Another day’s trading, another day of US dollar strength.

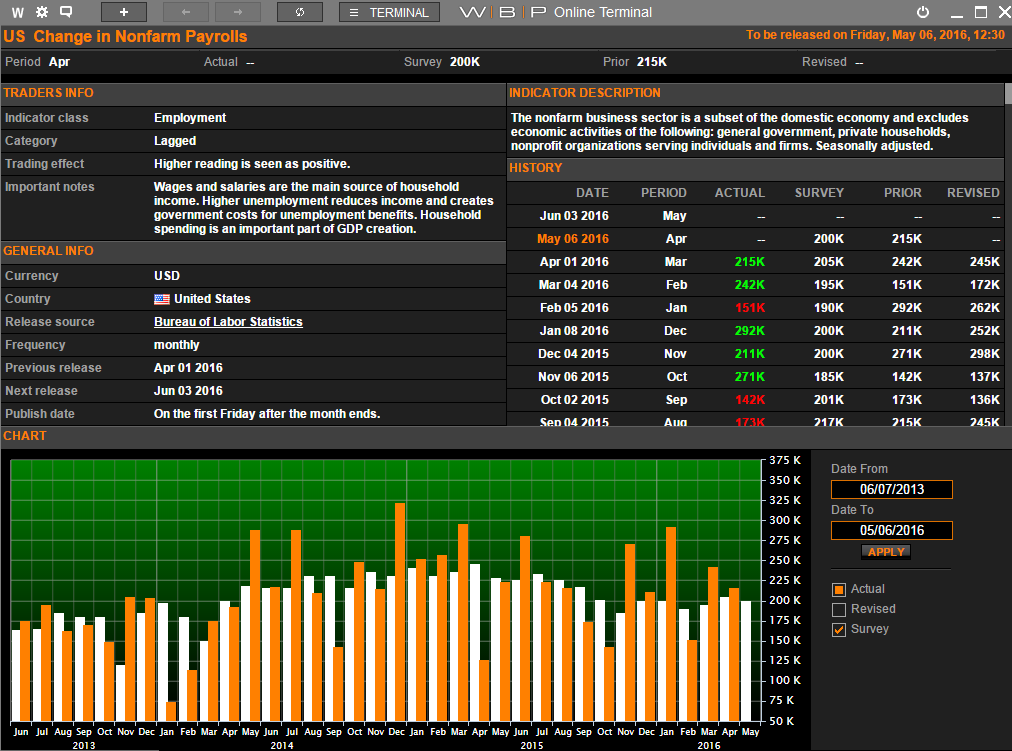

We spoke yesterday about market expectations heading into NFP and what that could possibly mean for USD. The thinking was that following Wednesday’s poor ADP number, markets might price in lower expectations for NFP tonight.

