A snapshot view of yesterday’s New York - London session with technical notes...

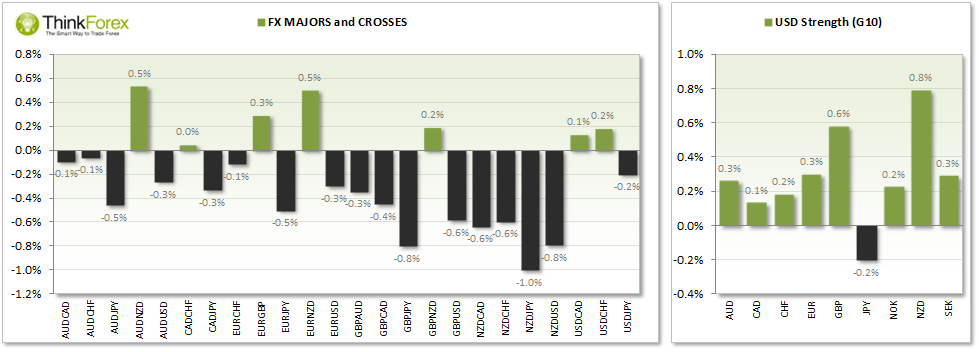

Poor data from Europe saw the euro lose ground across the majors, with the excption of the Kiwi Dollar, following lower business confidence as the interest rate rises begin to bite.

- French consumer spending is at a 3-month low at -0.3%, missing 0.5% forecast

- German unemployment is up for the first time in 6 months and at an 8-month high

- M3 money supply at it's lowest since August 2010 at 0.8%

GBP lost ground against all but EUR and NZD after BoE member Martin Weale stated he doesn;t see an urgent need to raise interest rates, despite the economy seeing some rapid growth. Smaller rate hikes would require more immediate attention, to suggest that whilst rate hikes may be later they may be more significant. GBP/USD responded by closing at a 7-week low and finding support at 32.8% retrace from the Feb low - May high.

The greenback broke above 80.50, driven mainly by the weaker euro to close at the high of the day, just beneath 80.65 resistance. NZD/USD broke through key support at 0.85 and likely to hold as resistance, with our next target at 0.841

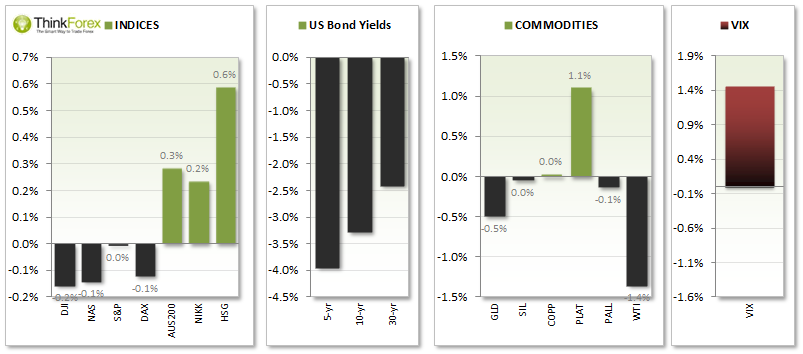

US Indices edged ower from their recent highs with the NASDAQ, DJI and S&P 500 all producing bearish Doji's to warn of pending weakness to the recent gains.

Bond Yields declined as money flowed into US and European bonds.

Gold hit out $1255 target with resistance close by at $12.63.

Silver rests precariously around $19 but appears increasingly bearish. This is an imprtant level to defend for the bulls with a downside break opening up $18.71 and $18.20.