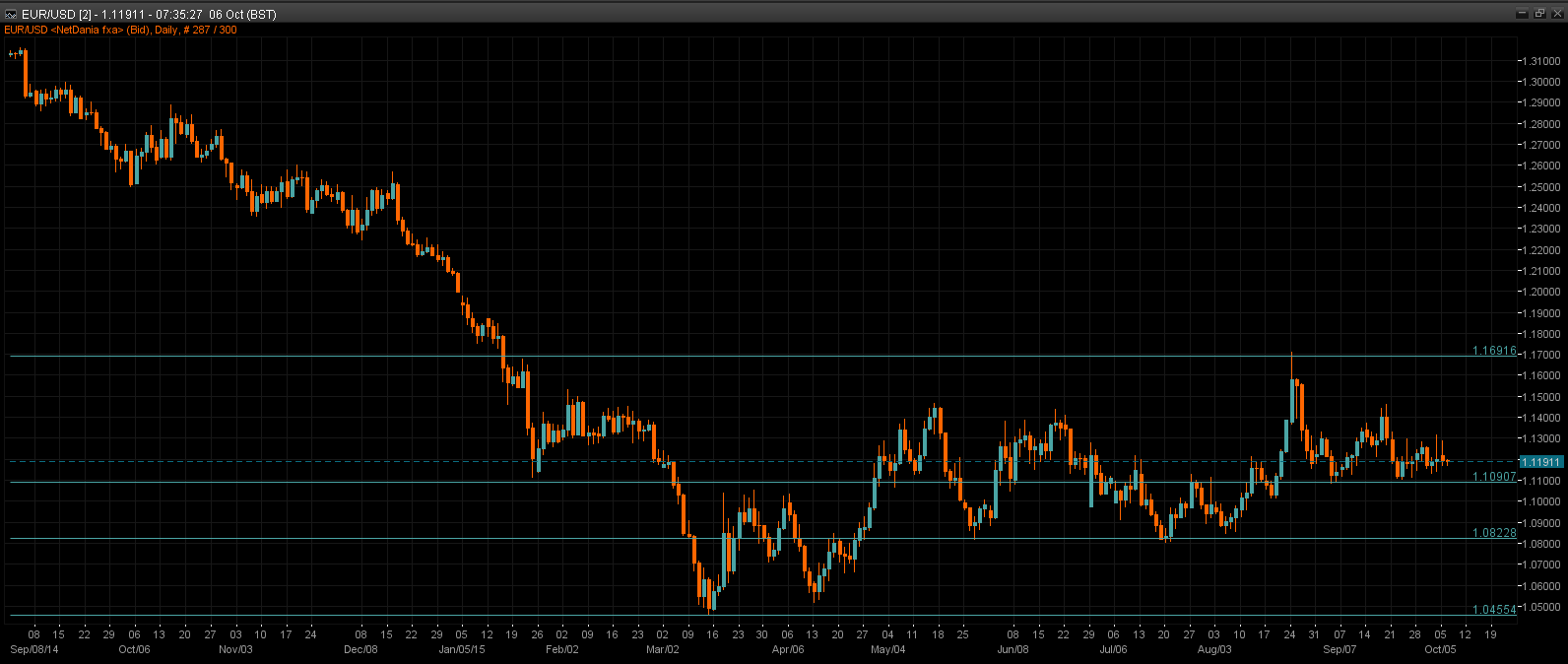

EUR/USD Outlook

Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: The European session saw mixed trading for the euro with European equities firming initially in the session before stalling out as German factory orders came in weaker than expected at 1.9% vs 5.6%, seeing EUR/USD eventually break higher on the session. US trade balance is key focus for the American session at 1330GMT1.

Technical: Failure at 1.12, while 1.1250 caps intraday upside reactions expect a retest of 1.1150 next, a bearish break of 1.1150 sees price test the pivotal 1.1050 level

- Interbank Flows: Bids 1.1130/50 stops below. Offers 1.13 Stops above.

