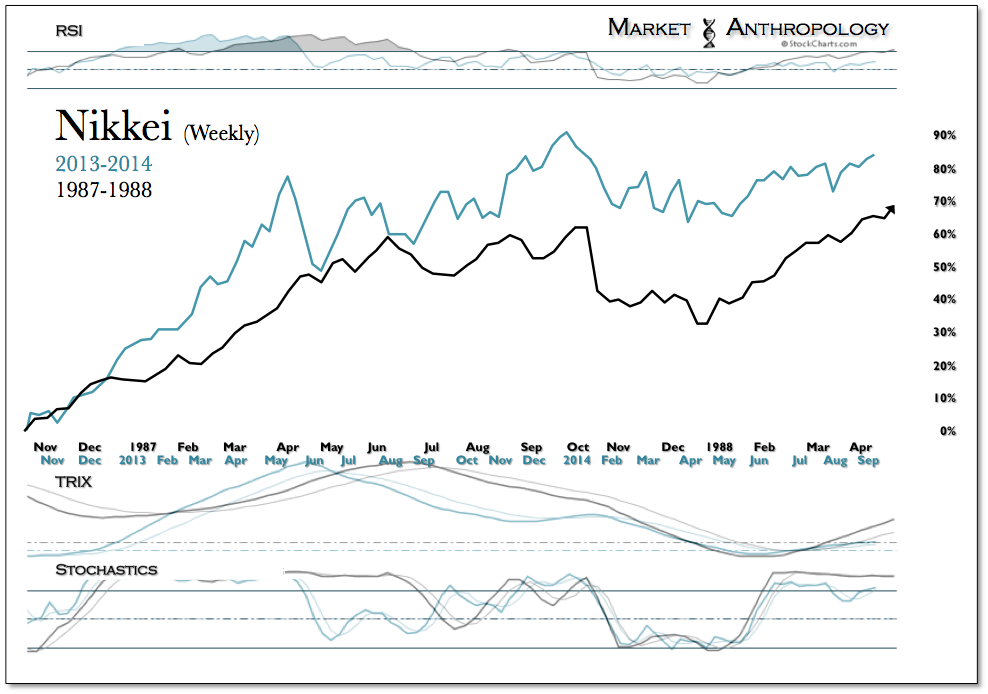

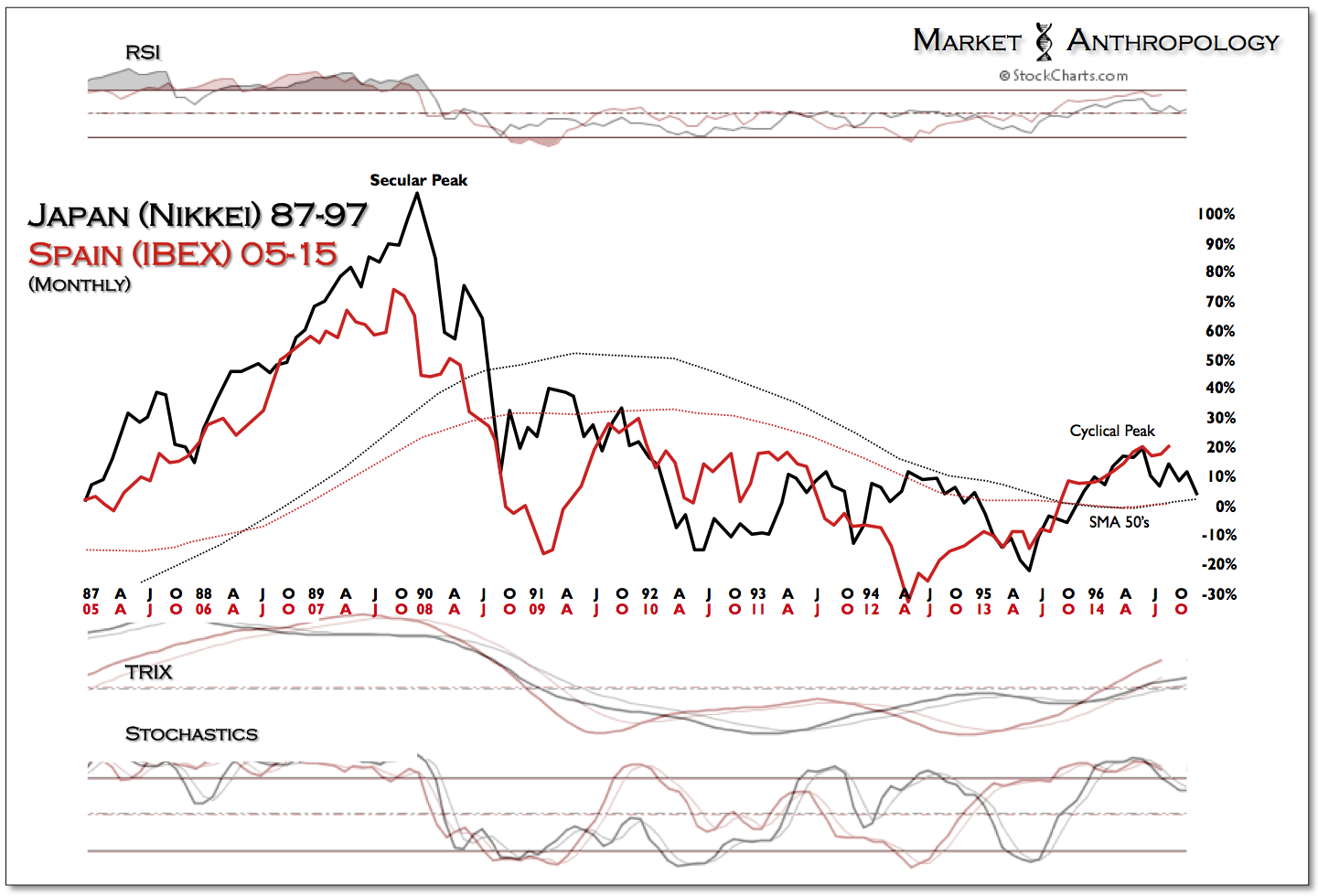

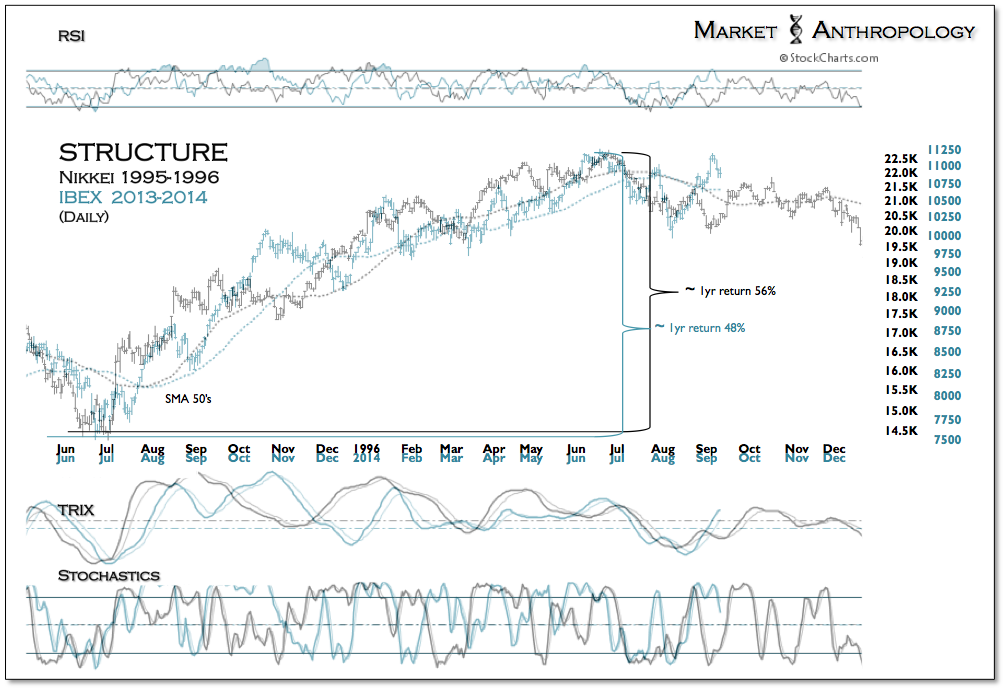

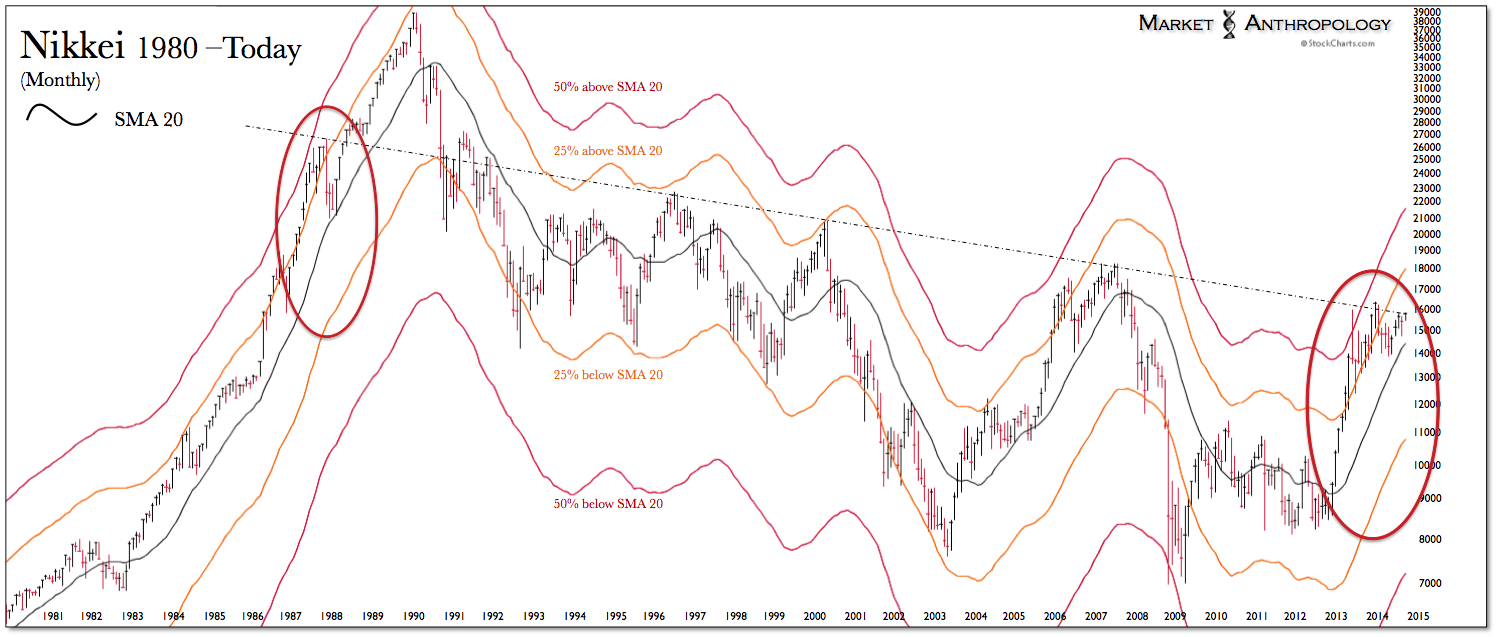

