Poor Google. The European Union landed a punch to its solar plexus earlier this week, saying it broke EU competition rules.

Google’s parent company Alphabet (NASDAQ:GOOGL) faces a $1.2 billion fine.

The following day, Canada’s Supreme Court dealt Google an uppercut to the chin. It wants Google to scrub search results about pirated products not just in Canada, but everywhere else in the world too.

Google is one of America’s most successful tech giants. It’s going to take more than a couple of punches to topple this powerful company.

The FAANGs Aren’t The Future

But if the news this week made you think twice about Google’s future, then that’s not such a bad thing. Google and its fellow tech megacaps - Facebook (NASDAQ:FB), Apple (NASDAQ:AAPL), Amazon.com (NASDAQ:AMZN) and Netflix (NASDAQ:NFLX) - have enjoyed great success.

Since 2016, they’ve accounted for more than 30% of the S&P 500 rise. That’s nothing to sneeze at.

But I’ve got news for you: The FAANGs aren’t the future. Sure, they’ve had a great run, and it’s not over yet.

But for an investor looking for exceptional growth opportunities, it might as well be over.

To get those kinds of gains, I’m looking for the next Google. It’s not going to be the current one.

I’m also looking for the next Apple, Facebook, Amazon and Netflix. And I’ll be finding them in the technologies and markets of the future...

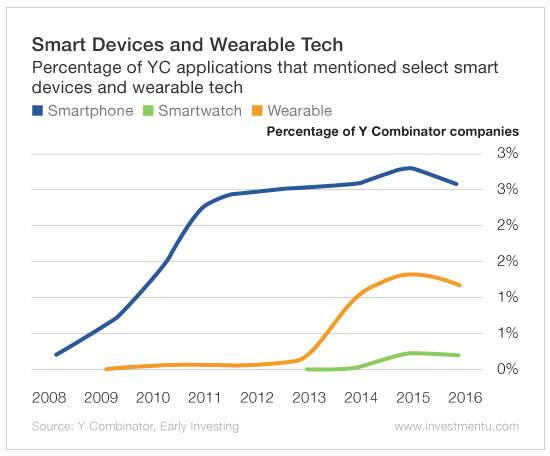

Which is why I like virtual reality. And I don’t like wearables.

I’ve done my research. And it doesn’t involve reading thousands of pages.

I’ve got a shortcut. Amazingly, it points me where I need to be looking for the next generation of great tech companies.

And now I’m going to be sharing my secret shortcut with you.

Some Proof

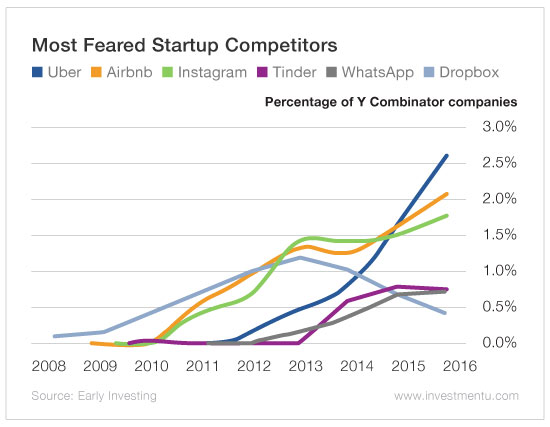

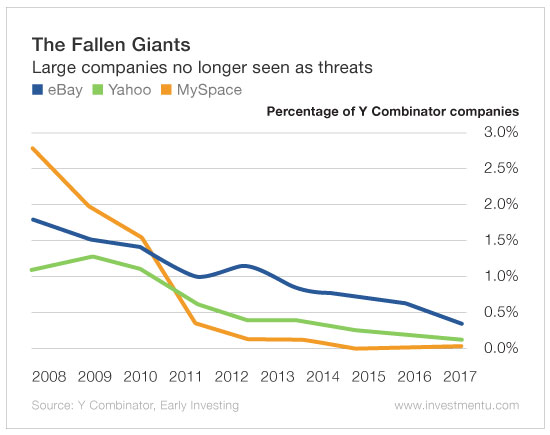

I have a dozen charts I could show you. Here are the two I’ve chosen...

As you can see, the soaring successes of Uber, Airbnb and Instagram were predicted way back in 2010 and 2011.

Yahoo (NASDAQ:AABA) was recently taken over by Verizon (NYSE:VZ) for pennies on the dollar. When did you see that coming? This chart shows that Yahoo’s decline was predicted in 2009. The underperformance of eBay (NASDAQ:EBAY) was pegged in 2008, when this data set first began.

The Oracle-Like Crowd Wisdom of Founders

These charts come from Y Combinator - the U.S.’s top startup accelerator. It has developed an incredible set of predictive data.

Its source?

The data came from tens of thousands of applications received from startup founders wishing to join it since 2008.

Founders were asked questions like, “Who do you see as your main competitors.” The answers were broken down into keywords, which were assigned percentages based on how many times applicants mentioned them.

The results allow you to see into the future. I have the space to show you only a few, unfortunately. What they say about the future - the future of technology - is simply fascinating.

