Following yesterday’s lead, USD strength has continued to dominate the forex trading landscape into this morning.

Traders shrugged off a notoriously unreliable March private payrolls miss, with the USD momentum unable to be halted on the unreliable and laggy release. The ADP report showed an increase of 156K jobs, missing the market’s 195K expectation. While this opens the door for a possibly weak Non Farm Payrolls number on Friday night, nothing really changes until markets see that number itself.

My thinking around the release is that we might see some pricing-in of a poor NFP number with some USD selling as we head into Friday, but with that comes the possibility of any positive number causing a shock jerk to the upside. This is why I’m nervous about AUD/USD shorts on the back of the RBA cut on Tuesday. USD is still king and this directional risk assessment is just about the most important factor to consider while taking positions into and around the NFP release.

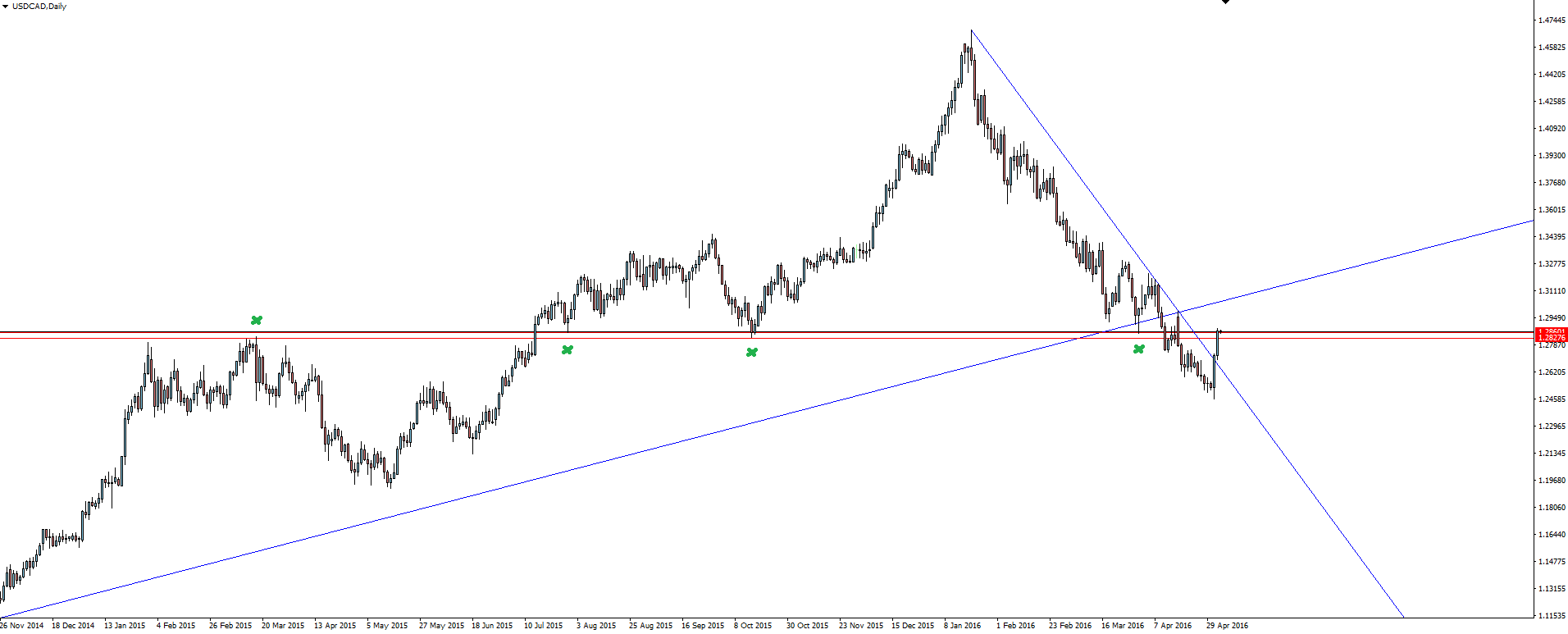

One of the big benefactors in the recent surge of USD buyers has been USD/CAD. Loonie weakness was exaggerated following last night’s worst ever (wow) trade deficit. With the Canadian dollar higher than the BoC would ideally like to see it and longer term oil prices still weak, exports were obliterated.