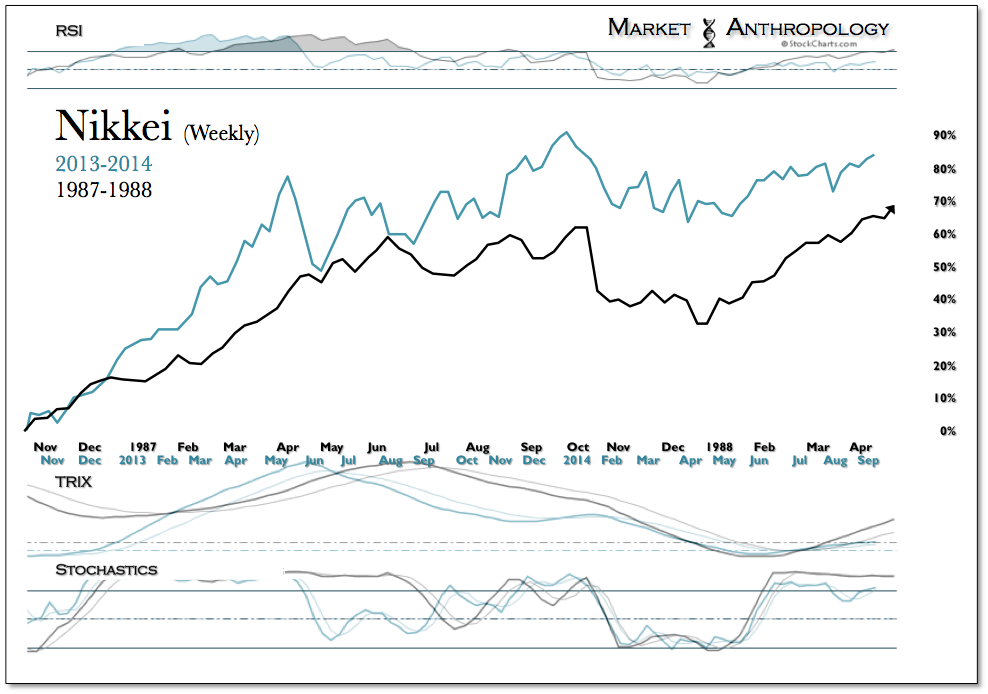

With the most recent push higher in the Nikkei, Japan finds itself at a threshold opening that has rejected their equity market advances over the past three decades. Throughout the year, on both sides of the field (see here), we have followed the momentum comparative of the Nikkei's 1987-1988 rejection and recovery.