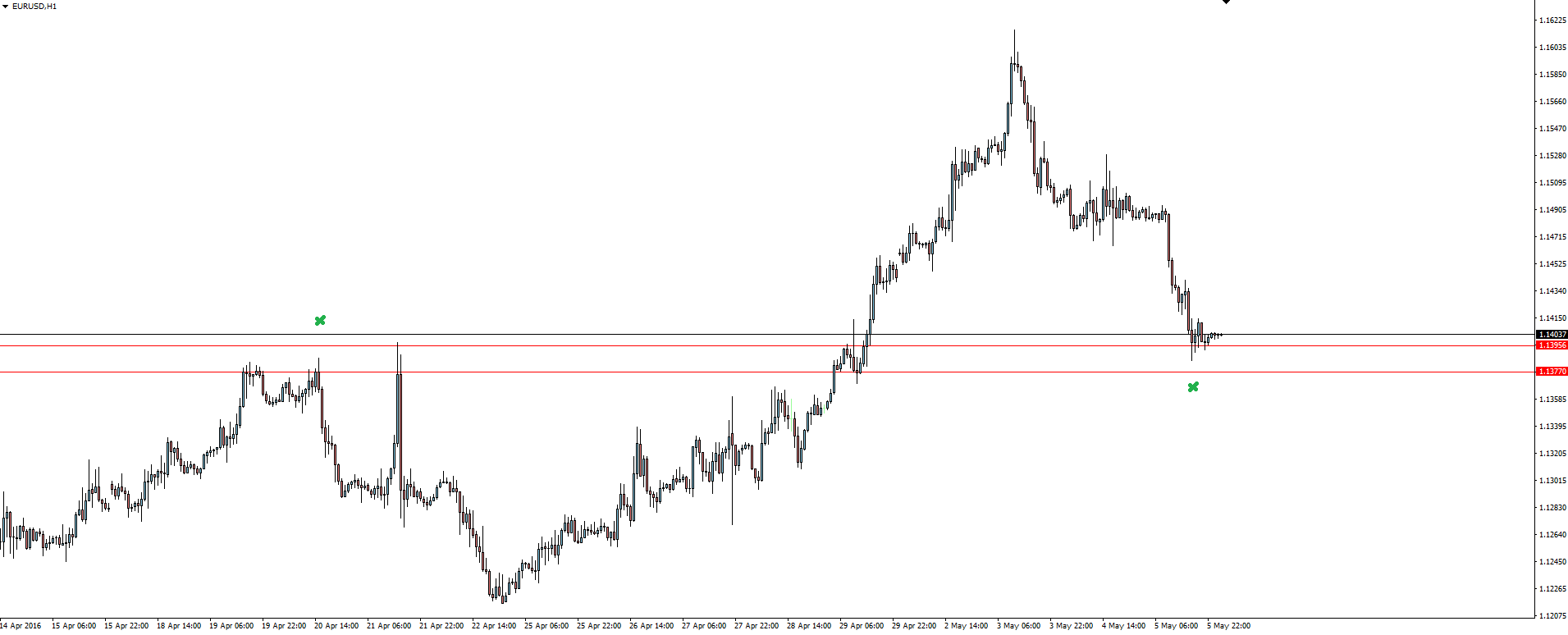

EUR/USD Hourly:

We’ll see where we end up heading into the release, but in early Asian trade, EUR/USD has pulled back to re-test previous resistance as support in the dead middle of an hourly range that has formed over the past month.

Price isn’t making things easy for us lately in assessing which side poses the greater risk when it comes to potentially game changing news, has it!

Above is the headline NFP number preview, but remember that during the most recent releases, the Average Hourly Earnings number has been the big key. With stubborn wage growth a major hurdle in the economic recovery that the Federal Reserve is currently overseeing, whether the recent upward trend in wages will continue, no doubt it reflects heavily in the post-release price action.

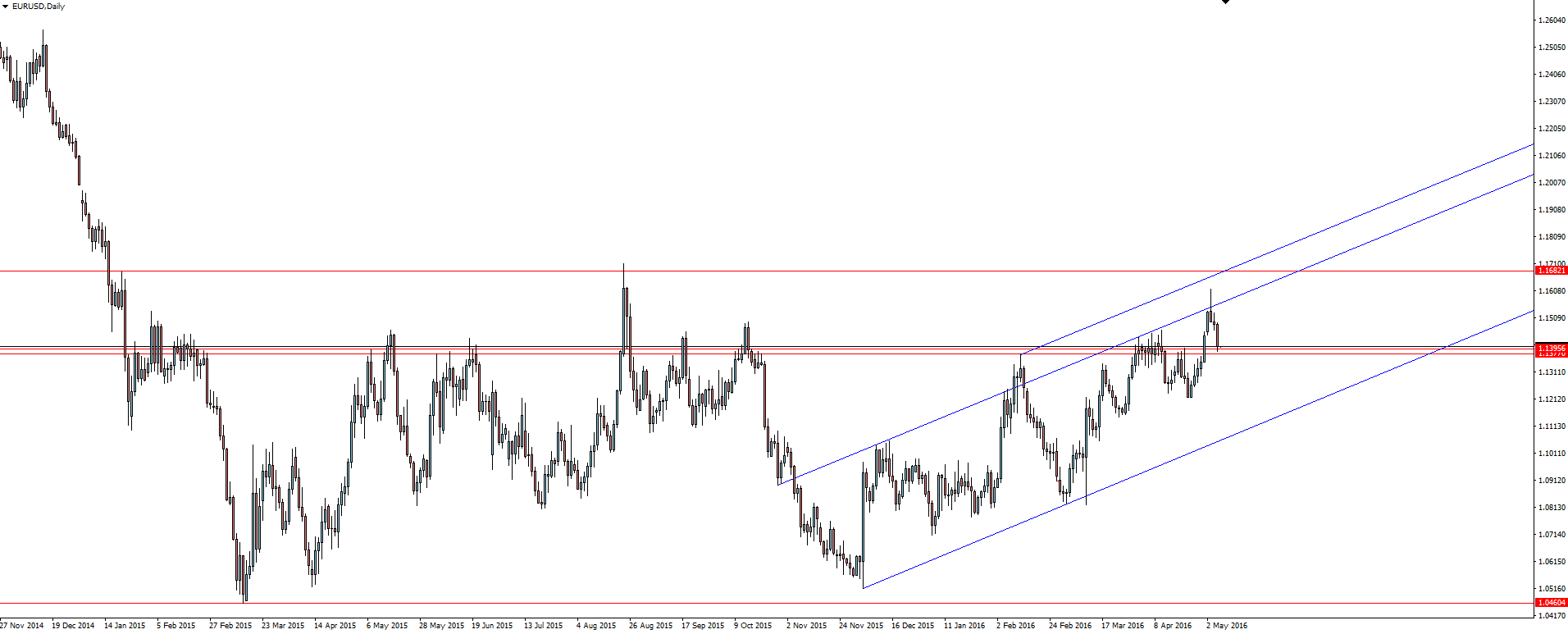

EUR/USD Daily:

Chart of the Day:

Today’s other major release comes during the Asian session with the RBA releasing their Monetary Policy Statement.