Talk about a tough global environment for oil reliant Canada.

USD/CAD Daily:

With the momentum break and re-test of the major bullish trend line all but erased in barely two daily candles, this horizontal zone might not be the level to be blindly fading into.

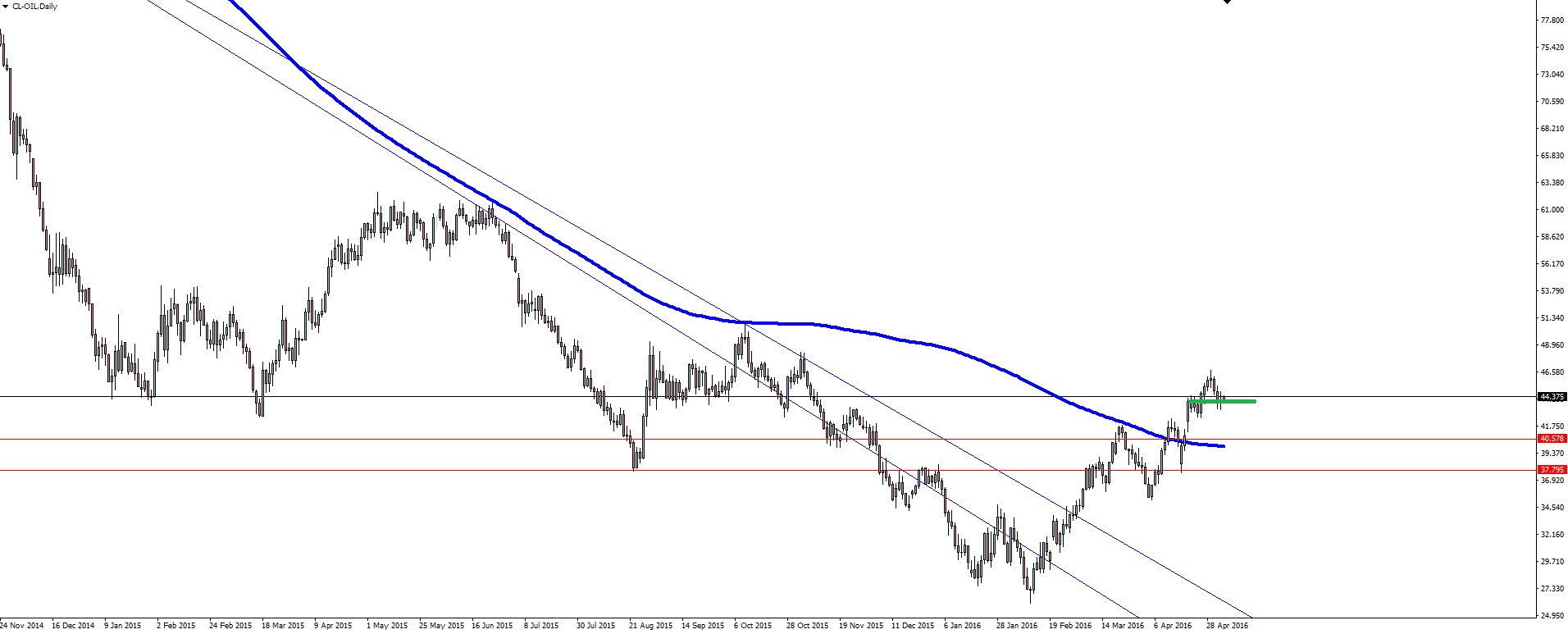

Speaking of the importance of oil to the Canadian dollar, it also seems we can’t include one chart without the other.

A quick overview, is that basically that price broke out of a long term bearish trend line in March and has edged higher ever since. The 200 SMA is on the chart simply because of past reactions from the level and because an April 19 gap fill will also coincide with the level on the daily.

The little green marker just highlights that the smallest, healthy pullbacks in oil seem to get headline attention like no other market. This is the recent weakness we’ve been reading about. THIS!