- Retail Sentiment: Neutral

- Trading Take-away: Sidelines for now

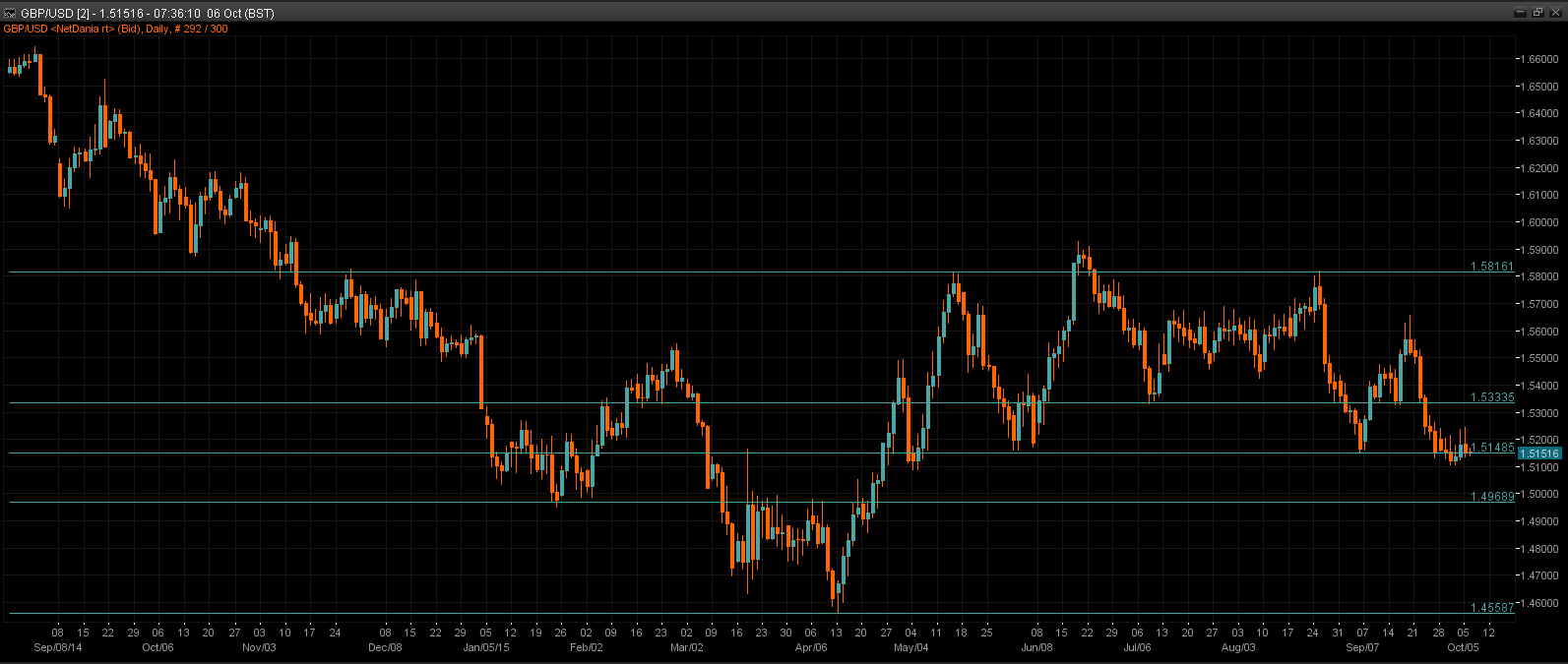

GBP/USD Outlook

Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: Sterling has continued to trade with a weaker tone over the European session following yesterday PMI data weakness. Markets are bracing for potential dovishness from the BOE on Thursday.

Technical: Offers towards 1.5250 remain firm and cap the upside reaction. While 1.5250 stems the advance on a closing basis next downside objective is a test of 1.50 psychological support. A close above 1.53 opens 1.54 as the next upside objective.

