New Zealand Dollar is the strongest one in the currency markets today, as boosted by fastest GDP growth in two years. Otherwise, the markets are rather mixed. Australian and Canadian Dollar turned softer and are trading as the weakest ones together with Swiss Franc. Yen regains some growths, followed by Euro. Dollar and Sterling are mixed. For the week commodity currencies remains the strongest but it’s now led by Kiwi. Yen remains the weakest, followed by Swiss Franc and then Dollar.

Asian stocks are mixed at the time up writing. Nikkei is up 0.37%, Singapore Strait Times up 0.09%. But Hong Kong HSI is down -0.02% and China SSE (LON:SSE) is down -0.12%. They’re digesting this week’s strong rebound. Overnight, DOW closed up 0.61% at 26405.76, It’s now reasonably close to record high at 26616.71 and could challenge it any time. S&P 500 rose 0.13% to 2907.95 but NASDAQ dropped -0.08% to 7950.04. Treasury yield staged another day of strong rally. 30 year yield closed up 0.042 at 3.237. 10 year yield closed up 0.035 at 3.083, now also close to 3.115 key resistance. 5-year yield rose 0.024 to 2.960, breaking 2.941 resistance. We’d like to repeat that larger strength in yield at the long end should be welcomed by Fed policy makers.

Technically, Yen crosses showed clear loss of near term upside momentum. WE could seen USD/JPY, EUR/JPY and GBP/JPY dip back to 111.65, 130.09 and 146.24 minor support levels today. EUR/USD still struggled to break through 1.1733 resistance. GBP/USD and USD/CHF showed loss of momentum too. The condition is set for Dollar to rebound too, it’s just a matter of time.

New Zealand GDP grew 1.0%, fastest in two year, but no trend reversal in NZD/USD yet

New Zealand GDP grew 1.0 qoq in Q2, doubled the speed of 0.5% in Q1 and beat expectation of 0.8% qoq. That’s also the fastest quarterly rate in two years. Over the year ended June 2018, growth also accelerated to 2.8% yoy, up fro 2.6% yoy and beat expectation of 2.5% yoy. Growth was broad based with 15 of 16 industries up. GDP per capita also gained 0.5%.

Looking at more details, the 1.0% quarterly rise in services was the main contributor. Goods-producing industries were up 0.9%. Primary industries grew 0.2%, with strong growth in agriculture, forestry, and fishing offset by a significant fall in mining.

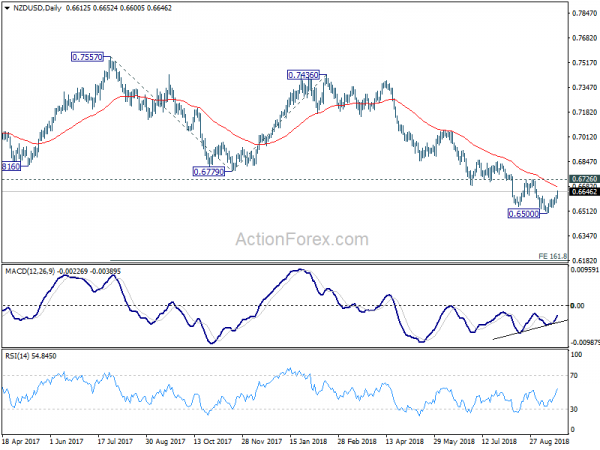

NZD/USD’s strong rally today solidify the case that 0.6500 is a short term bottom. There is prospect of it being a medium term bottom considering bullish convergence condition in daily MACD. But it’s early to tell as NZD/USD is held well below 0.6726 resistance. For now, outlook stays bearish as we’d still expect recent down trend to extend lower to 161.8% projection of 0.7557 to 0.6779 from 0.7436 at 0.6177 on down trend resumption.

Selling her serious and workable Brexit proposal, UK PM May got cold responses from EU leaders

At the dinner in the first day of the EU summit in Salzburg, Austria, UK Prime Minister Theresa May was given the stage to sell her Chequers Brexit proposal. It’s reported that she said theses were “serious and workable proposals” and hoped that the EU will “respond in kind”. She emphasized the Irish border problem could be solved by the type of “frictionless trade” envisaged in the Chequers plan. But the Commission’s proposal is “not credible.

But there were little responses from the leaders of the other 27 EU nations. They are expected to discuss the issues among themselves over lunch on Thursday today, so as to give a united stance for chief negotiator Michel Barnier to conclude a final in two months.

After the dinner, Lithuanian President Dalia Grybauskaite said “At this stage, it’s a standstill. There is no progress.” Slovak Prime Minister Peter Pellegrini said, “On the border issue, there has been no progress.” An unnamed diplomat said “She spoke. There was no reaction.”

NAFTA negotiation restarted with constructive talks but no end in sight yet

Canadian Foreign Minister Chrystia Freeland met US Trade Representative Robert Lighthizer again on NAFTA overnight. After the meeting, Freeland said the talks had been constructive, without giving any details. She said earlier that while Canada is a “country that is good at finding compromises”, the team was also there to “defend the national interest”.

Back at home in Ottawa, Canadian Prime Minister Justin Trudeau urged more flexibility from the US side in making a deal. He said, “we’re interested in what could be a good deal for Canada but we’re going to need to see a certain amount of movement in order to get there and that’s certainly what we’re hoping for.”

Referring a key deadlock in Canadian diary market access, Dairy Farmers of Canada vice president David Wiens said, “For American farmers the Canadian market is a drop in the bucket. For us it’s our livelihood.” And he added that concessions in past trade deals had already hurt Canadian farmers.

US Chamber of Commerce President Thomas Donohue warned that a damaging trade war would be underway if Trump puts all his tariff threats to China into practice. However, he also added “if we can do something next week and get NAFTA done and we do it on a tripartite deal, if we make progress, by the way we are talking in Europe, if we can get that done…we can pretty quickly resolve some of this.”

In Japan, the chairman of the Japan Automobile Manufacturers Association, Akio Toyoda said “Japanese automakers’ businesses in North America are based on the NAFTA framework, and that framework is based on a three-party agreement.” And, “We hope that framework continues this way, and that it remains well-balanced.”

SNB and UK retail sales to highlight the day

Looking ahead, SNB rate decision is a major focus today. The three month Libor target range is expected to be kept at -1.25 to -0.25%. Sight deposit rate should be held at -0.75%. Based on recent volatility in the financial markets, SNB will likely reiterate the risks and maintain its current defensive monetary policy stance. UK retail sales is another key focus. The Pound failed to extend the strong CPI inspired rally, due to Brexit uncertainties. Now it’s time to lend a hand from retail sales.

Later in the day, US will release Philly Fed survey, jobless claims, leading indicator and existing home sales. Canada will release ADP payrolls.