Do your own research.

Chart of the Day:

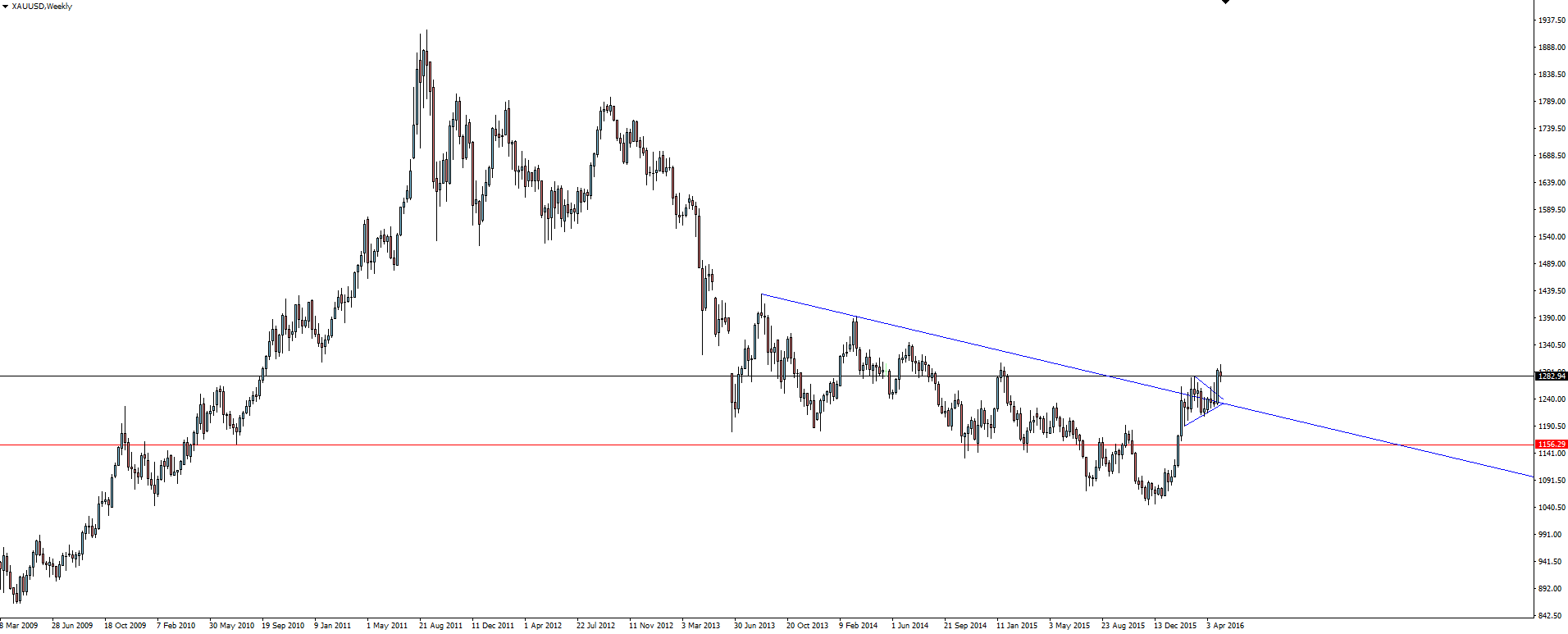

I know there are plenty of gold and metals bugs on our Twitter stream who would have probably flicked browser windows as soon as they read another fiat currency headline, but if you’re still here then this is for you!