- Interbank Flows: Bids 1.5080/60 stops below. Offers 1.5250-1.53 stops above

- Retail Sentiment: Bullish

- Trading Take-away: Sidelines for now

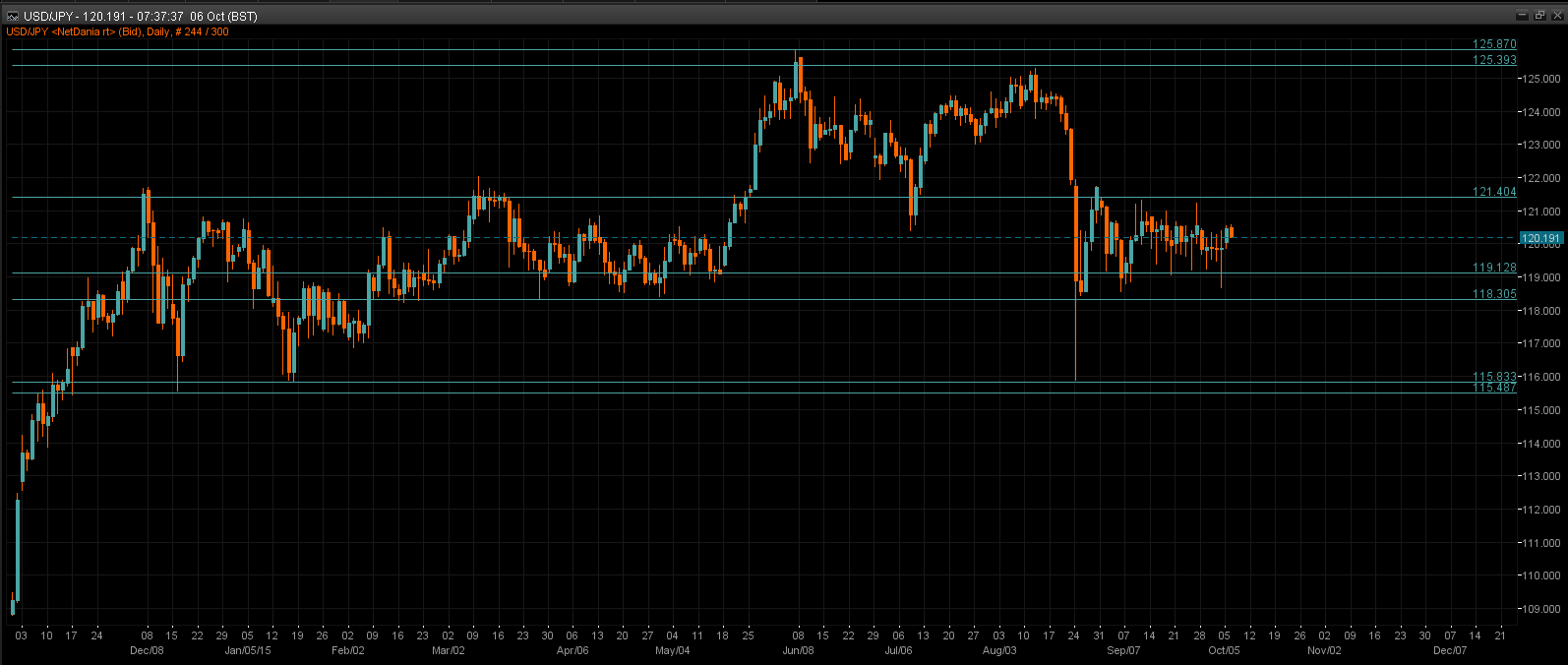

USD/JPY Outlook

Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Fundamental: Improved risk sentiment over yesterday’s session has seen JPY weaken. Flows remain contained ahead of he BOJ’s monetary statement early Wednesday morning.

Technical: Bids towards 118.50 hold strong once again, now trading back to the midpoint of the recent range. For now play range 121.50 the offer and 118.50 the bid until broken.

