Market Brief

Oil Rebound Dominates Illiquid Trading Session

Trading in the Asian markets continues to be driven by an improvement in oil prices. Crude prices, if able to hold gains will have their best week since March due to speculation that major oil producers will address a tightening supply glut. Brent oil peaked above $51brl, up 0.4% on the session, having started the week at $47brl. Public comments from Saudi Arabian and Russian officials suggest that next month’s OPEC meeting might result in actions to stabilize the market.

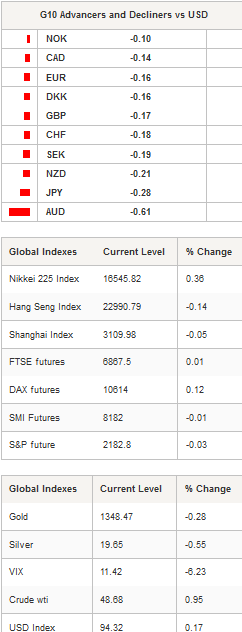

Asian regional equity indices were mixed, highlighting the low summer volumes and lack of new drivers. The Nikkei rose 0.26%, supported by a weaker JPY, while Hang Seng and Shanghai Composite were stuck in the red -0.28% and 0.31% respectively. Illiquid FX markets exaggerated moves in a generally uneventful session. Japan’s all-industry activity rose to 1 from -1.0 yet USD/JPY was range-bound between 100.10 and 100.45. AUD was weaker as USD rebounded and Moody’s lowered its outlook on Australian banks to negative (citing weak growth and low interest rates). AUD/USD fell to 0.7626 from 0.7661 but late session demand has stepped in to cool bearish momentum (potentially following NZD example). Both AUD and NZD have gathered support from stronger commodity prices and will continue to lead pricing. Yesterday’s ECB minutes suggest that policy makers are ready to extent their current €80bn per month bond buying program. The tone was influenced by EMU inflation expectation, which has once again decelerated. However, the ECB’s ability to weaken the EUR through monetary policy is now reaching its limits (as seen at the BoJ and SNB). Traders have shrugged off the FT report that the UK financial sector will attempt a Swiss-style access to the EU market which failed to provide GBP with any meaningful boost.

USD this week has been driven by a Fed credibility gap, with speaker comments keeping the September meeting “live”, yet markets are unwilling to believe the narrative. New York Fed President Dudley backpedaled slightly, unwilling to repeat comments that would imply his belief that markets were underpricing a September rate-hike risk indicated on Tuesday. However, Dudley reiterated that the US economy remained healthy with solid labor reads and steadily improving wage prices, which are all consistent with a rate hike. San Francisco Fed President Williams suggested that the risks of waiting too long to tighten policy are mounting. Despite the relative hawkish message from the Fed this week, expectations for a 25bp hike in September are stuck at 20%. Barring a material shift in US economic data we are doubtful of Fed action in September and anticipate the USD to remain weak. With EM FX offering a solid yield as developed markets shift lower/negative, inflow to EM should continue.

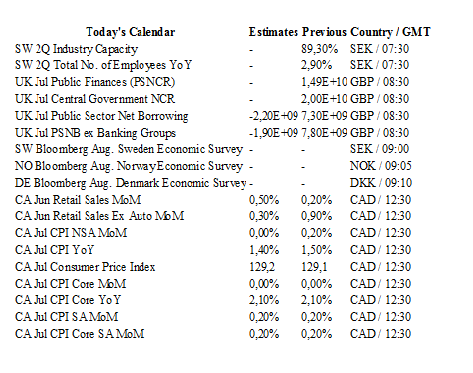

On the data front, traders will have to brace themselves for yet another slow day. In the European session German PPI, Sweden industrial capacity, Spanish trade balance and UK public finance will be released. In the afternoon, Canada will dominate, with the scheduled release of retail sales and consumer inflation data. The strong rebound in oil and fading expectations for a Fed rate hike should support near-term CAD buying. USD/CAD traders will focus on the 1.2655 June low.

Currency Tech

EUR/USD

R 2: 1.1616

R 1: 1.1428

CURRENT: 1.1321

S 1: 1.1046

S 2: 1.0913

GBP/USD

R 2: 1.3534

R 1: 1.3372

CURRENT: 1.3063

S 1: 1.2851

S 2: 1.2798

USD/JPY

R 2: 107.90

R 1: 102.83

CURRENT: 99.81

S 1: 99.02

S 2: 96.57

USD/CHF

R 2: 1.0328

R 1: 0.9956

CURRENT: 0.9593

S 1: 0.9522

S 2: 0.9444