by Pinchas Cohen

Key Events

Global equities and US futures responded positively this morning to Friday's record-setting US close.

Before the weekend, the S&P 500 Index scaled and conquered the 2,500 key-level for the first time. Haven assets fell hard in Asian trade today, on a gap, as investor optimism that the US will reach a peaceful resolution with North Korea drove sentiment.

After Japanese shares reaching their highest since early August last week, and almost the highest since August 2015 – even after a second missile invaded Japan’s airspace on Friday, in less than a month – global investors haven't been able to tap into sentiment in Tokyo, nor take advantage of stocks rendered cheaper by the lower yen since Japan's markets were closed for the country's Respect for the Aged Day holiday.

Another country exposed to North Korea’s threats is South Korea. Yet its KOSPI Index surged today, up the most since May. It seems as though local as well as global equity traders, who have long been blind to anything that can spoil the party in this cheap-money environment of QE and near-zero interest rates, want to milk the markets for all they're worth, before the party ends and central banks begin to tighten their monstrous balance sheets while normalizing interest rates.

Additional signs of what can only be considered irrational exuberance have been on display via the dichotomy between weaker readings on factory output, coupled with the second highest level of consumer confidence since December 2000. How do economists explain this near multi-decade confidence? They point to rising home prices, a healthy jobs market and stocks close to record.

We postulate that the soaring stock market is the real reason for all this buoyancy; should it fall, everything else will fizzle as well, perhaps especially the exceptional confidence.

Global Financial Affairs

The focus now turns to the Federal Open Market Committee policy decision on Wednesday, at 14:00 EDT. After the Fed’s detailed plan last June, which was followed by subsequent communications, it is widely expected that the benchmark rate will remain unchanged but policy makers will announce the start of the normalization of its $4.5 trillion balance sheet at the next meeting. The shrinking of the bloated balance sheet is meant to raise long-term interest rates and help the economy get back to the old normal. However, because it is consensus, volatility isn’t expected to rise.

While the Fed’s biggest obstacle to increasing interest rates has been abnormally low inflation, they may have a more complex problem ahead. Inflation may get a boost from rising energy prices and spending on rebuilding in the aftermath of the hurricanes. The Fed’s challenge would be to figure out whether the readings in upcoming months represent a trend or merely outliers. This murky picture can potentially stall policy change.

Japanese equity and currency investors may be about to experience considerable volatility, as Prime Minister Shinzo Abe considers pulling a Theresa May and holding a snap general election as early as next month. Like May, he wishes to take advantage of growing support for the way he’s handling the North Korea Crisis.

At the time of May's announcement the British pound soared, which was seen as an expression of confidence, after David Cameron resigned, leaving the nation leaderless. However, May’s gamble boomeranged when in fact she lost, rather than gained power. Keeping that in mind, the yen – and therefore the dollar - could experience significant volatility.

Up Ahead

- U.S. home construction, via building permits and housing starts as well as existing home sales are the highlights of this week’s U.S. economic calendar.

- The Reserve Bank of Australia releases minutes of its September board meeting on Tuesday.

- The People’s Bank of China releases its net foreign exchange position data for August.

- Japan trade and Malaysia CPI are also due.

- Campaigning continues in Germany. It's just days before the Sept. 24 election, as Chancellor Angela Merkel and challenger Martin Schulz both make their final pitches to voters.

- New Zealand also goes to the polls on Sept. 23.

Market Moves

Stocks

- The Stoxx Europe 600 Index increased 0.4 percent as of 8:01 a.m. New York time, the highest in almost six weeks.

- The MSCI All-Country World Index advanced 0.2 percent to its highest point on record.

- S&P 500 Futures climbed 0.3 percent to their highest on record.

- The MSCI Emerging Market Index gained 1 percent to the highest in more than six years on its biggest rise in five weeks.

Currencies

- The Dollar Index climbed less 0.2 percent to 92.06

- The euro advanced less than 0.05 percent to $1.1948.

- The British pound dipped 0.1 percent to $1.3586.

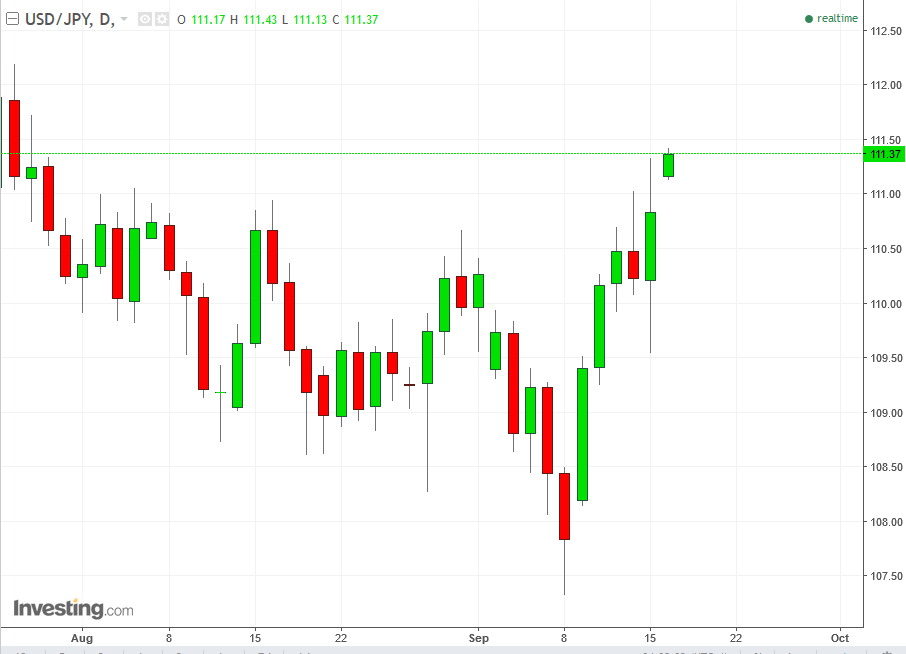

- The Japanese yen declined 0.3 percent on a gap and extended its decline to 0.55 percent, settling at a decline of 0.45, to 111.38 per dollar, the weakest position for the currency in almost eight weeks.

Commodities

- Gold fell 0.4 percent on a gap and extended the decline to 0.6 percent, to $1,315.21 an ounce, the weakest in almost three weeks ,and falling, as we write these lines.

- West Texas Intermediate crude advanced 0.2 percent to $49.98 a barrel, reaching its highest point in seven weeks on its sixth consecutive advance.

Bonds