Similar to our Meridian work with the SPX that also extends from 1987, this time period as well marks the upper-pivot of the declining resistance trend, the Nikkei has strictly adhered to and been rejected by since making its historic peak in late December 1989.

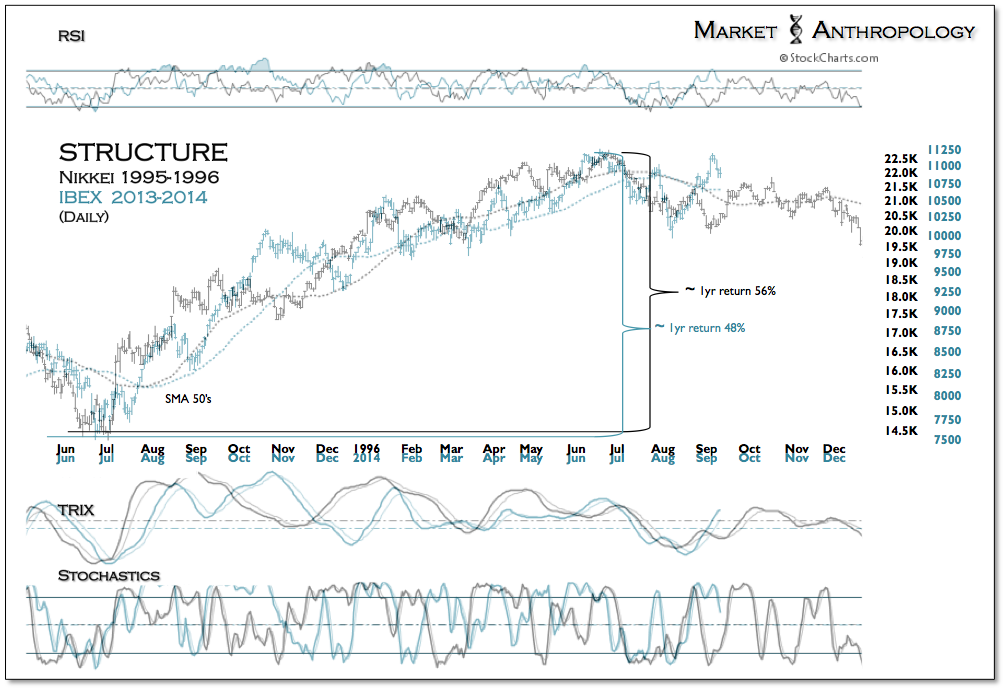

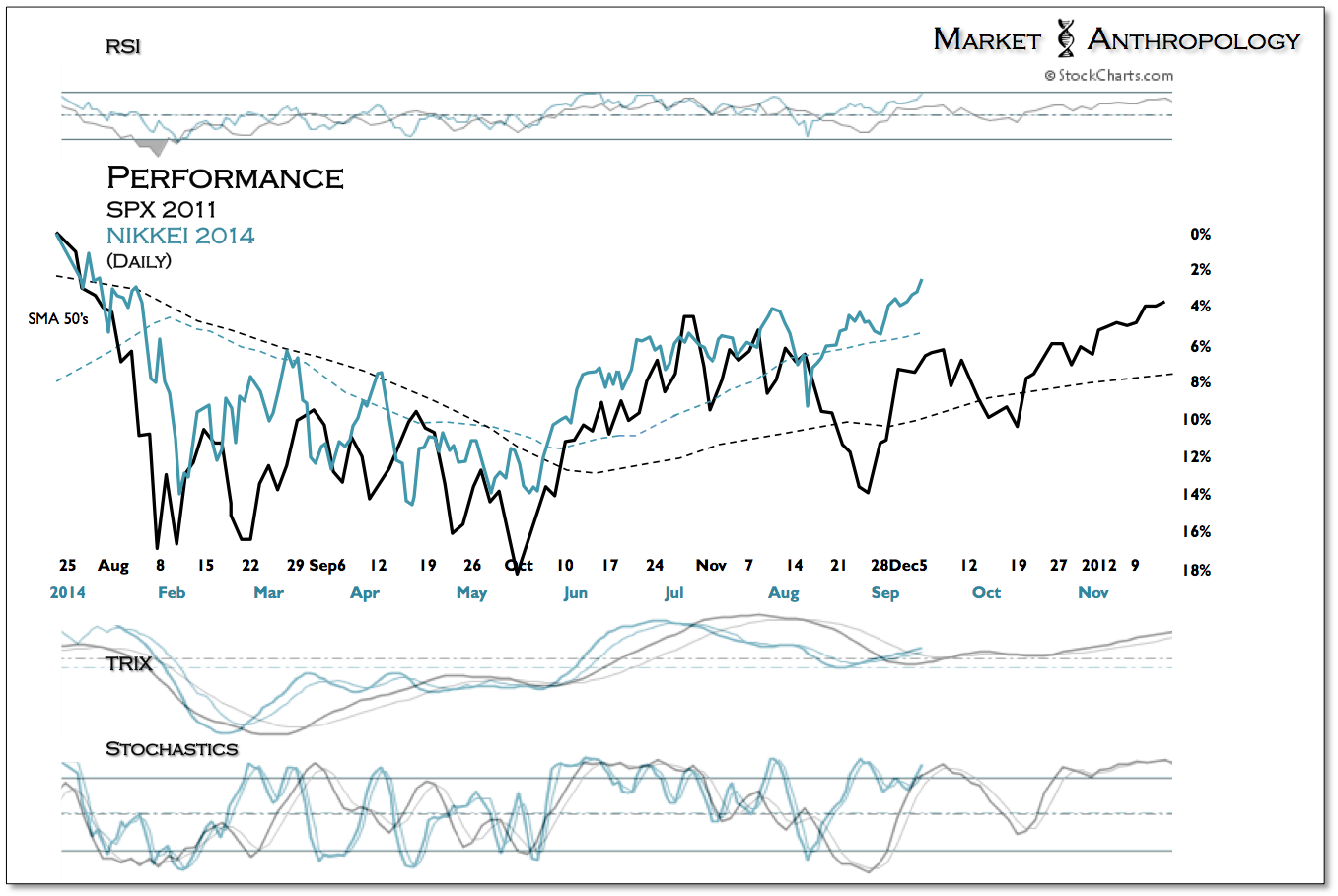

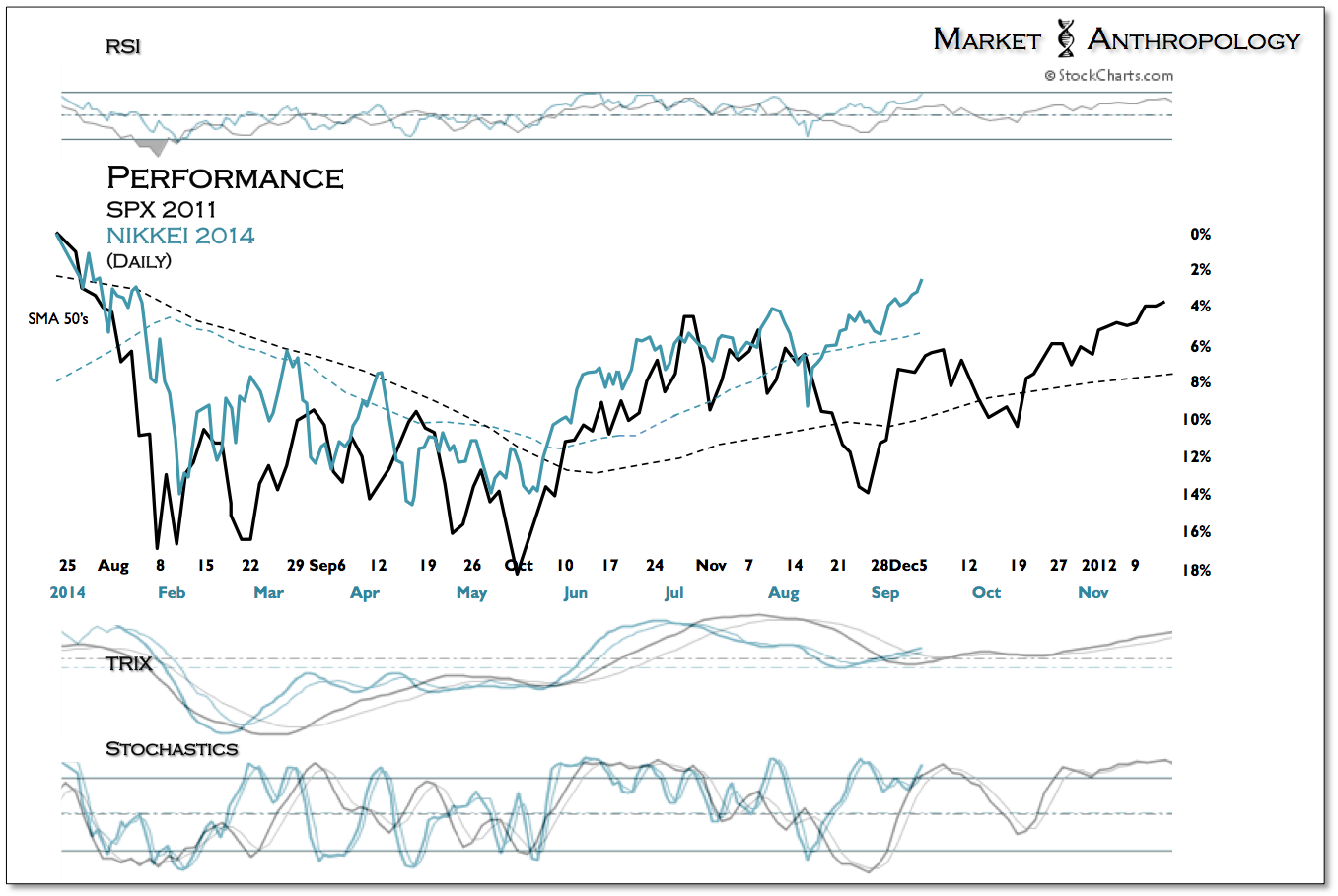

In our most recent note on Japan (see here), we had described that the Nikkei was following a similar recovery pattern that our own equity markets had taken at pivotal times - most recently in 2011. What they all had in common - with varying proportions, was that momentum was quickly restored to the upside, once the retracement decline was completed.

