- Dollar Index hits 92.00, crossing above its 200 DMA

- WTI consolidates above $68, despite a strengthening dollar, as Israel attacks Iran's nuclear promises

- US futures edge lower

- Does 'sell in May and go away' still apply?

Key Events

US stocks look poised for a lower open as futures on the S&P 500 and the NASDAQ 100 edged lower during Tuesday's early trade. Dow futures had already posted an earlier decline.

Numerous Asian and European markets were closed for holidays today, post yesterday's late session selloff, as national exchanges in Germany, France, Italy, Spain and other countries celebrate Labor Day. The UK's FTSE 100 is advancing for a fourth straight day.

Earlier, in the Asian session, Australia's S&P/ASX 200 was pulled higher by bank shares, which rebounded after taking a hit from a government's inquiry into poor customer practices such as charging deceased clients for 'financial advice.'

AMP (AX:AMP) has been especially hard hit. It has lost 20 percent of its value since November 29, 2017, when the inquiry began, on revelations that the bank misled many customers and deceived the corporate regulator, which resulted in the resignation of chair Catherine Brenner.

AMP's price is consolidating, climbing for a second straight day on Tuesday for the first time since mid-March, as it approaches a macro uptrend line since the 2009 bottom. Is its plunge over? For investors seeking distressed assets, this may be an ideal entry point.

The Australian dollar fell heavily, resuming the selloff seen in recent weeks, tumbling to its lowest level year-to-date after the RBA kept its rate on hold. Goldman analysts forecast the Aussie will continue to fall to $0.72. Should that happen, it would have completed a double top, after already falling below its uptrend since January 2016.

Global Financial Affairs

Yesterday's failed rally of the S&P 500 turned into a decline that erased two days of gains. This pattern formed a Bearish Engulfing Pattern, bolstering the argument of a resistance at the top of a triangle.

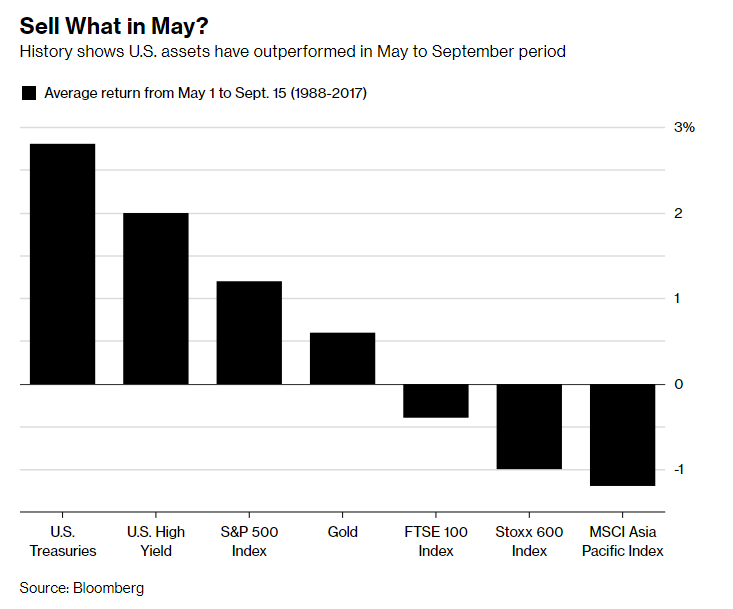

Hopeful investors can now perhaps trust to favorable seasonal statistics which indicate that US assets typically outperform in the period between May and September (see chart below):

However, investors relying on harder data will focus instead on the Fed tomorrow, to see whether they reiterate and clarify what the market seems to perceive as a threat: three additional interest rate hikes, for a total of four in 2018.

The Dollar Index crossed the 92.00 mark this morning, hitting its highest level since January 12. Traders are gauging whether the recent completion of a Symmetrical Triangle has in fact formed a bottom, or whether the USD—flirting with the 200 DMA at highest level in over three-and-a-half months—would top out.

The price of crude oil held today, despite the rising dollar, after Israel Prime Minister Benjamin Netanyahu delivered a dramatic speech yesterday accusing Iran of lying about its nuclear plans. The timing of Netanyahu's remarks, less than two weeks before the deadline for US President Donald Trump to extend a waver on sanctions against Iran, seems to be deliberate. Should Iranian oil be banned from the global market, the price of oil is poised to shoot up significantly.

EOS, currently the fifth most popular cryptocurrency by market cap, led the asset class gainers in April, rising 195% on the month. All of the 10 most popular digital currencies surged in the past month along with some newer tokens.

Up Ahead

- The Federal Open Market Committee begins a two day meeting on Tuesday. Its rate decision will be announced on Wednesday.

- The European Commission presents its spring economic forecasts, which include projections for EU growth, inflation, debt, and deficit.

- US nonfarm payroll numbers, scheduled for Friday, will probably show an increase for the month of April, while the unemployment rate is forecast to drop to 4 percent.

- Pfizer (NYSE:PFE) reports earnings before market open today, with analysts recently increasing their estimate to $0.74 EPS, versus $0.69 of the same quarter last year. Does this updated estimate indicate that the stock will retest its January $39.43 high?

- Apple (NASDAQ:AAPL) is scheduled to release results after the market close today, for the fiscal quarter ending March 1, with a $2.69 EPS forecast, vs $2.1 for the same quarter last year. Can it continue to show growth for its iconic iPhone?

- Tesla (NASDAQ:TSLA) will report earnings on Wednesday after the market close, with a $-4.45 EPS forecast, compared to $-1.97 for the same quarter last year.

Market Moves

Stocks

- Futures on the S&P 500 Index gained 0.1 percent.

- The MSCI All-Country World Index dipped 0.1 percent.

- The UK’s FTSE 100 rose 0.1 percent to the highest level in almost three months.

- The MSCI Emerging Market Index decreased 0.2 percent.

- The MSCI Asia Pacific Index sank 0.1 percent.

Currencies

- The Dollar Index increased 0.35 percent to the highest level in almost 16 weeks.

- The euro fell 0.1 percent to $1.2064, the weakest level in almost 16 weeks.

- The British pound declined 0.1 percent to $1.3749, reaching the weakest level in more than 15 weeks on its fifth consecutive decline.

- The Japanese yen decreased 0.1 percent to 109.41 per dollar.

Bonds

- The yield on 10-year Treasuries increased one basis point to 2.96 percent.

- Britain’s 10-year yield rose one basis point to 1.418 percent, the biggest advance in more than a week.

Commodities