- Interbank Flows: Bids 118.50/30 stops below. Offers 121.50 stops above

- Retail Sentiment: Bearish

- Trading Take-away: Sidelines for now

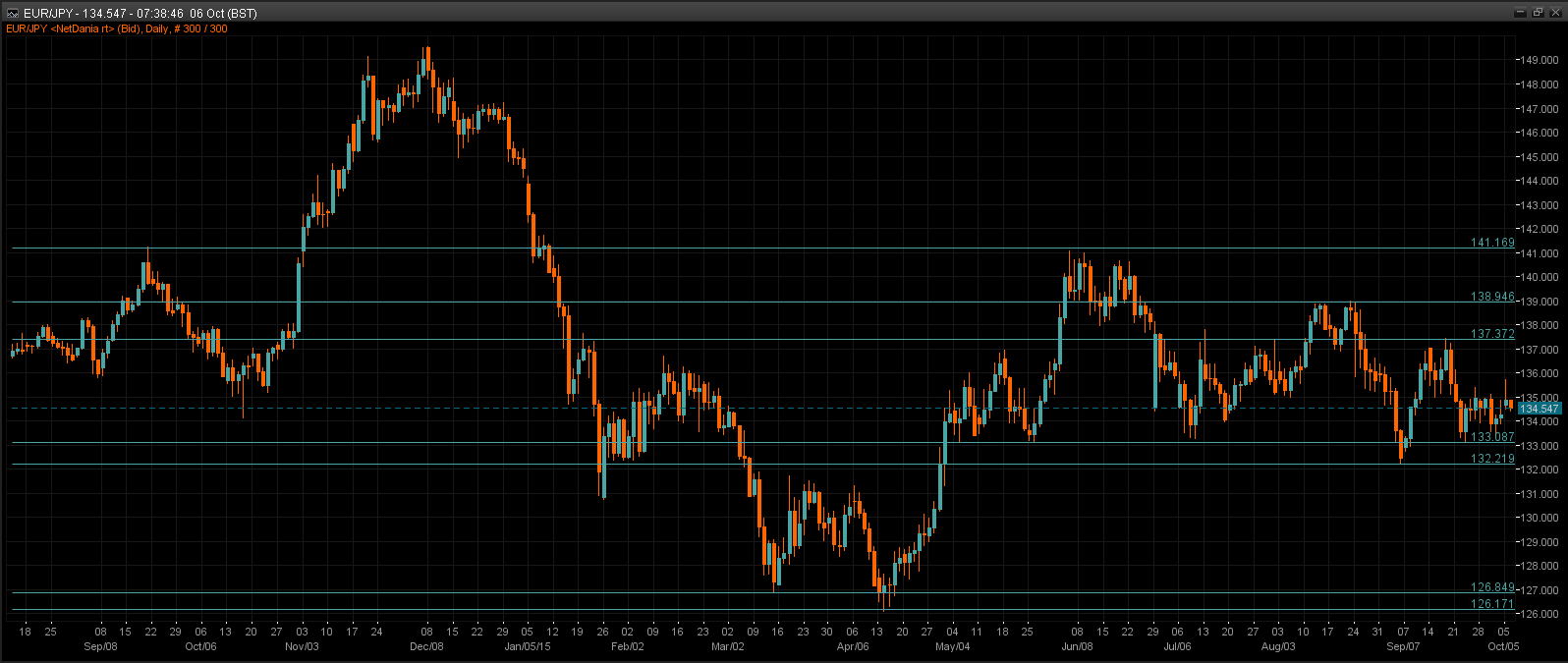

EUR/JPY Outlook

Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: EUR strength and JPY weakness have seen EUR/JPY better supported over European trading.

Technical: 134 intraday support to watch a failure here targets a retest of 133 bid. While 134 survives on a closing basis expect renewed upside pressure on 135.60 interim resistance. A close above 136 opens a retest of upper end of the recent range and a retest of offers at 137 next.

