New York Forex Report: In comments over the weekend, Fed’s vice chairman Stanley Fischer said that “raising interest rates may be the appropriate step” if asset prices are thought to be excessively high, paving the grounds for further rate tightening this year after the first hike in nearly a decade last month. In the same American Economic Association meeting on Sunday, Cleveland fed chair Loretta Mester said that the path of hike will be gradual and decisions will hinge on economic data and medium term outlook. Currently, the market anticipates four 25 bps hike in 2016. PMI data misses from China overnight have weighed on risk sentiment with circuit breakers triggered as the Shanghai Composite falls 7%. USD has been sold in response to the China development as the Japanese yen and Swiss franc both see safe haven demand.

EUR/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental:Over the weekend, Greek finance minister said, IMF is not convinced that Greece will meet its fiscal targets. A raft of positive PMI data supported EUR initially over European trading before price fell back heading into the US crossover. Key data focus for the US session today will be on German CPI at 1300 GMT, which is expected to show a mild improvement, and US ISM Manufacturing which is also expected to show an improvement.

Technical: While offers at and just above 1.0930 contain upside attempts, expect rotation south to test 1.0850 bids failure here opens retest of overnight lows ahead of symmetry objective at 1.0730

Interbank Flows: Bids 1.08 stops below. Offers 1.0950 Stops above.

Retail Sentiment: Bearish

Trading Take-away: Sidelines

GBP/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: GBP strengthened initially over the European morning as the latest Mortgage Approvals data showed an increase with an accompanying increase in Net Consumer Credit, these gains were reversed however as Dec Manufacturing PMI data printed below expectations.

Technical: While 1.48 caps intraday upside, expect a drift lower to retest bids at 1.4690, a breach of 1.4830 opens test of pivotal 1.49 level.

Interbank Flows: Bids 1.47 stops below. Offers 1.48 stops above

Retail Sentiment: Bullish

Trading Take-away: Sell pullback against 1.48/49 for 1.45

USD/JPY

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: USD/JPY continued to trade lower over the European morning, extending losses from the Weekly open as news of the halt in Chinese trading has seen strong safe-haven demand for JPY.

Technical: While 120.30 caps intraday upside attempts, expect a sustained break of 119.50 to test bids at and just below the 119 figure.

Interbank Flows: Bids 119 stops below. Offers 120 stops above

Retail Sentiment: Bullish

Trading Take-away: Sidelines

EUR/JPY

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: The cross opens the year under significant pressure weighed on by the strong risk aversion sentiment that has developed overnight with sizable data miss out of China dragging global equity markets lower and driving a move into the the relative safe haven JPY.

Technical: While 131 caps intraday upside reactions, expect a grind lower to test bids at 129.60/50, failure here opens 128.30s as the next downside objective

Interbank Flows: Bids 129.50 stops below. Offers 131.20 stops above

Retail Sentiment: Bullish

Trading Take-away: Sidelines

AUD/USD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Fundamental: The significant data miss out of China overnight and the subsequent trading ban has seen AUD under pressure over the European session so far today as commodities are led lower. USD weakness keeping direction contained for now.

Technical: While .7250 caps intraday upside, expect a test of .7150 ahead of pivotal.7100

Interbank Flows: Bids .7150 stops below. Offers .7250 stops above

Retail Sentiment: Neutral

Trading Take-away: Sidelines

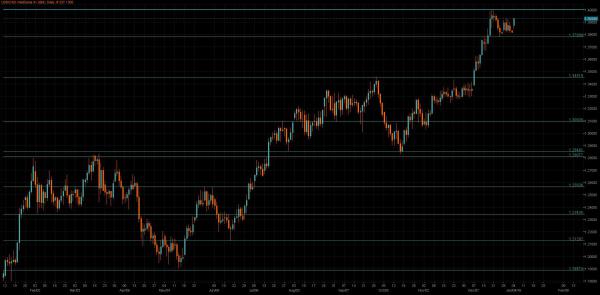

USD/CAD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bullish

Fundamental: USD/CAD saw choppy and volatile trading over the early European session today as USD weakened in response to the China trading ban but CAD too softened as oil made its way lower over the session.

Technical: Bulls have the ball while 1.37 supports, expect a grind higher to test stops above 1.40 while 1.3840 caps intraday downside. A close below 1.37 would ease the near term bullish bias.

Interbank Flows: Bids 1.3850 stops below. Offers 1.40 stops above

Retail Sentiment: Bearish

Trading Take-away: Sidelines