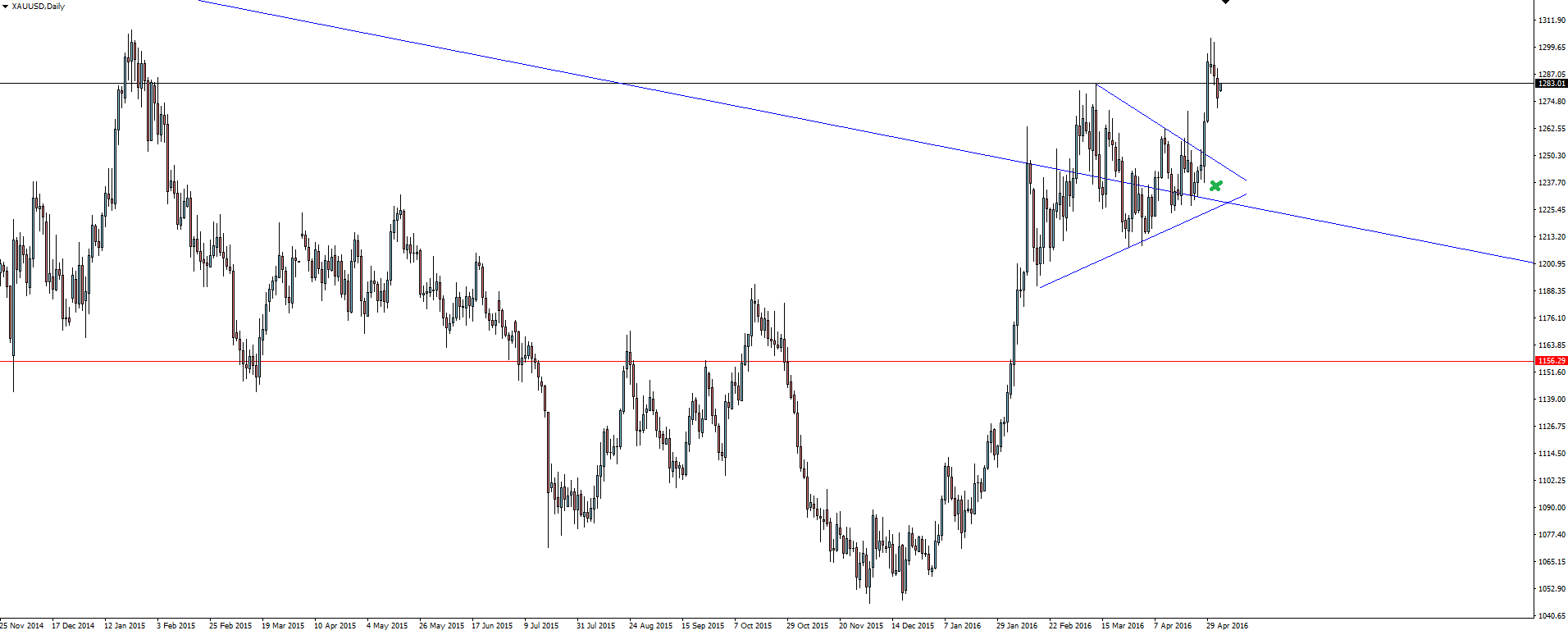

The weekly highlights the bearish trend that gold has been in since the bubble highs. If you open up your own gold MT4 chart, the red line I have marked is a price that has reacted in both directions over the years, but really it’s part of a larger demand zone where buyers have regained some control.

Control that has led to a re-test of resistance, a pennant consolidation pattern and an eventual breakout.

We spoke above about the pre-NFP risk possibly seeing some USD weakness if markets expect the ADP indicator to be true which could see Gold continue higher. If NFP then beats expectations, the possibility of using that weekly trend line as a point of resistance to sell into then comes back into play.

Gold is always a chart that divides opinions and this is going to be no different.

On the Forex Calendar Thursday:

AUD Retail Sales m/m

AUD Trade Balance

GBP Services PMI

Japanese banks will be closed in observance of Children’s Day:

“Children’s Day is a Japanese national holiday which takes place annually on May 5, the fifth day of the fifth month, and is part of Golden Week. It is a day set aside to respect children’s personalities and to celebrate their happiness.”

European banks will be closed in observance of Ascension Day:

“The Feast of the Ascension of Our Lord and Savior Jesus Christ, also known as Ascension Thursday, Holy Thursday, or Ascension Day, commemorates the bodily Ascension of Jesus into heaven.”

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex Broker Vantage FX Pty Ltd does not contain a record of our prices, spreads or solicitation to trade. All opinions, news, research, prices or other information is provided as general news and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness, Australian Forex Broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.