- U.S. futures, European stocks markedly in the red as China rebukes U.S. interference in Hong Kong turmoil

- Gold, yen and dollar all climb on risk off; yields tumble

- Australian shares take a hit from allegations of severe legal breaches against Westpac

Key Events

Futures on the S&P 500, Dow and NASDAQ 100 joined global stocks in a decline this morning after China rebuked a unanimous U.S. Senate legislation supporting Hong Kong protestors, which further distanced an already elusive trade deal. Safe-haven assets all gained ground on renewed risk off, with Treasurys advancing alongside the dollar, the yen and gold.

A standoff on the question of tariffs timing—with the U.S. tying any tariff rollback to a phase-one agreement, and China wanting tariffs to be removed from the outset—became a lot more complicated after U.S. lawmakers intervened in what the Chinese government consider internal problems. U.S. Vice President Mike Pence said on Tuesday it would be tough for the U.S. to seal a deal if the demonstrations in Hong Kong are met with violence.

Moreover, a data miss on U.S. core retail sales indicated that a continuing economic expansion is far from being a foregone conclusion. Japanese figures this morning showing a tumble in exports also underlined the global hit from the trade dispute.

Meanwhile, the release later today of minutes from the last FOMC meeting may provide fresh insight into what the Federal Reserve makes of the current macro signals.

Europe's STOXX 600 slid with oil producers and banks shares.

In the earlier Asian session, Australia’s S&P/ASX 200 (-1.35%) tumbled after Westpac (ASX:WBC) was accused of severely breaching anti money-laundering and terrorism financing laws. Given the country's heightened sensitivity to the U.S.-China trade spat—China being Australia's largest two-way trade partner—new threats from U.S. President Donald Tump to further hike levies on Chinese goods further soured the mood in Sydney.

Hong Kong’s Hang Seng (-0.75%) also slid lower as the city's political turmoil kept monopolizing news headlines.

Global Financial Affairs

On Tuesday, the S&P 500 and the Dow closed lower after disappointing retail numbers, giving up fresh intraday records. Only the NASDAQ Composite managed to hold onto gains to post a new record close.

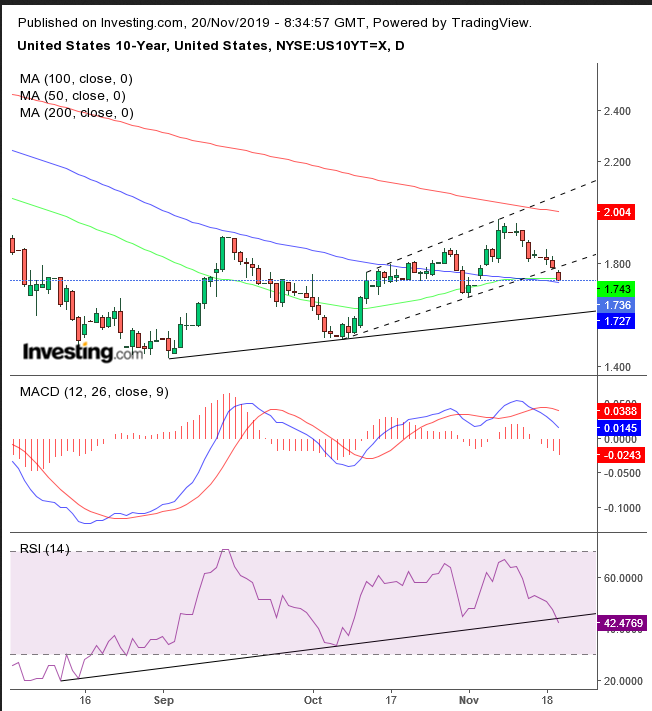

The yield on 10-year Treasurys fell for the third straight day to a three-week low today, slipping below the rising channel since the Oct. 6 low. Rates are now flirting with the 50 and 100 DMAs, heading back to the uptrend line since the Sept. 3 bottom. Both the MACD and the RSI are favoring that view.

In safe-haven markets, risk-off concerns offset asset-price considerations: the dollar strengthened despite a rise in the Japanese yen, and gold advanced even against a more expensive dollar.

Up Ahead

- Corporate earnings coming up this week feature consumer brands including: Target (NYSE:TGT), Macy’s (NYSE:M) and Foot Locker (NYSE:FL).

- U.S. initial jobless claims come out on Thursday.

- Federal Reserve speakers this week include district bank presidents Loretta Mester and Neel Kashkari.

Market Moves

Stocks

- The U.K.‘s FTSE 100 dropped 0.6%.

- The MSCI World Index of developed countries fell 0.2%.

- The MSCI Emerging Market Index declined 0.4%.

Currencies

- The Dollar Index rose 0.1%.

- The euro fell 0.1% to $1.1067.

- The British pound dipped 0.1%.

- The Japanese yen appreciated 0.1% to 108.42 per dollar.

Bonds

- The yield on 10-year Treasurys slid five basis points to 1.73%, the lowest in almost three weeks.

- The yield on 2-year Treasurys fell two basis points to 1.57%.

- Germany’s 10-year yield gave up four basis points to -0.38%.

- Britain’s 10-year yield declined five basis points to 0.686%.

- Japan’s 10-year yield lost three basis points to -0.106%.

Commodities

- West Texas Intermediate crude fell 0.1% to $55.13 a barrel.

- Gold strengthened 0.4% to $1,477.82 an ounce.