Currencies

EUR/USD – is moving down again to near the 1.05 level which could be tested today as we see the USD strengthening. While tomorrow it will be the day of the USD with the NFP which will be in the spotlight, today it will be the EUR with the ECB interest rate decision. What is more important though is what the ECB will decide with regards to its QE program. Some are expecting that the time has come for the ECB to start tapering, and if that would be the case we could see a strengthening of the EUR, although the devil a lot of times is in the details.

USD/JPY – the weak GDP data out of Japan and the strong USD have led the pair higher to reach the highest level in nearly a month. We are seeing some resistance just below the 115 level, and if we are able to reach that level than we also see a change in the trend which has been down since the start of the year.

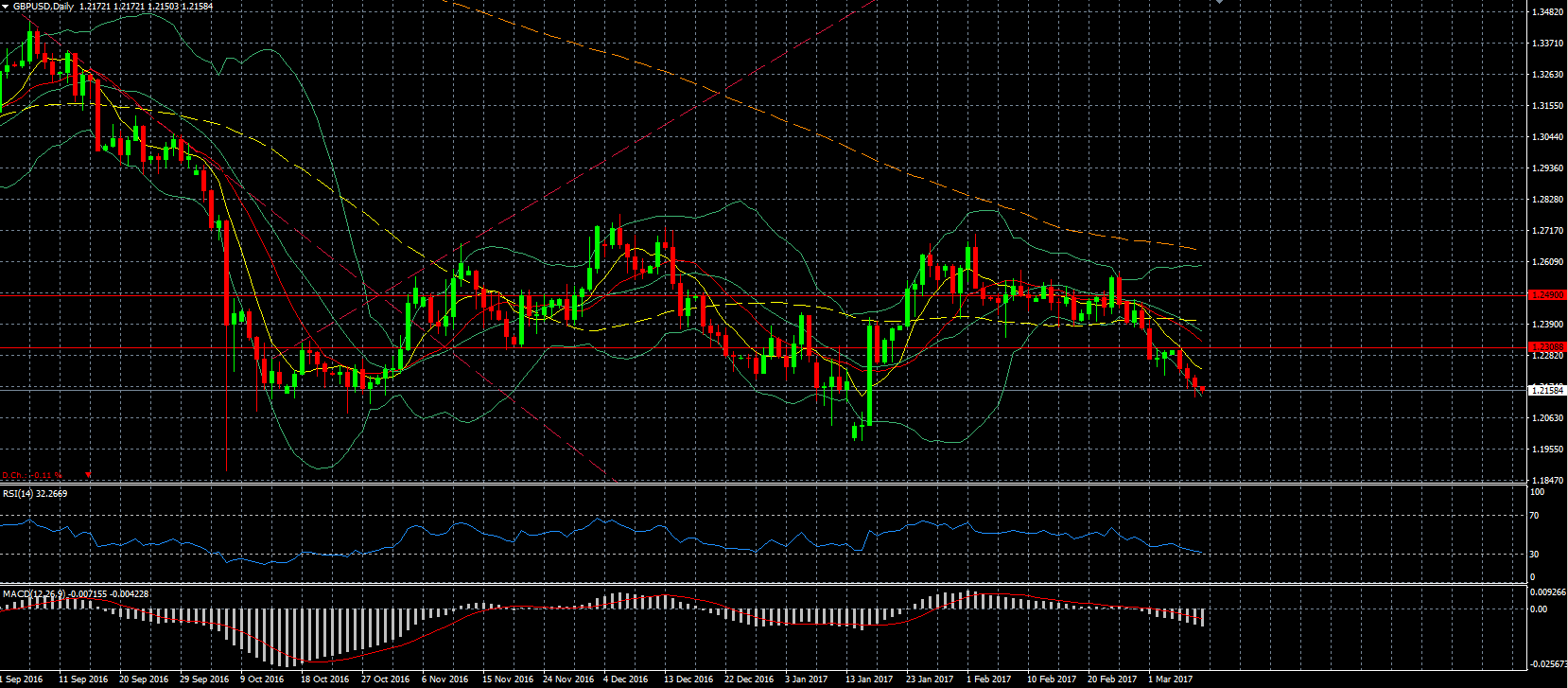

GBP/USD – is on its way for yet another weekly decline, the latest in a trend that started at the end of January. There hasn’t been a lot of positive data out of the UK lately and the USD is also strengthening which has caused the GBP to drop to the lowest level in 2 months. We are also nearing the date that the UK is expected to trigger Article 50 which will officially start the Brexit countdown.

USD/CAD – with oil prices dropping fast and the USD strengthening we see the pair trading at the highest level this year and nearing the resistance around the 1.356 level.

USD/ZAR – has reached the resistance level again and with the strong US data we could see this level breached soon.

Bitcoin – saw a bit of a selloff over the last 2 days, as it needed some air as indicators were stretched, and now can resume its climb again, which it is doing this morning. The question is if the mid-1200 level will be a top and resistance level, but that we will find out soon.

Indices

Nasdaq 100 – with the lack of energy companies it was the only index which was able to close higher yesterday, although it is being dragged lower by sentiment.

S&P 500 – was lower for most of the day and the sharp drop of oil prices made sure that the S&P was unable to move higher as the energy sector dropped over 2.50%. In addition, we saw that the data out of China was weak with inflation decreasing and below expectation.

XLE (NYSE:XLE) – as indicated, the energy sector dropped sharply yesterday as we can see that it is in a downwards trend since mid-December.

Commodities

Gold – remains under a lot of pressure with the strengthening of the USD and saw another leg down after the huge beat on the ADP data. We are now approaching the support levels around the 1200 level, as we will wait what the NFP of tomorrow will bring. If the NFP is solid, the FOMC will probably decide to increase the interest rate next week. It will then depend also on the accompanying statement what will happen next.

Oil –

the API data already indicated a large build and the EIA data of yesterday confirmed this, although the data was a bit lower than the API data. Nevertheless, inventories rose by more than 8 million barrels and as we have been on record highs already, this marks a new record high in inventories. The oil inventory now stands at 528.4 million barrels which is 37.6 million barrels more than last year. Not only are the inventories rising, production is also rising and is now well over 9mbpd and reached the highest level in over a year.

Another aspect which is also weighting on oil is the rising USD, although that is a relatively small part at the moment.

We are also still seeing a relatively low compliance level from non-OPEC countries, mainly Russia, and this is also making it possible that Saudi Arabia, who bears the brunt of the production cuts, will cease to comply as well, as at the moment it appears that they are the main ones suffering. This has been said as much at the CERA conference this week. If that happens, the entire deal will fall apart which could result in a lot more red on the charts.

What also made the drop of yesterday so sharp is that many people were long, and as indicated at the end of February, this means that the way down can be very fast as they are trying to get rid of their positions at nearly any price. We usually see that when prices drop, some comments are coming from OPEC or Russia to reassure the market and hint at further cuts, so we could see the same thing happen again and oil prices recover, at least for now.

Stocks

Snapchat – continues to see quite a lot of volatility in the days following its IPO as can be expected.