 41 cents per share over the same time frame. The estimate revision magnitude has also remained encouraging for the current year witnessing a 1.3% rise to $1.56.

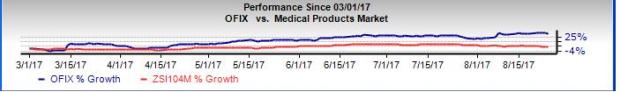

Moreover, Orthofix has been gaining investor confidence on consistent positive results. Over the past six months, the company’s share price has outperformed the broader industry. The stock has gained 33.4%, in comparison with the broader industry’s 4.1% gain. The company has also outperformed the 2.2% gain of the S&P 500 market over the same time frame.

Further solidifying its status as a solid momentum stock, Orthofix has a very favorable 50-day moving average price stands at $46.08 covering a period of last six months.

Notably, the stock displayed a sharp rise on the day of its earnings release on Aug 7, 2017 and since then the company has been continuing with its upward trend supporting Orthofix as a favorable momentum stock.

Other Momentum Stocks to Consider

Other momentum picks in the medical sector that are worth mentioning are Owens & Minor, Inc. (NYSE:OMI) , OraSure Technologies, Inc. (NASDAQ:OSUR) and Teleflex Incorporated (NYSE:TFX) .

Owens & Mionor carries a Zacks Rank #1 and a Momentum Score of A. You can see the complete list of today’s Zacks #1 Rank stocks here.

OraSure Technologies carries a Zacks Rank #2 and a Momentum Score of B.

Teleflex Incorporated carries a Zacks Rank #2 and a Momentum Score of B.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Teleflex Incorporated (TFX): Free Stock Analysis Report

Orthofix International N.V. (OFIX): Free Stock Analysis Report

Owens & Minor, Inc. (OMI): Free Stock Analysis Report

OraSure Technologies, Inc. (OSUR): Free Stock Analysis Report

Original post

Zacks Investment Research