NFP Hodge Podge

While US employment data disappointed the market, on the whole, it was a Hodge podge of sorts. The Unemployment Rate came in at a stellar 4.6% vs. 4.9%; NFP was in at consensus but the key Average Hourly Earnings (AHE) shocked by missing badly on the downside -0.1% month on month vs. 0.2% expected . With the USD reflation trade in full bloom; the earnings component overshadowed the gains in the Unemployment number, while the downward NFP revision to October also upstaged a significant decline in the jobless rate to a 9-year low. But arguably , it was the miss on AHE that caught the most attention with US dollar bulls stumbling into the weekend as the wage-earning component was nowhere near supportive of the Fed’s often stated inflation target of 2 %. While the AHE component was soft, the Feds remain locked, loaded and ready to roll out a December rate hike but expectations have faded slightly for an early 2017 Fed follow-up .

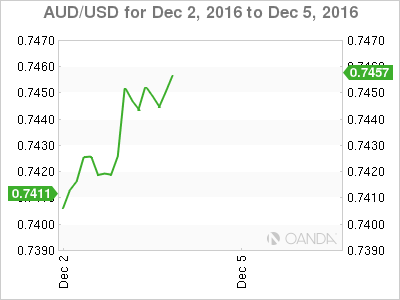

Australian Dollar

While the initial market reaction was muted, Friday’s stronger than expected OZ retail sales number eventually boosted the Aussie dollar fortunes during the USD rally curtailment post-NFP. However, the domestic risk is brewing with the RBA policy deciison and statement on tap Tuesday , even more so after a string of weaker than expected economic releases in November. Regardless, It’s hard to envision the RBA moving off its’s neutral stance but if anything the tail risk would be for a slight easing bias.So while no change in policy remains the markets baseline, traders are eager to scrutinise the accompanying statement for future policy guidance. Also, with some anticipating a GDP downgrade on Wednesday, although the negative impact will be somewhat tempered by the recent bounce in commodity prices, none the less, it could provide some headwinds for the Aussie

The RBA post rate announcement statement will undoubtedly create some decent price action as will Wednesday’s domestic GDP release, but I anticipate Aussie dollar overall sentiment will continue to be supplanted by US Fiscal and Monetary policy evolution which should build further conviction and an additional tailwind for the Aussie bears.

We sit on the edge awaiting the Italian referendum results .

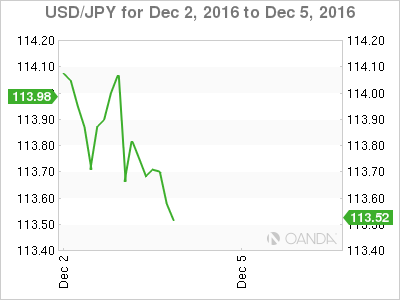

Japanese Yen

While the base case for USD dips to remain shallow stays intact. But given that many year-end currency levels have been achieved (Specifically , 114.75 USD/JPY ). There is a growing propensity for traders to lighten long USD spot positions while preparing to buy into possible USD/JPY pullbacks to the 110.50-111 region. Keep in mind; every model has jumped on the clear cut 10 Year Bond Yield divergent trade on USD/JPY post USD election. And if US bond markets show any inclination to trade sideways this week and selling pressure does not re-emerge, I think there will be greater fervour for traders to book profits. So 114.50-115 levels will likely provide a high barrier to breach, and the market could ultimately fall into to a broader 110-115 range trade mentality.

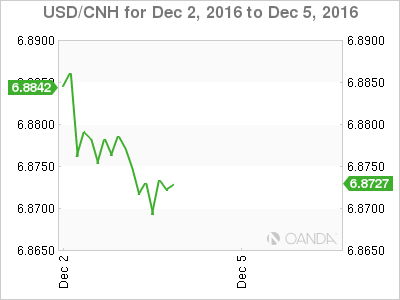

Chinese Yuan

While the outlook hasn’t changed for a weaker Yuan, Dealers are in little mood to challenge state-owned banks selling flows nor the exorbitant short-term Yuan funding rates as the markets concede to a likely 6.90 USD/CNH top end heading into year end. The CNH Hibor rose to 7.159 which is discouraging short yuan trades and has traders looking to express a negative regional bias through other vehicles.

The PBOC has made a stance and drawn a line in the currency sandbox with the primary focus to ward off accelerating capital outflows as we head to year end. However, the Trump reflationary trade is expected to reassert itself in early 2017, which will leave the PBOC struggling to support the Yuan in the face of broader USD strength. While traders are currently sitting back waiting for USD offers to come their way, look for the market to accelerate higher in 2017.

