Bank stocks around the globe dramatically underperformed respective stock markets in 2007. And by 2008, a global financial collapse punished every economic sector.

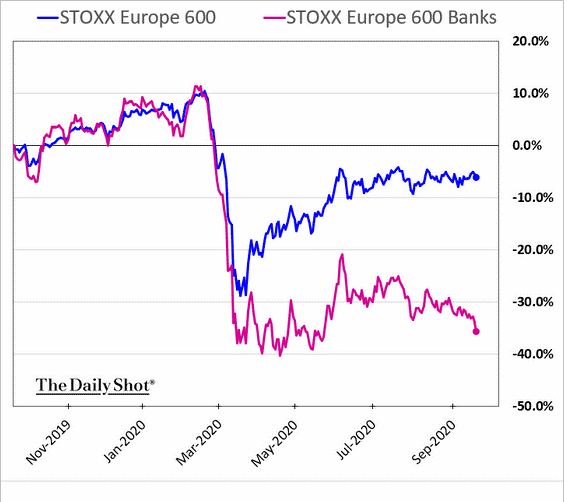

Here in 2020, bank stock troubles are resurfacing. Year-over-year differences between ‘Big Finance’ and primary stock benchmarks are downright jaw-dropping.

In Europe (STOXX 600 vs European Banks):

And in the United States (SPY vs KBE):

In a world where central banks have destroyed yield curves with negative interest rate policy (NIRP) and zero percent rate policy (ZIRP), not to mention a pandemic that has decimated millions of private businesses, banks have little reason to lend. Prospects for bank growth appear limited at best.

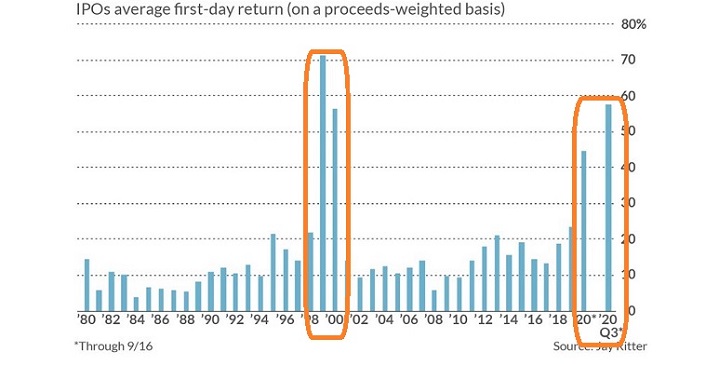

That hasn’t deterred get-rich-quick investors from bording the IPO rocket ship. Returns in the first day of trading have been astronomical. Think Snowflake (NYSE:SNOW)) or JFrog (NASDAQ:FROG).

The last time that participants went completely bonkers for anything ‘IPO?’ The 2020 tech bubble burst in dramatic fashion, wiping away more than 75% of the NASDAQ’s price.