The U.S. Stock market rallied last Friday and again into Monday as TSLA crushed earnings crushing expectations as well as on news that any positive U.S. trade deal outcomes could see almost immediate removal of future tariffs that are scheduled to be implemented near the end of October. That was enough for the markets to rally. After new highs were reached, the markets contracted a bit headed into Friday's close only to rebound on Monday.

Gold shot up early this morning before the news related to the U.S. trade deal hit. Our opinion is that this is a natural advancement in precious metals that is not news related or muted by some external factors. Precious metals have been setting up a sideways FLAG formation for over 2 months and we believe the apex/breakout move is near.

Oil was somewhat flat to close out last week and again on Monday. The past three days have seen oil rise from the $53 level to the current price levels, but we believe oil is still fundamentally oversupplied and that price will continue to weaken over time.

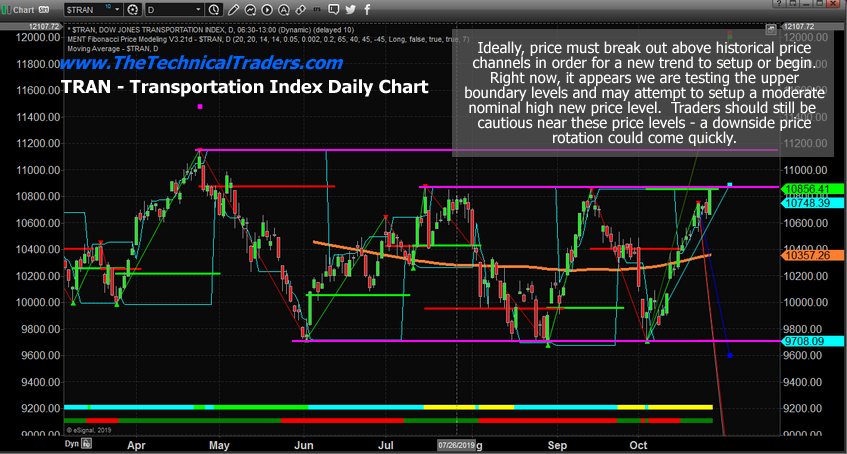

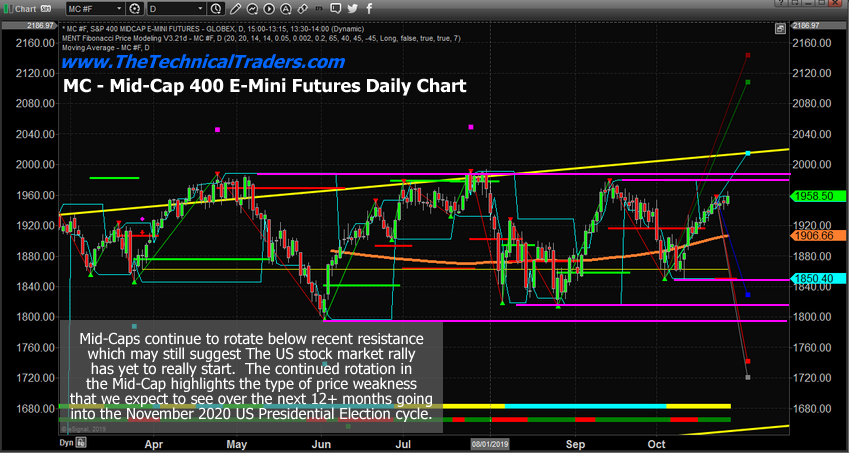

The real question before us right now is will this new nominal high represent a breakout bullish price trend heading into a U.S. Presidential Election cycle, or is this more of a price rotation within a defined price range?

If you consider all the shifting aspects of the U.S. political and economic landscape as well as the current geopolitical and economic factors, we believe any real breakout move will come as we get closer to November 2020 – not now. We believe this is still price rotation and think the NQ is the likely cause of this new nominal price. Tesla (NASDAQ:TSLA) crushed earnings, which has set a positive tone for trading.

The TRAN is still trading near current resistance and has not shown any true new price high yet. It will be interesting to see how the markets perform this week and what news may drive a new price trend then.

The Mid-Cap has failed to rally to recent price highs, which suggests this is not a broad market rally. We would want to see more defined price advancement across all sectors and above recent price highs to call this a broad market rally/breakout.

Pay attention to the news that ahead. We don’t believe a deal will be reached with regards to trade as quickly as others may think and we still believe the next 12+ months of the U.S. Presidential election cycle will be full of surprises. We may start to get more clarity of a true price trend after the New Year (2020). Until then, we’re staying cautious on these price rotations and when it comes to picking our trades.

I can tell you that huge moves are about to start unfolding not only in metals or stocks, but globally and some of these supercycles are going to last years.