- Corporate earnings continue to meet or beat expectations

- Fed speakers calm concerns of aggressive tightening

- Bitcoin remains under pressure

Key Events

US futures on the Dow Jones, S&P 500, NASDAQ and Russell 2000 were mixed in trading on Wednesday, at time of writing, while global stocks were on track for the sharpest four-day advance since November 2020. Positive sentiment from corporates posting results that beat expectations, as well as Fed members talking down forecasts of aggressive monetary tightening, has resulted in dip buying driving equities in Europe and the US higher.

At time of writing, Brent crude is trading lower.

Global Financial Affairs

Approximately 80% of companies listed in the S&P 500 Index have now released their quarterly report cards, showing growth that's +4.3% above consensus estimates. While the market narrative continues to focus on the good news, these results are well below the 16% average for the past four quarterly earnings releases. Still, this performance is in line with the 4.1% average going back to 1994.

So far this week, all six Fed speakers have proven more dovish than expected, with none calling for a half-point rate hike in March.

Nevertheless, US futures were mixed and fluctuating. At the time of writing, NASDAQ 100 futures were leading the pack with a 1.31% gain, while the Russell 2000 was lagging.

This morning, Europe's STOXX 600 Index traded above its 50-day moving average for the first time since Jan. 21.

The Asian session saw stocks rising, as traders took a cue from Wall Street gains on Tuesday. Japan's Nikkei 225 rose 1.68%, outperforming the region's other significant benchmarks. Markets in China, Hong Kong, and South Korea remain closed for holidays.

On Tuesday, all four major US averages gained during the Wall Street session, for the third straight day, for the first time since late December with the S&P 500 closing up 0.69%. Throughout the session, stocks wavered along a flat line until the final hour, when stocks jumped on robust earnings calls.

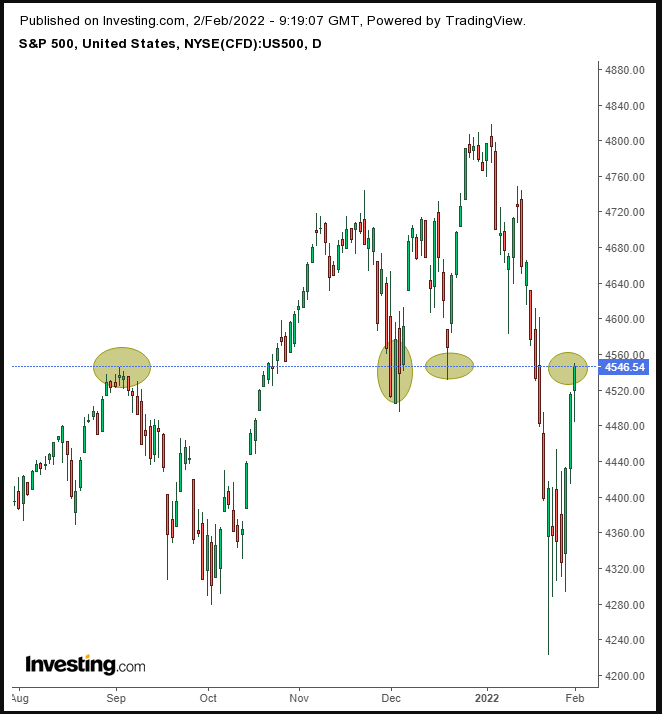

The current gains for the index follow the worst month for US equities since March 2020, and traders will need to decide whether they believe this rally is a dead cat bounce—a rebound that will not last—or a proper buying dip following a corrective decline amid a rising trend.

Yesterday, the SPX closed below 4,550, a crucial support-resistance level.

Treasury yields on the 10-year note dipped within a symmetrical triangle, following a much larger triangle formation.

Both are bullish patterns upon upside breakouts. Rising yields, which point to higher interest rates, will probably weigh on stock prices. Also, higher bond payouts provide an attractive, safe haven which could further pressure stocks.

The dollar tracked yields lower, extending a decline to its third day.

Nevertheless, the greenback found support by a broken descending trendline. Either way, the rising trend line below would support the continued uptrend.

Gold was little changed. The yellow metal's performance is strongly influenced by economic data, including Friday's US nonfarm payrolls.

Bitcoin edged higher within a bearish flag, the second one in a row, after completing a large H&S top, which has an implied target that will push the digital currency below the neckline of an even larger double top.

We could see the leading crypto reach multi-year lows if that completes.

Oil slipped and crossed the midway toward $86 a barrel for the first time since Oct. 7, 2014, after API reported a decline in US crude stockpiles yesterday and ahead of today's OPEC+ meeting when the cartel is expected to modestly lift output.

Up Ahead

- The European Central Bank announces its rate decision on Thursday.

- US initial jobless claims are published on Thursday.

- On Thursday, ISM Non-Manufacturing PMI figures are reported.

Market Moves

Stocks

- The STOXX 600 rose 0.5%

- Futures on the S&P 500 rose 0.4%

- Futures on the NASDAQ 100 rose 1.1%

- Futures on the Dow Jones Industrial Average fell 0.1%

- The MSCI Asia Pacific Index rose 1%

- The MSCI Emerging Markets Index rose 0.2%

Currencies

- The Dollar Index fell 0.1%

- The euro rose 0.4% to $1.1318

- The Japanese yen fell 0.3% to 114.36 per dollar

- The offshore yuan was little changed at 6.3663 per dollar

- The British pound rose 0.3% to $1.3564

Bonds

- The yield on 10-year Treasuries fell one basis point to 1.78%

- Germany's 10-year yield rose to 0.035%

- Britain's 10-year yield was little changed at 1.29%

Commodities

- WTI crude rose 0.65% to $88.72 a barrel

- Brent crude rose 0.2% to $88.90

- Spot gold rose 0.1% to $1,803.11 an ounce