- Interbank Flows: Bids 134 stops below. Offers 136 stops above

- Retail Sentiment: Neutral

- Trading Take-away: Sidelines for now

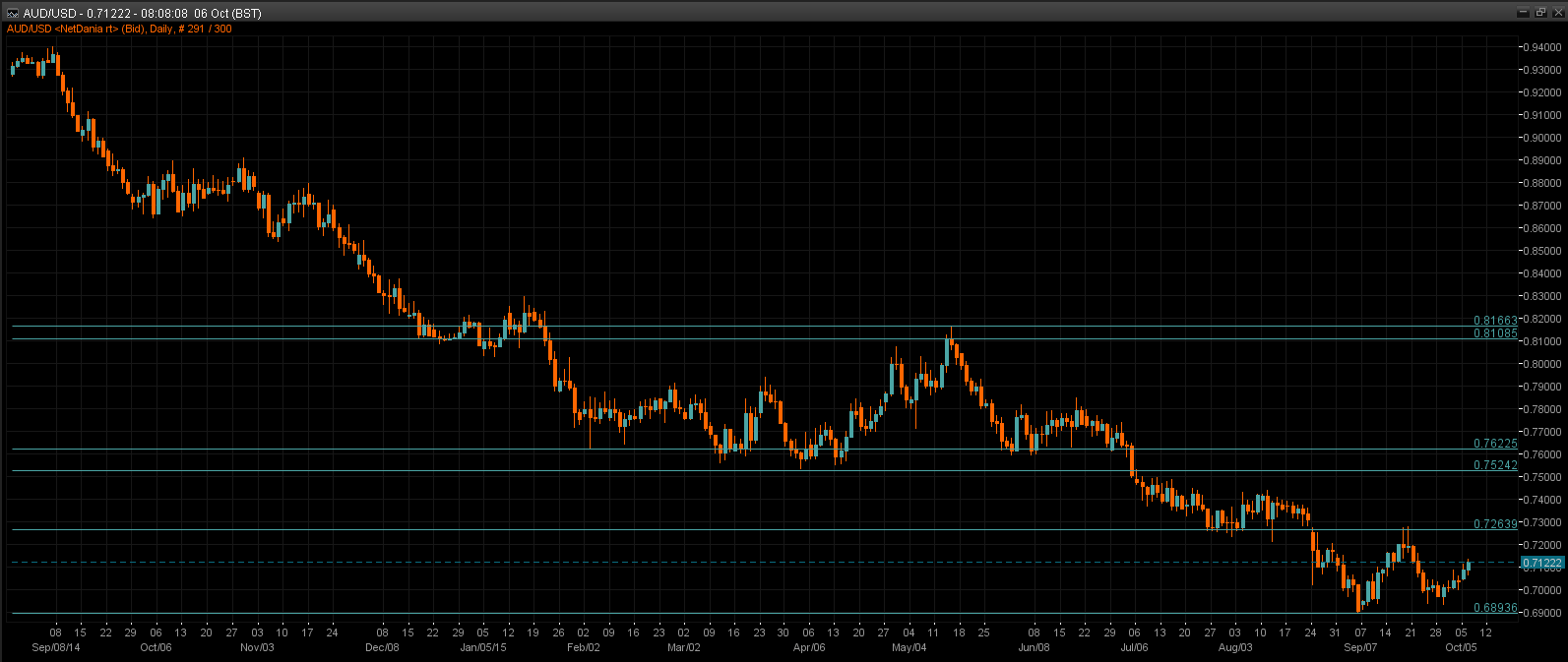

AUD/USD Outlook

Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: Following initial strength as the RBA maintained rates and struck a very neutral tone in their accompanying policy statement, the Aussie concede gains over European trading as equity markets softened ahead of the New York open.

Technical: Rally breaks .71 resistance now set to test offers towards .7150 which will likely cap upside at the first attempt. While .7050 supports intraday downside reactions expect renewed upside pressure to target stops above .7150.