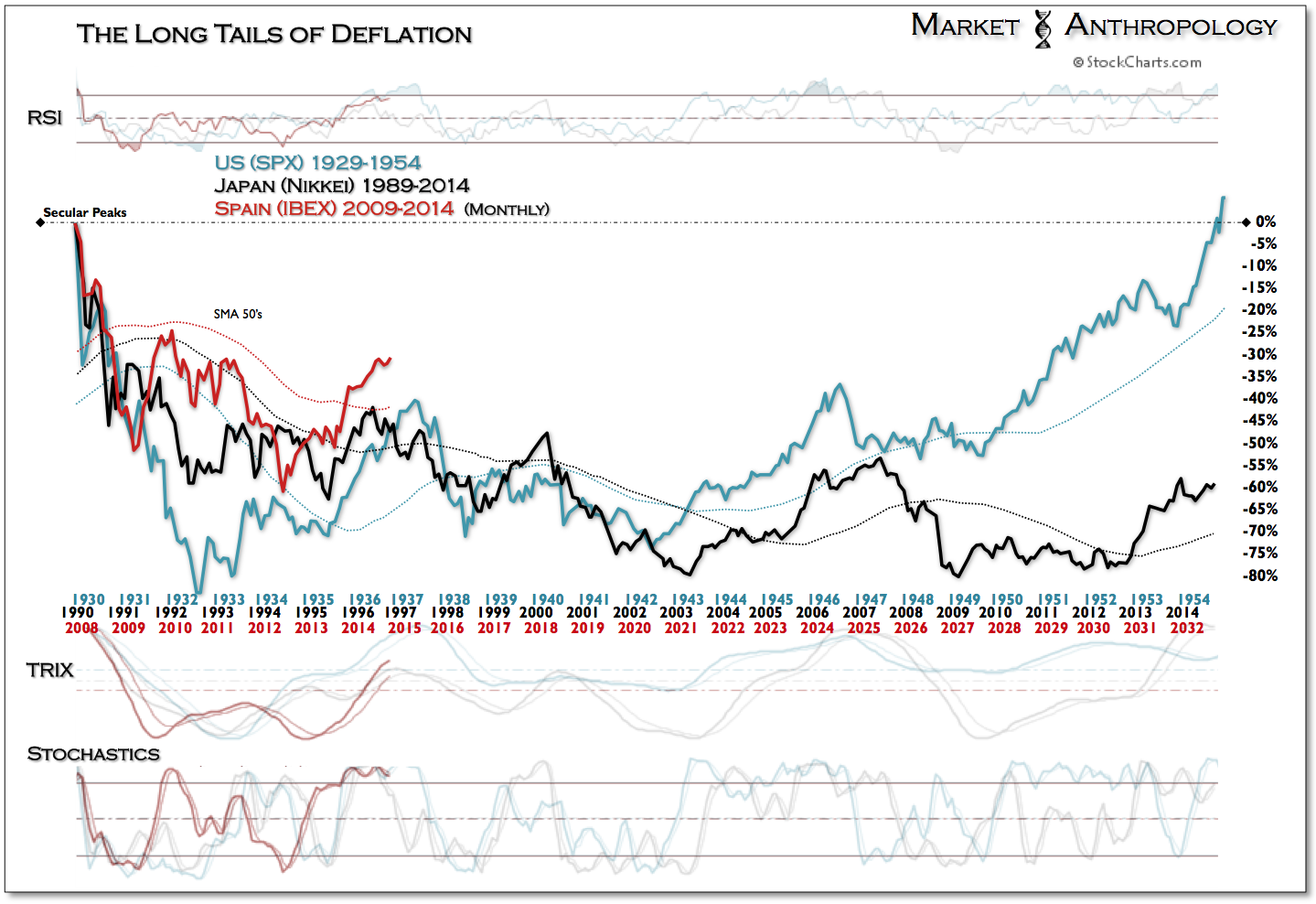

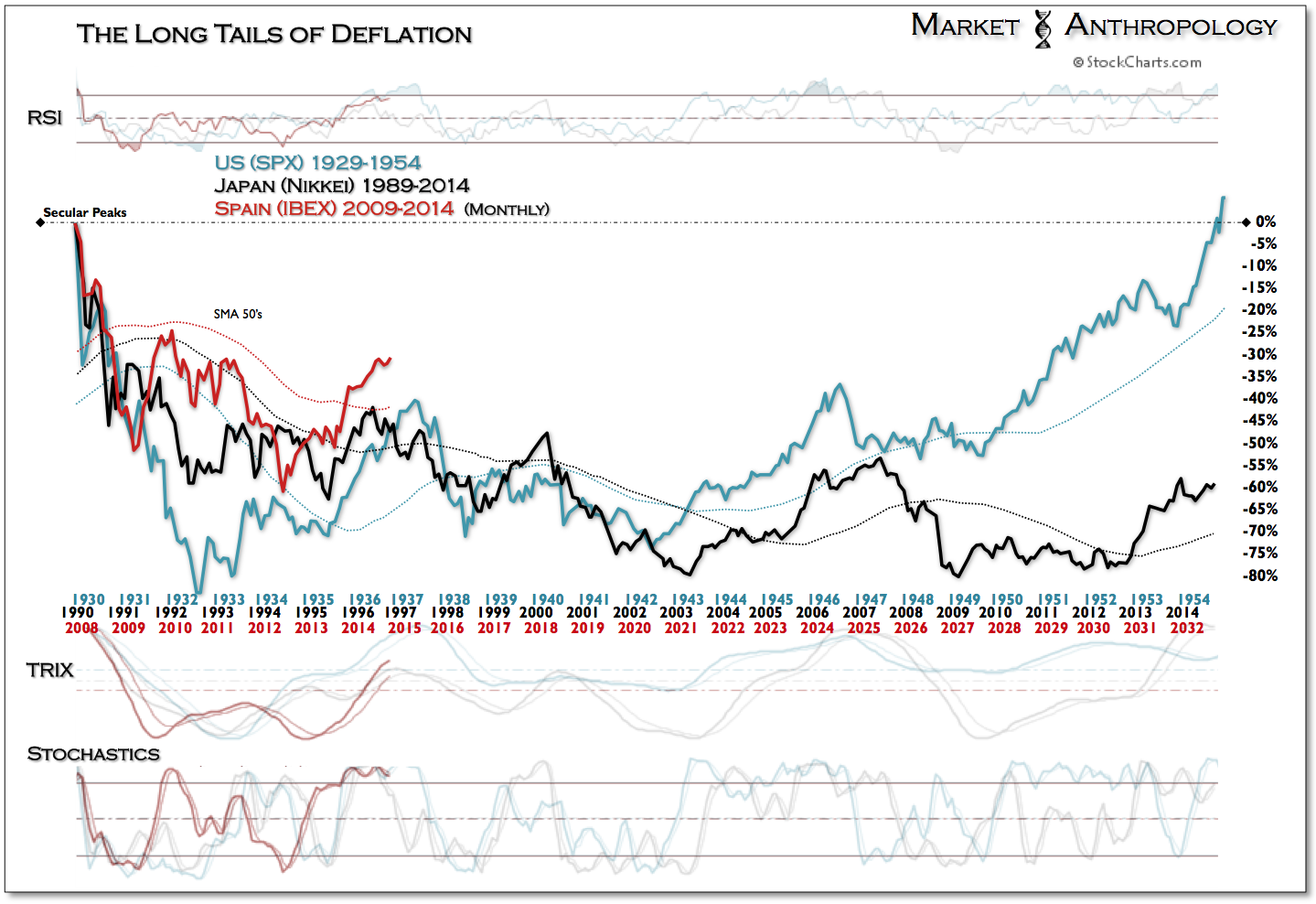

From our perspective, it appears the Nikkei will loose its deflationary shackles, just in time to celebrate its twenty-fifth anniversary this Christmas. Coincidentally, it took the S&P 500 twenty-five years to the month to break above its nominal high from 1929. While the lay of the land is much different for the Nikkei and Japan today, perhaps similar to the US generation born during the Great Depression and World War II, historians will eventually refer to those brought up in Japan over the previous two decades as the "Lucky Few" as well. History repeats - often with a great sense of irony.

