The S&P 500 futures (ESU17:CME) rallied Thursday night into Fridays jobs number, pulled back below the VWAP, and then ‘double’ bottomed at 2473.00 before shoot up to 2478.25. After that, the ES pulled back down below the VWAP at 2474.25, and then rallied up to 2479.75. From there, the ES sold back off down to 2477.75, closing up +0.15% on the day, and up nearly 60 handles since making its Tuesday night globex low at 2421.00.

It was a big week for the U.S. markets, as reports on personal spending and income showed the U.S. economy has continued to grow at a steady, slow, pace. The S&P 500 futures gained 1.4% on the week, its biggest weekly move since mid-July. The Dow Jones futures (YMU17:CBT) gained almost 1% for the week, and the Nasdaq 100 futures (NQU17:CME) futures closed down -0.07%, but made a fresh record close.

Wrong, Wrong, Wrong

The markets have been going up in the face of some very large geopolitical events, and the main one is North Korea. In a TV broadcast not long after the hydrogen bomb test, the announcer boasted about the North’s ability to ‘detonate a hydrogen bomb at high altitude to create an electromagnetic pulse that could knock out parts of the U.S. electrical grid.’

For years U.S. intelligence has been wrong about North Korea’s nuclear advancements. It was only last year analysts were still saying the North was years away from being capable of sending an intercontinental ballistic missile that could hit the united States, and that they lacked the intelligence to miniaturize an A-bomb. The intelligence community, including the rest of the world, has been wrong, wrong, wrong.

