It’s a real pleasure to be heading into a week devoid of FOMC nonsense. Yes, I know the Fed talking heads will be yacking away on the speaking circuit, but what could they say to hurt us? “Yep, it’s still zero percent. Zero. Nada. Zip. You betcha. Any questions?” What a bunch of useless, feckless baboons.

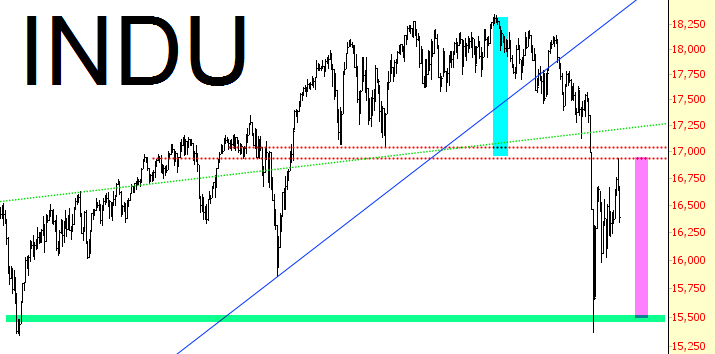

So I’m simply looking for how low we could head. The indexes offer a mixed bag of answers, so there’s no clarity at this time. The Dow, I believe, is headed back to its 8/24 crash low, and it might not might it quite that far. I think a very close double-bottom is in the offing.

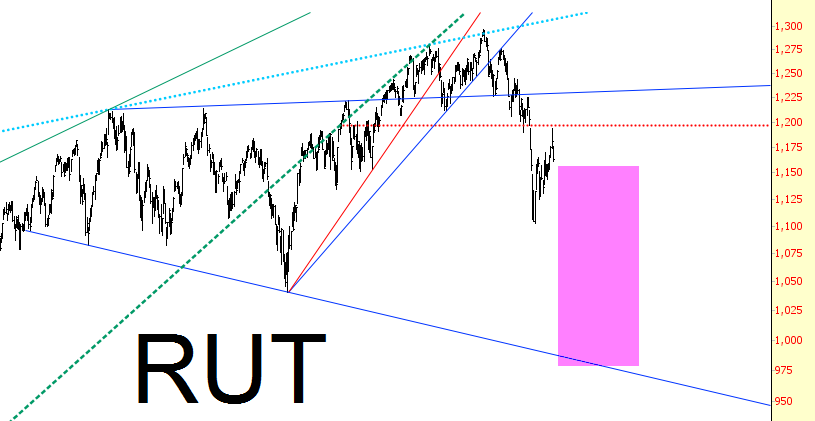

Small caps offer a more exciting picture, although this projection doesn’t jibe at all with the Industrials. Its path could lead it, over the coming months, all the way back down into the very high triple digits.

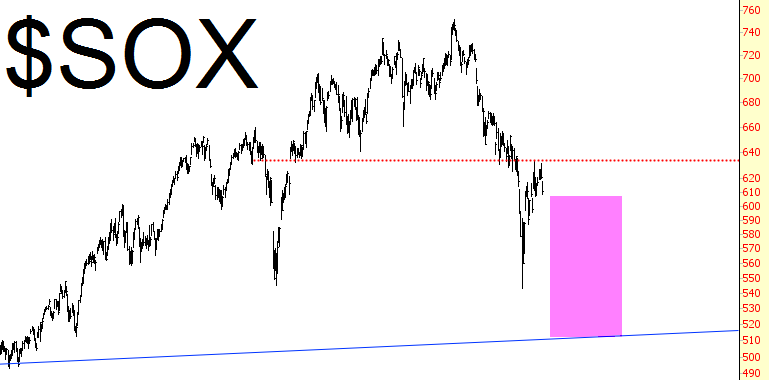

The Philadelphia Semiconductor Index, similar to the Russell 2000, offerings up an intriguing “new yearly low” target based on its trendline.

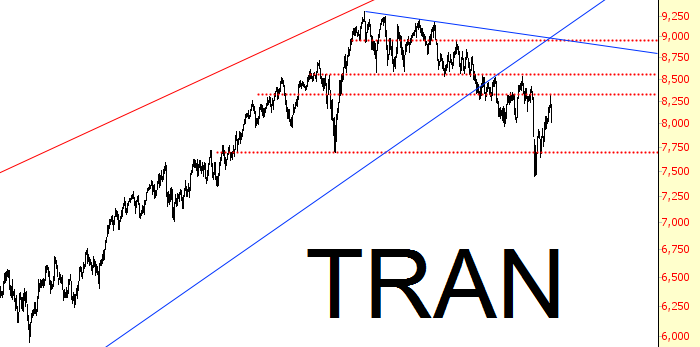

And, perhaps most tantalizing of all, the Dow Transports looks ready to resume an absolutely epic breakdown. I won’t even speculate as to a bottom target.

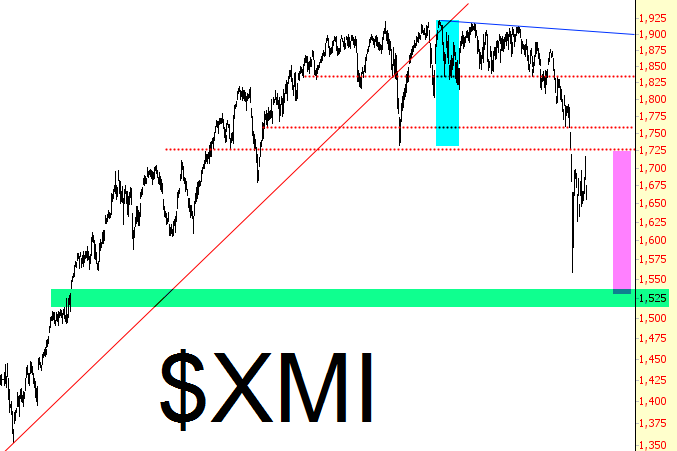

Probably the clearest one of all is the Major Market Index, which provides a price target of about 1525, a little below the crash low. This “feels’ right to me, since I do think we’re going to slightly take out the crash low before some ridiculous new federal salvation will be trotted out. Until then, I’m planning on party time.