Current Position of the Market

SPX Long-term trend: The long-term trend is up but weakening. Potential final phase of bull market.

SPX Intermediate trend: The uptrend from 1810 continues. It could soon enter a corrective phase.

Analysis of the short-term trendis done on a daily basis with the help of hourly charts. It is animportant adjunct to the analysis of daily and weekly charts which discuss longer market trends.

Market Overview

Last Friday, the better than expected jobs report moved SPX to a new high of 2185. However, it seems to have a problem following through after that move. This past week, the index had a minor correction which was followed by a new high to 2188, but that was it! Sellers appeared and drove prices back down. This action is causing bearish divergence in the daily and hourly indicators, and even the weekly indicators have gone flat and could turn down at any time. Last week, I suspected that a new top was forming and nothing has occurred to change my mind. This is why I kept the same title for this newsletter.

Erik Hadik’s explanation for the market’s behavior is that we are at the top of some important cycles which, if they take hold, could drive prices downfor an intermediate period of time. Seasonally, this makes sense and I would not be surprised if we corrected the advance from 1992 with a decent decline into October.

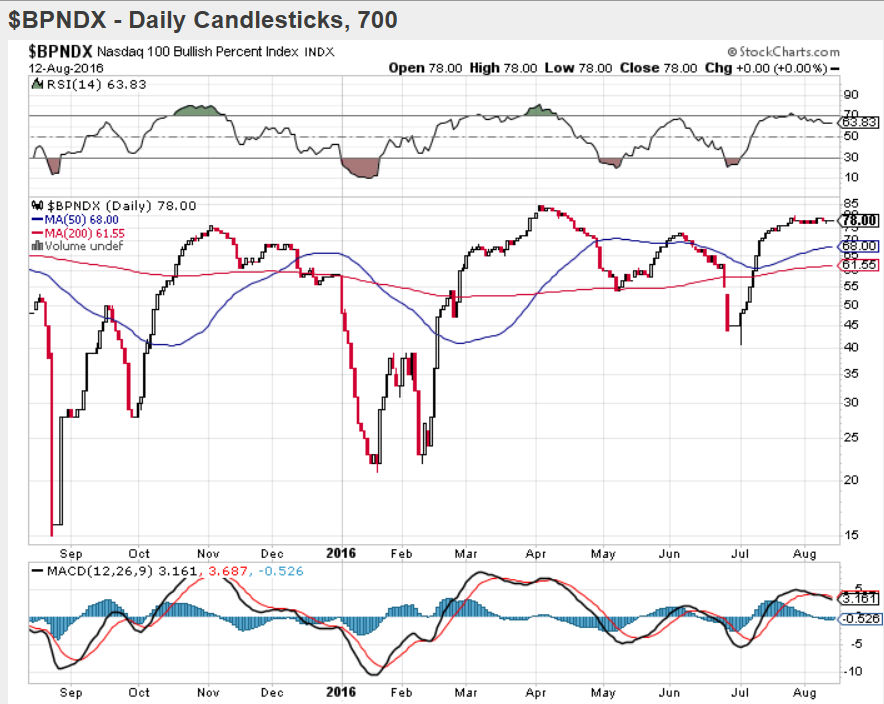

This time, for the sake of variety, I am showing the BPNDX (courtesy of StockCharts.com). Although the COMP did not make a new high, it came very close to doing so, but its BPNDX was not impressed. It kept going sideways while its RSI and MACD are beginning to roll over. No bullish pattern here, either!

SPX Chart Analysis(This chart and others below, are courtesy of QCharts.com.)

Daily chart

If you are wondering why SPX cannot rise more than a few points before pulling back, just look at the dashed blue line on the chart. This is a parallel of the trend line labeled “intermediate trend line”, above. It is drawn at the top of the April rally and has acted as a line of resistance for the past five weeks. If we cannot break through it on the upside, when the next intermediate cycle turns down the index should start to pull away from it, as it did a couple of weeks ago, except that this time, if Eric Hadik is right, we will not stop after a decline of two or three days, but should continue until the next level of support which is the former top at 2135, and perhaps even a little lower, at the highs of the two previous short-term tops.

It’s probably too early to go down and challenge the new black trend line from the 1810 low. There was enough accumulation at that low to take the index to the mid-2200s, and if we do correct into October, by the time we make another new high, the dashed blue line may have progressed upward to that price level; and this time, it could put an end to the bull market -- if we are indeed currently in primary wave V. But this is not something that we need to decide today.

The crawling pattern made by the index is reflected in the oscillators at the bottom of the chart. All show negative divergence and even though the SRSI is still in an uptrend, it has reached an overbought level and could turn down as soon as we get a couple of downticks in price. Perhaps breaking the minor trend line (which makes a wedge with the blue line) will get something started. If not, penetrating the moving averages certainly will.

Hourly Chart

The top dashed line on the daily chart has become a heavy blue line on this chart. We can see that except for a brief move outside of the line on 7/20, most other advances were pushed back on contact. I have drawn a parallel heavy line at the first pull-back. It has acted as the bottom of a narrow channel which has contained the downside price excursions except for the one time that the index expanded the original channel by 1.382 before moving back into the original one. That channel is still relevant and prices will have to break out of it in order to extend the rally. If it falls through the bottom of the first channel, it will probably challenge the new line at the bottom. Continuing lower should confirm that an intermediate downtrend has taken hold.