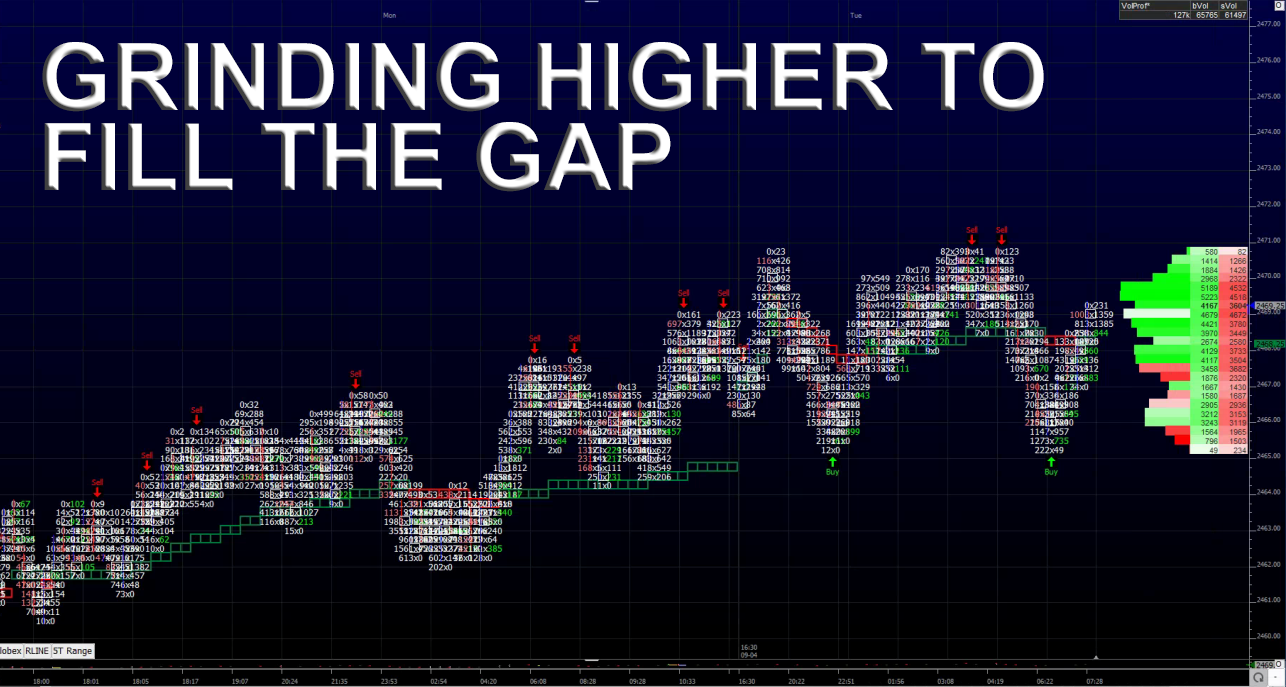

On Sunday nights 5:00 CT globex open, the ES ‘gapped’ 14 handles lower and then stutter stepped back up to 2466.60, 20 handles off Fridays high. On a Tweet President Trump threatened that the U.S. will stop trading with any country that does business with North Korea, including China (https://www.youtube.com/watch?time_continue=57&v=BnmEPIGuOxI). During Sunday nights globex session, going into Mondays 12:00 CT close, the ES sold back off below the vwap several times, but at 10:00 CT traded up to new highs at 2469.00. Total volume was 200,000 contracts. The ES settled at 2468.00, down 5.75 handles.

U.S. Urges Strong UN Response as North Korea Prepares New Launch

Even the PitBull said he could not believe how the markets seem to disregard the problems with North Korea, and in all honesty, I do not really understand it either. While China and Russia both say cooler heads must prevail, and that all parties should go back to the negotiating table, how can Japan, South Korea and the U.S. just sit back while North Korea continues to threaten the use its nuclear weapons?

Nikki Haley told the U.N. Security Council that the North Korean leader ‘is begging for war,’ and that’s right. Would China or Russia sit back and do nothing if the threats were being aimed at them? I highly doubt it. The other part of this is how unpredictable President Trump is. With his own problems at home, what better way could there be to draw attention away from himself that to do a military strike on North Korea? I know that may sound crazy, but there has been talk of a ‘limited’ strike, and I think that would start out an all out war. That would be something the markets could not overlook, and it would not just be a one time drop for the U.S. markets, or for that matter, the global markets as a whole.

Threatening to stop doing business with any countries that do business with North Korea would not work either. So why are the markets not panicking? Maybe it’s because there really is nothing the U.S. can do, or for that matter, any country can do, including China. The intelligence gathering has been so wrong about North Korea’s nuclear advancements that it’s almost embarrassing. How could our intelligence be so wrong?

While You Were Sleeping

Overnight, equity markets in Asia traded mostly higher, led the Straits Times Index (STI), which closed up +0.63%. In Europe, most majors are also trading higher this morning, with the DAX taking the lead at +0.59%.

In the U.S., the S&P 500 futures opened last night’s globex session at 2466.50. The low at 2460.25 was printed during Sunday night’s extended globex session. The ES has been on a steady grind higher since gapping open 14 handles lower Sunday night, and only has a few handles left to rally to fill the gap. As of 6:55am CT, the last print in the ES is 2469.25, down -5 handles, with 341k contracts traded.

In Asia, 7 out of 11 markets closed higher (Shanghai +0.16%), and in Europe 8 out of 12 markets are trading higher this morning (FTSE -0.06%).

This week’s economic calendar consists of 19 reports, 10 U.S. Treasury auctions and announcements, and 8 Fed speakers. Today’s economic calendar includes Lael Brainard Speaking, Factory Orders, a 4-Week Bill Auction, a 3-Month Bill Auction, a 6-Month Bill Auction, TD Ameritrade IMX, Neel Kashkari Speaks, Gallup US ECI, and Robert Kaplan Speaks.

Our View

Right now it’s hard to gain traction in this market. A couple gap downs over the last week on North Korean news, and the markets keep rallying. As we go into a seasonally weak time of the year, this market is going to catch someone off guard. Either the bulls who keep buying it up will get caught with their pants down below 2400, or the bears who keep shorting it will end up being run out of the market up to ES 2500 and beyond.

For now, we must go with the flow, and buy the dips. The weekly pivot comes in at 2460.08. We like being long above that, looking for last week’s high of 2479.75, and maybe the all time high print of 2488.50. However, it is a two sided market, and unless it’s a high volume, high momentum, run higher, we see resistance at 2480 and 2490.

Our call is to buy early weakness and to sell the rallies in the afternoon after the Euro close.

PitBull: CLV osc -9/-11 turns down on a close below 45.07; ESU osc 23/-6 turns down on a close below 2464.45; VIX osc -14/2 turns up on a close above 10.65.