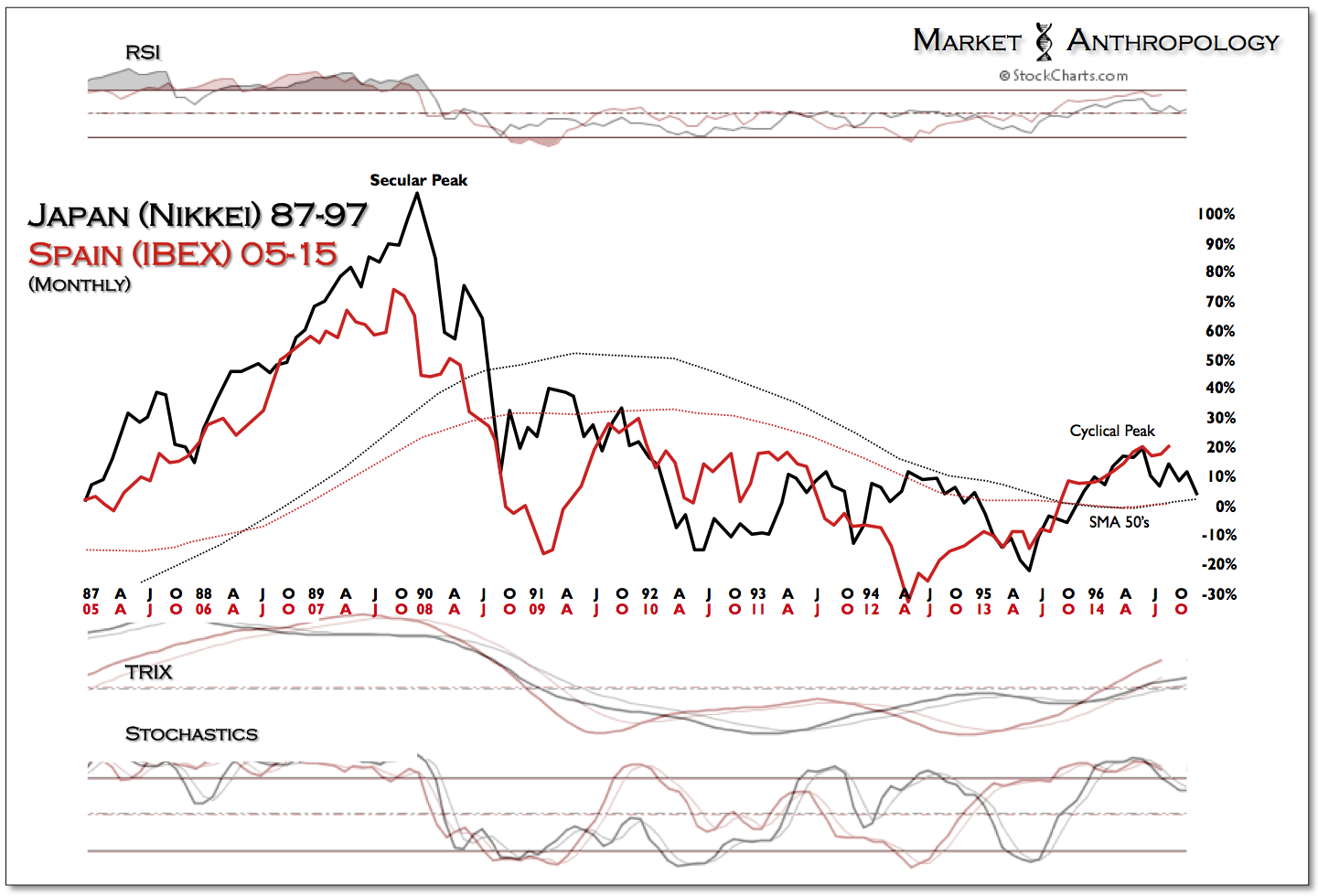

With Draghi recently breaking the glass and pulling the QE fire alarm, he's attempting to startle some of Europe's markets out of their respective cyclical peaks and deflationary glide-paths, we believe they have been moving towards this year. Will it work?

We remain skeptical, and look towards Japan's initial efforts that broadly failed at maintaining momentum in their capital markets. As Paul McCulley aptly describes in his latest note for September (must read - see here), it is a Hobson's choice - and one that theoretically, "should never be on the table, if the fiscal authority is willing and able to party hardy..."

Considering the many disparate economies, players and opinions around that table today in Europe, the amount of libations needed to imbibe and maintain the festive atmosphere will likely need to be significantly larger than what was initially floated. Don't get us wrong, it was really nice to receive the invitation - it's another thing entirely when folks show up at the party.