After being battered and bruised the past two weeks the Ringgit finally showed some moxie into weeks end after the Bank Negara Malaysia (BNM) laid their cards on the table. In an attempt to provide traders with some exchange rate policy clarity, a hedging alternative while offering a boost to onshore liquidity. At 4 PM local time Friday, (BNM) stated in a declaration that “exporters could only retain up to 25% of export proceeds in a foreign currency, while the remainder must be converted into Ringgit. Higher balances would need BNM approval, it said. The central bank also upped the ante to kerb capital outflows by providing a provision that all ringgit proceeds from exporters will earn a higher deposit rate of 3.25% per year, until 31 Dec 2017, subject to further review.”

After two weeks for virtually pegged onshore currency markets, the onshore unit finally moved to the left but more interestingly was the desperate convergence of the NDF market to spot which paired nearly 3 % of the basis on the spot to NDF convergence after all was said and done. Pretty ghastly move for new offshore hedgers to absorb, but at least some policy clarity is forthcoming from the Central Bank after weeks of market turmoil offshore.

However, no one seems to be rushing back to the Ringgit Trading Post, so I suspect liquidity will remain spotty with very few speculators willing to partake.

The Week Ahead.

Europe

The ECB and the Renzi referendum double feature have put the Euro back in the cross hairs. With only a minor retracement higher in the EURO despite the disappointing US employment numbers, the market is likely holding on to EUR shorts despite the referendum ‘ NO ” result probably priced correctly. While the tail risk of an ECB tapering has tempered the current EUR/USD assault, the baseline market view is for an extension of QE and as the market continues to support the view of higher US yields; EUR/USD rallies will likely be short lived and aggressively sold.

Australia

While the RBA will come into focus Monday, as the tail risk for the Aussie to move lower if the RBA downgrades either of its domestic or global views remains possible . This shift could increase the risk for easing bias. Wednesday’s 3 Q GDP will come under similar security, but the Aussie markets continue to engulf external drivers especially with the political risk in Europe accelerating and the USD dollar bull trend likely to re-emerge.

New Zealand

Focus shifts to the political landscape when the Government releases its bi-annual budget update on Thursday. Focus is centred on how the government will view the financial impact of the Kaikoura earthquake. My opinion is that the negative implications are all but priced in while positive surprises from additional tax cut incentives may provide a near-term boost to local investor sentiment

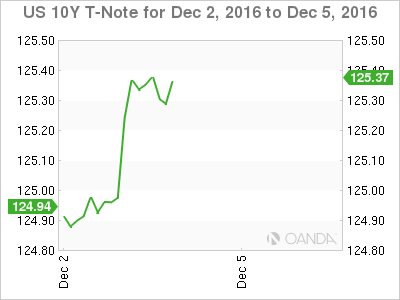

Reflationary Trade

I view this week as an important directional inflexion point for the dollar as to where it will close out 2017 but does not alter the medium -term bias that Investors will continue buying USD dollars, nor will they shy away from selling Bonds in early 2017. The key for near-term direction will be the US fixed income markets, which rallied into weeks end as traders covered shorts heading into what may be a politically charged start to the week with the Renzi Referendum on tap. How quickly the “Short” Fixed Income Trade re-emerges will likely dictate the USD’s early APAC momentum and in my view will; l provide some guidance for the Greenback direction into years end. Typically, an aggressive rally on fixed income into the weekend signals a greater propensity for additional profit taking early the falling week. So the dollar may remain on the defensive at the beginning of Monday trade, and with the political storm clouds and uncertainty brewing in Europe, dealers will likely err on the side of caution and wait for a clearer signal on the referendum before aggressively re-engaging.

Adding to this week’s reflationary trade was the impressive rally in oil prices, But with upticks likely to be sold on the threat of increased US Shale supply, last week’s moves could run into a supply of offers. With a sizable element of the street viewing OPEC’s recent production cuts as a possible last stand, the overall effectiveness of the production cut near term is dubious at best, so whatever expectation for a quick bump to the perceived reflationary Goldilocks zone of $55-60 per barrel might need to remain on hold.

Have the bond market overshoot? Not a chance and in my view, they are just getting warmed up. With a massive wave of fiscal spend all but rubber stamped in the US, the Federal Reserves forever inaccurate dot plots are likely in need of some serious overall as turning on the US.“Fiscal Policy Taps” will be highly inflationary. Are the Feds behind the curve ? of course, but the question is will they officially plan to remain so? Either way, the Bond Bears will continue to rule the day as Fixed Income Desks will continue to price in the reflationary trade through 2017 while Forex Desks continue to accrue USD topside exposure.

The More Things Change the More They Remain the Same

We are in fact back at those same levels on EUR/USD we were at in December 2015. No wonder they call Forex a cyclical game.