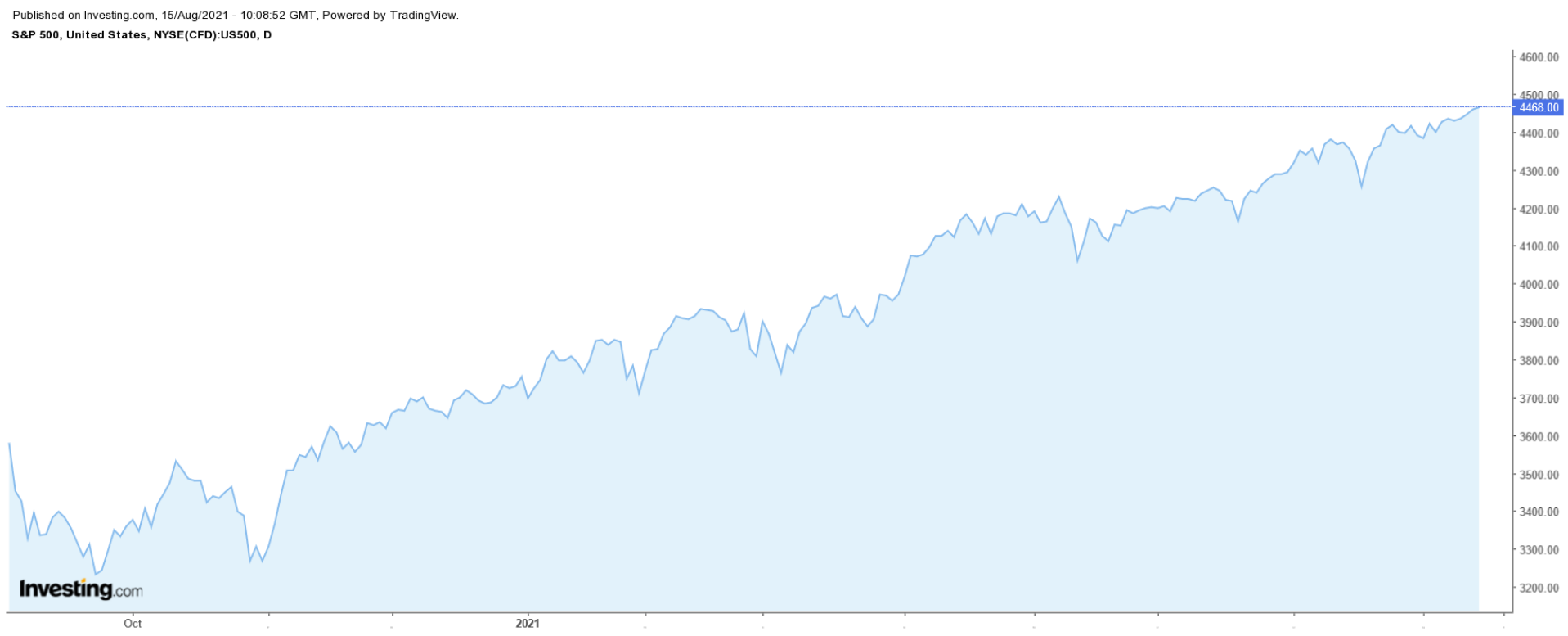

Stocks on Wall Street eked out small gains on Friday, with the benchmark S&P 500 index reaching yet another record high amid strong corporate earnings.

As second quarter earnings season starts to wind down, this week will see several high-profile retail companies reporting, e.g., Walmart (NYSE:WMT), Target (NYSE:TGT), Macy’s (NYSE:M), Home Depot (NYSE:HD), NVIDIA (NASDAQ:NVDA), and Cisco Systems (NASDAQ:CSCO). Add to that the latest U.S. retail sales figures and the FOMC meeting minutes, and the week ahead is expected to be an eventful one.

Regardless of how the market reacts, below we highlight one stock likely to be in demand in the coming days and another which could see fresh losses.

Remember though, our timeframe is just for the week ahead.

Stock To Buy: Tesla

Tesla (NASDAQ:TSLA) shares are likely to enjoy increased buying activity in the week ahead as the electric vehicle maker holds its highly anticipated artificial intelligence event, dubbed ‘AI Day’ on Thursday, Aug. 19. Tesla reported second quarter earnings back in July.

The invitation-only event is expected to provide updates on the EV pioneer's increasing role as an AI robotics player with new revenue stream potential, as Tesla seeks to enter new markets, including battery storage, and trucking logistics.

AI Day will feature a keynote speech by Tesla's CEO Elon Musk, as well as hardware and software demos from Tesla engineers showcasing the company's AI use cases beyond its EV fleet. Tesla will also likely give updates on its neural networking training Dojo Supercomputer project.

TSLA shares ended Friday’s session at $717.17, roughly 20% below their all-time high of $900.13 touched on Jan. 25, giving the Palo Alto, California-based company a market cap of $718.4 billion.

At current valuations, Tesla is the world’s largest automaker, bigger than names such as Toyota (NYSE:TM), Daimler (OTC:DDAIF), General Motors (NYSE:GM), Honda (NYSE:HMC), and Ford (NYSE:F).

The electric vehicle sector was one of the best-performing group of stocks, before an aggressive reset in valuations hit the industry earlier this year.

After scoring a gain of more than 740% in 2020, TSLA shares are up just 1.6% in 2021.

Stock To Dump: Krispy Kreme

Shares of Krispy Kreme (NASDAQ:DNUT)—which started trading on the NASDAQ after going public for the second time in its history last month—are expected to suffer another volatile week as investors brace for disappointing financial results from one of America’s largest doughnut chains.

Krispy Kreme first went public during the 2000 dot-com bubble and then reverted to private in 2016 after being purchased by JAB Holdings for $1.35 billion. The donut and cake maker is scheduled to report earnings on Tuesday, Aug. 17 after the closing bell.

Consensus estimates call for earnings per share of $0.13 for the second quarter, while revenue is forecast to clock in at $332.6 million.

Perhaps of greater importance, investors will monitor growth in Krispy Kreme’s same-store sales, a key metric in the retail industry which evaluates sales in stores that have been open for at least a year.

Market players will also be keen to hear if the company, which raised $500 million from its IPO, plans to take further steps to reduce its high debt load.

In addition, Krispy Kreme’s outlook for the rest of the year will be in focus amid lingering uncertainty resulting from the COVID health crisis and as Americans continue to shift away from sugary foods toward health-conscious alternatives.

The Charlotte, North Carolina-based company launched its second initial public offering on July 1, pricing its IPO at $17 per share. That was well below the original listing price range of $21-to-$24 a share.

DNUT stock surged briefly in its first day of trading, reaching a peak of $21.69, before pulling back sharply in the days and weeks following its debut.

Shares—which are down 28% since their IPO—fell to a new low of $14.70 on Friday, before closing at $15.03. At current levels, the maker of doughnuts and other sweet treats has a market cap of $2.46 billion.