“…emerging markets experienced a more recent run-up in indebtedness, which started around the time of the crisis, and is still continuing. In other words, their deleveraging has not even begun. This has the potential to create persistent spending disappointments, if monetary policy is unable to stimulate other spending sufficiently.” – “Debt, Demographics and the Distribution of Income: New challenges for monetary policy” – Gertjan Vlieghe, Member of Monetary Policy Committee, Bank of England, January 18, 2016.

This observation from Vlieghe of the Bank of England (BoE) should ring alarm bells for anyone expecting further increases in Chinese demand and consumption in the near future. China is reportedly transitioning from an export-driven to a consumption-driven economy. This economic adjustment is supposed to lead to more sustainable and stable economic growth. Yet, debt levels are exceptionally high in China and still rising. Unless the Chinese government has figured out how to create a perpetual motion machine of debt and consumption, China’s transition to a consumption-driven economy should soon hit a significant roadblock.

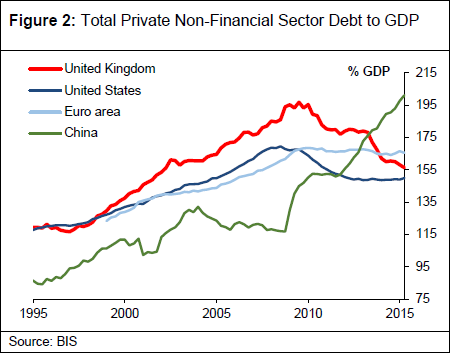

The chart below puts China’s debt run-up in global context. Total private non-financial sector debt has increased rapidly since the financial crisis. As a percentage of GDP, China has surpassed even the pre-crisis peak seen in the United Kingdom.

Total private non-financial sector debt has soared in China relative to GDP in the past several years. It has now surpassed the pre-recession peak even in the United Kingdom.

This high-level of debt helps explain why the Chinese government has struggled to get much response out of a long series of stimulus measures over the past year or so. The capacity for piling up yet more debt must be reaching some kind of limit. While that specific limit cannot be known in advance, especially since China’s economy is in a much higher growth mode than its Western competitors, I strongly suspect the limit is near. Companies that are continuing to rely upon the China growth story to support their own growth story over the next few years will (continue to) stumble as China approaches and then breaks down from this debt limit.

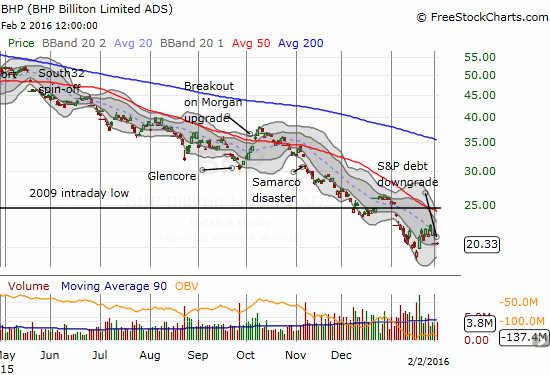

Commodity-related companies generally peaked in 2011. Companies trapped in industries where supply has yet to respond to the realty of future Chinese demand, like iron ore, have suffered accelerating pain in the past 18 to 24 months. Apple (O:AAPL) provided the most high-profile example of a glitch in the Chinese growth story. As most investors and traders know by now, Apple Inc (O:AAPL) finally reported some “softness” in China, mainly in Hong Kong. Apple’s observation could be the last sign of the beginning of the end of China’s great debt run-up.

Iron ore giant BHP Billiton Ltd (N:BHP) has suffered a near relentless sell-off for many months now.

Apple (AAPL) has been breaking down since last summer. Beyond the 2015 flash crash, AAPL trades at levels last seen in the summer of 2014.

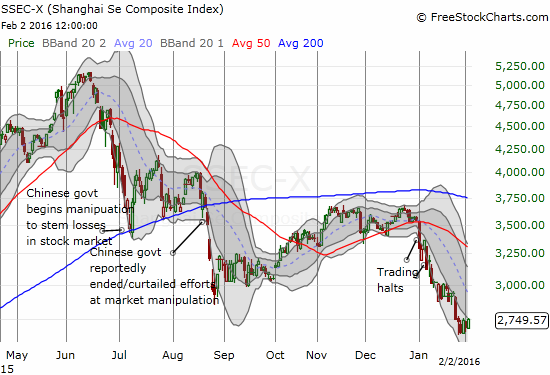

The Shanghai Composite Index has fallen by almost 50% from its peak last summer. The index trades at levels last seen in December, 2014.

These three charts – BHP, AAPL, and SSEC – display an almost alarming convergence of troubles. Time could soon tell whether this is more than a coincidental correlation.

Be careful out there!

Full disclosure: long BHP put options

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Why China's Debt Run-Up Should Ring Global Alarms Now

Published 02/03/2016, 05:26 AM

Updated 07/09/2023, 06:31 AM

Why China's Debt Run-Up Should Ring Global Alarms Now

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.