The rise in the market has seemed unstoppable. Despite the Federal Reserve continuing to hike interest rates and tightening monetary policy, geopolitical risks from North Korea to Iran, mass shootings, failure of legislative agenda and weak economic growth – the market’s rise has continued unabated.

Much of the recent rise, as discussed last week, has been based upon faulty assumptions about the effect of tax cuts and reforms. However, in the short-term, it is always the exuberance of market participants chasing returns as the “fear of missing out,” or FOMO, overrides the logic of fundamentals.

The problem for investors is that since fundamentals take an exceedingly long time to play out, as prices become detached “reality,” it becomes believed that somehow “this time is different.”

Unfortunately, it never is.

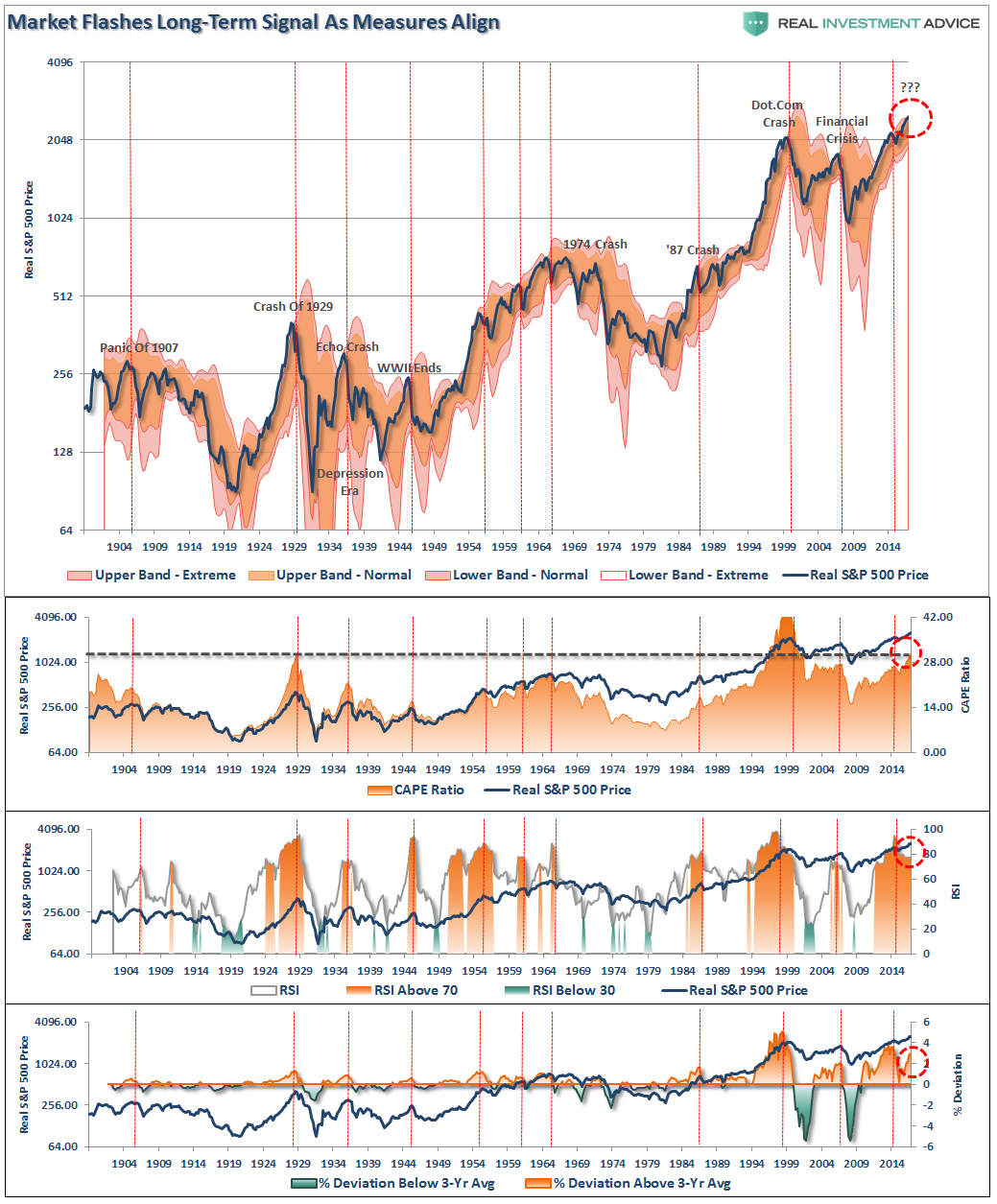

Our chart of the day is a long-term view of price measures of the market. The S&P 500 is derived from Dr. Robert Shiller’s inflation adjusted price data and is plotted on a QUARTERLY basis. From that quarterly data I have calculated:

- The 12-period (3-year) Relative Strength Index (RSI),

- Bollinger Bands® (2 and 3 standard deviations of the 3-year average),

- CAPE Ratio, and;

- The percentage deviation above and below the 3-year moving average.

- The vertical RED lines denote points where all measures have aligned

Over the next several weeks, or even months, the markets can certainly extend the current deviations from long-term mean even further. But that is the nature of every bull market peak, and bubble, throughout history as the seeming impervious advance lures the last of the stock market “holdouts” back into the markets.

As Vitaliy Katsenelson penned last week:

“Our goal is to win a war, and to do that we may need to lose a few battles in the interim. Yes, we want to make money, but it is even more important not to lose it.

We are willing to lose a few battles, but those losses will be necessary to win the war. Timing the market is an impossible endeavor. We don’t know anyone who has done it successfully on a consistent and repeated basis. In the short run, stock market movements are completely random – as random as you’re trying to guess the next card at the blackjack table.”

I wholeheartedly agree with that statement which is why we remain invested, but hedged, within our portfolios currently. Unfortunately, for most investors, they are currently playing with a losing hand.

As the chart clearly shows, “prices are bound by the laws of physics.” While prices can certainly seem to defy the law of gravity in the short-term, the subsequent reversion from extremes has repeatedly led to catastrophic losses for investors who disregard the risk.

With sentiment currently at very high levels, combined with low volatility and excess margin debt, all the ingredients necessary for a sharp market reversion are currently present. Am I sounding an “alarm bell” and calling for the end of the known world? Should you be buying ammo and food? Of course, not.

However, I am suggesting that remaining fully invested in the financial markets without a thorough understanding of your “risk exposure” will likely not have the desired end result you have been promised.

As I stated above, my job is to participate in the markets while keeping a measured approach to capital preservation. Since it is considered “bearish” to point out the potential “risks” that could lead to rapid capital destruction; then I guess you can call me a “bear.” However, just make sure you understand that I am an “almost fully invested bear”…for now.

But such can, and will, rapidly as the market dictates.

(Follow up read on how to approach the market: The 80/20 Rule Of Investing)

Just remember, in the market there really isn’t such a thing as “bulls” or “bears.” There are only those that “succeed” in reaching their investing goals and those that “fail.”