- Interbank Flows: Bids .6850 stops below. Offers .7150 stops above

- Retail Sentiment: Neutral

- Trading Take-away: Sidelines for now

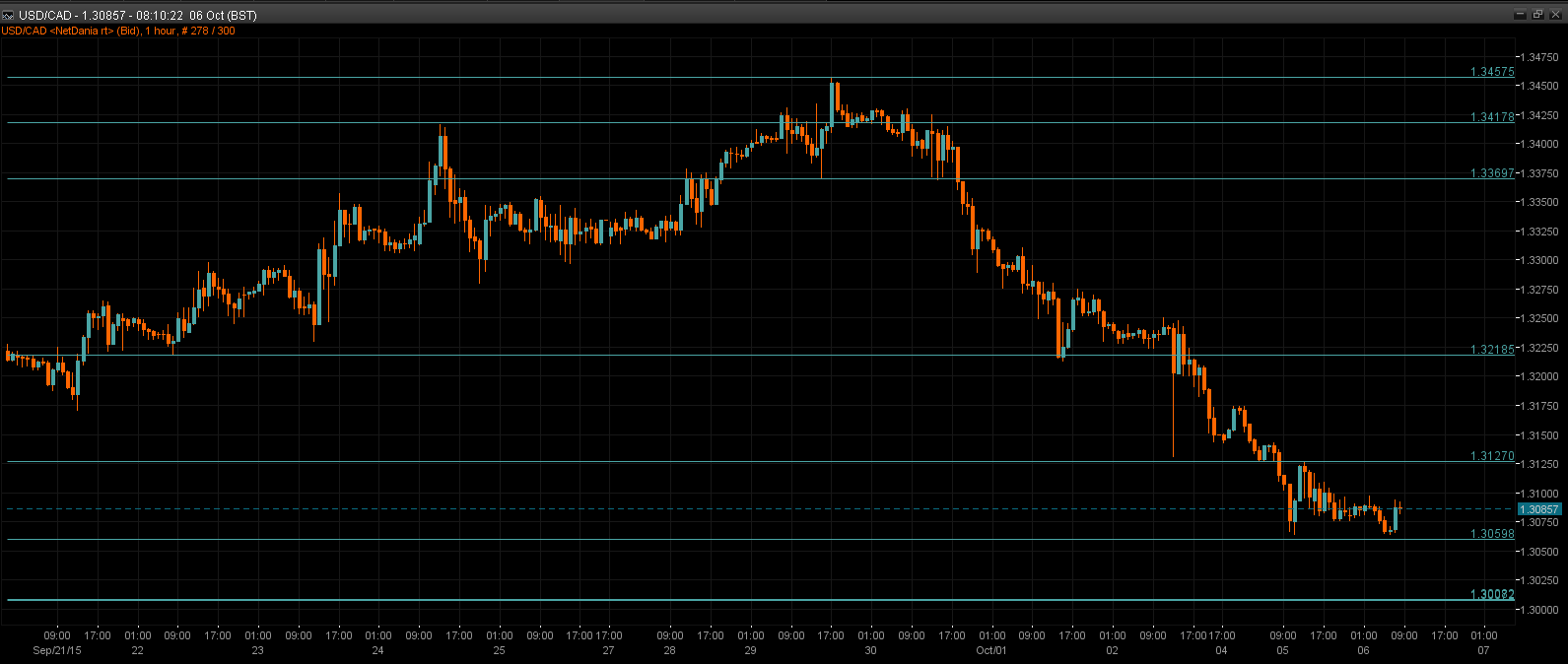

USD/CAD Outlook

Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bullish

Fundamental: European trading saw the loonie moving down to just shy of yesterday's lows before recovering ground as oil price rotated lower within their current range.

Technical: Testing downside symmetry objective at 1.31 stops sub 1.31 being eroded, broad supports between 1.30 and 1.31 are pivotal for trend continuation this area supports potential for trend continuation, a failure below 1.30 suggests the potential for a more significant trend reversal.

- Interbank Flows: Bids 1.31 stops below. Offers 1.33 stops above

- Retail Sentiment: Bullish

- Trading Take-away: Sidelines for now