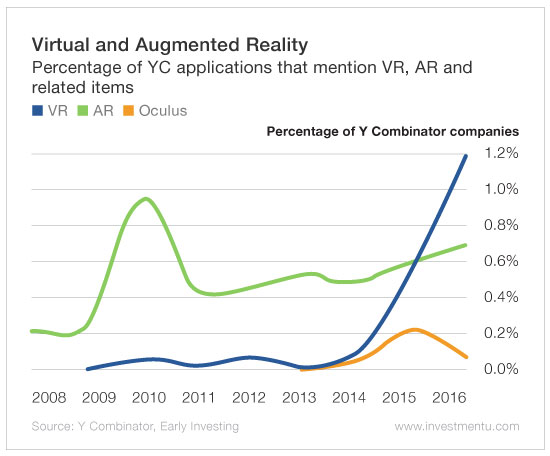

The Rise Of Virtual Reality

We’re bullish on virtual reality (VR), with two VR startups in our First Stage Investor portfolio versus none for augmented reality (AR). Both of our recommendations are gaming-related. In startup land, there’s little consensus for which will do better or arrive faster. For example, Kabam’s Holly Liu said, “I think there’s an interesting play for AR as a step to VR,” citing the popularity of Pokémon Go. This chart says differently.

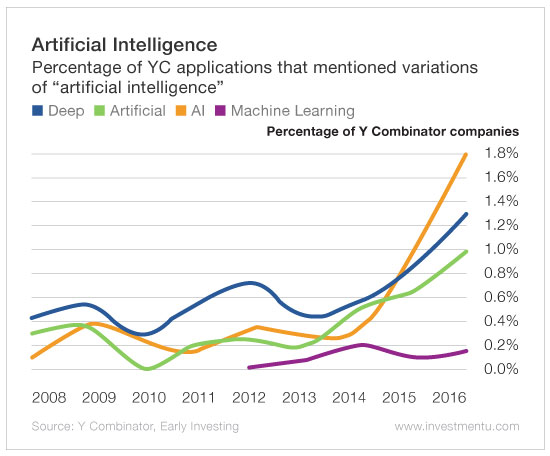

Artificial Intelligence Will Be Huge

There’s so much hype already about AI. It’s been called the “new electricity.” Here’s a typical quote... “The business plans of the next 10,000 startups are easy to forecast: Take X and add AI.” So why show you this chart? To suggest only that the hype is probably warranted.

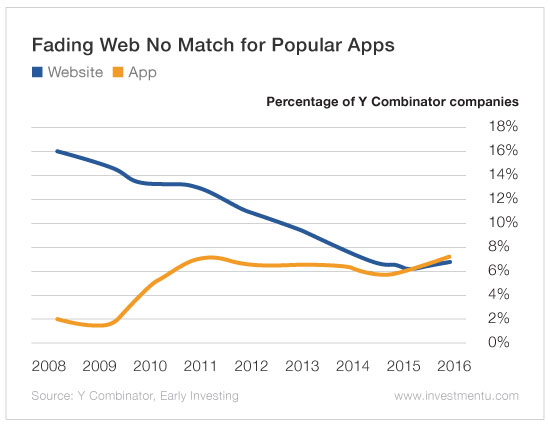

The Age Of Apps Begins Now

Hello apps, and farewell websites. App Annie says that, in 2016, worldwide downloads of apps increased 15%; time spent on apps went up 25%; and the revenue paid to developers jumped 40%. The top five apps by revenue were Spotify, LINE, Netflix, Tinder and HBO Now.

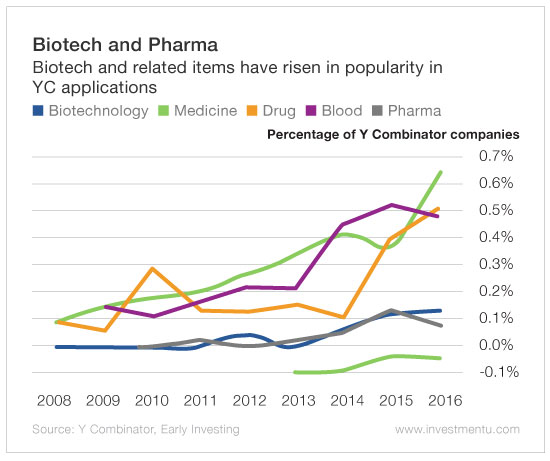

Meds’ Future Shines Bright

With advances being made seemingly every day in genome tech, biome tech, personalized medicine and cancer research, several new drug breakthroughs seem closer than ever. Startups aren’t shying away from this field, despite the cost of bringing new drugs through clinical trials to commercialization.

Why I Don’t Like Wearables

I mentioned this at the very beginning. This chart is a big reason why. Our smartphones changed everything. Their demise would signify the end of an era. But the chart above shows that they’re not being replaced with smartwatches or wearables.

Founders Can Predict Future

I’m lucky. I get to talk to founders almost every day as part of my research into the best startups to recommend to subscribers of our First Stage Investor service.

So I get why these charts can see into the future. Founders are constantly pushing technology into areas where it can make a difference. They know what the big problems are. And they have solutions. They’re on top of the latest technology developments. And they’re keenly aware of the current business successes and failures in their fields.

One of them could be heading the next Google or Amazon, even. And because of their collective insight, I pretty much know where to look.

Good investing