Following the inflation miss which inspired the Aussie central bank to cut rates on Tuesday, today’s statement will inevitably see some downward revisions in forecasts. Most important will be some of the inflation forecasts for later in the calendar year and whether they remain within the 2-3% target band. With the rate cut highlighting just how important the RBA’s mandate on inflation is, these forecasts are sure to be highly AUD sensitive.

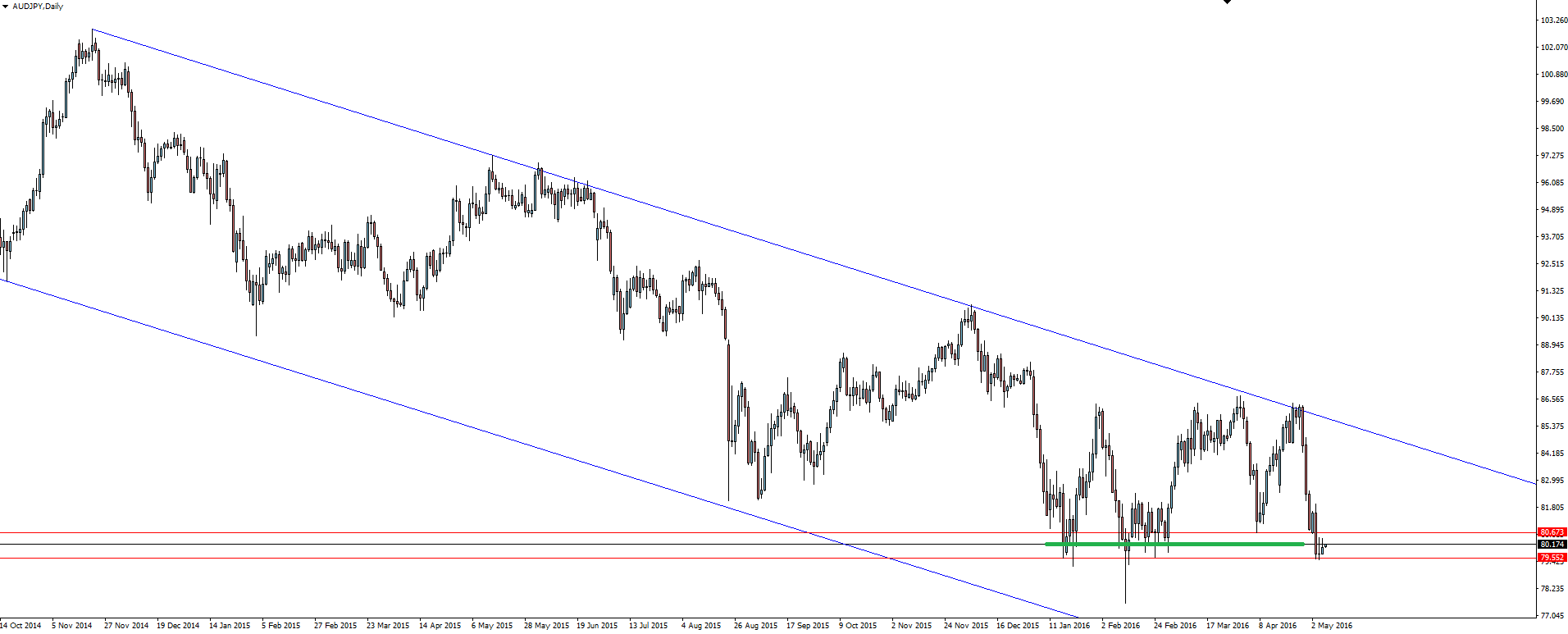

AUD/JPY Daily:

I have included an AUD/JPY chart for the horizontal zone that price is testing again. Are you managing your risk around this level?

On the Calendar Friday:

AUD RBA Monetary Policy Statement

CAD Employment Change

CAD Unemployment Rate

USD Average Hourly Earnings m/m

USD Non-Farm Employment Change

USD Unemployment Rate

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex Broker Vantage FX Pty Ltd does not contain a record of our prices, spreads or solicitation to trade. All opinions, news, research, prices or other information is provided as general news and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness, Australian Forex Broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.