The hourly indicators are all showing bearish divergence although it looks as if a final attempt is going to be made to move higher. All the oscillators have started to turn up. For prices to break down convincingly, they will have to go through the black trend line as well as the red horizontal line.

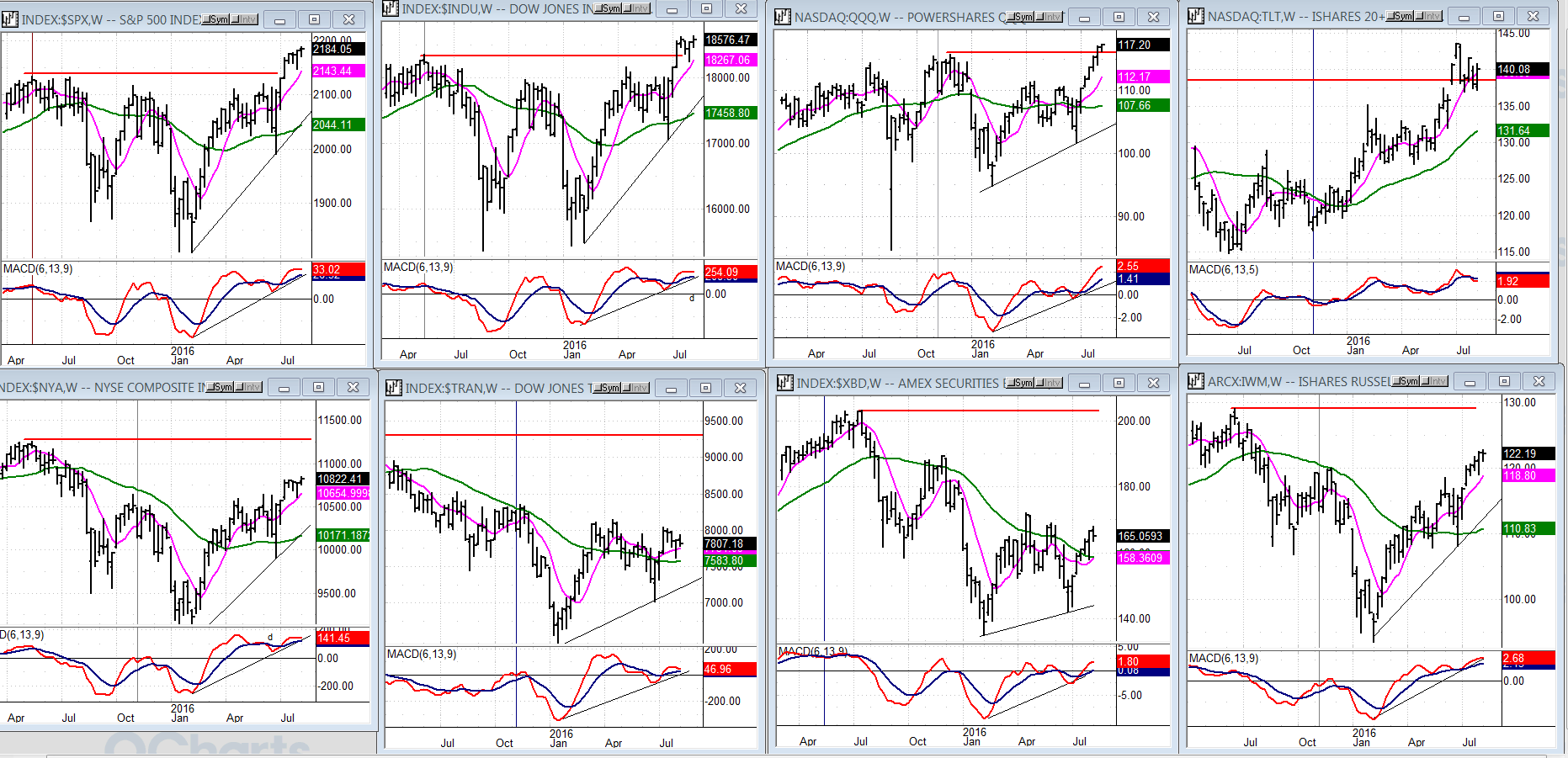

Some leading & confirming indexes (Weekly)

Here is a display of various market components which play a key role in determining the market’s overall position. In the top row are those which have made a new high. Oddly enough, iShares 20+ Year Treasury Bond (NYSE:TLT) is one of them. This alone should tell you that we are not in a normal bull market. The bottom row includes all the laggards from the NYSE, which is the most diverse index, to the Dow Jones Transportation which is badly lagging the Dow Jones Industrial Average. According to the DOW Theory, this means that this bull market should be close to the end of the road.

PowerShares DB US Dollar Bullish (NYSE:UUP) (dollar ETF)

UUP continues its correction and has retraced back to a support line from which it may attempt to resume its uptrend. If it does, it will face several resistance challenges directly above. Let’s see how it fares, but if it succeeds it could have an effect on gold which looks ready to correct.

GDX (Gold Miners ETF (NYSE:GDX))

GDX has entered the deceleration stage of its uptrend from its 12.40 low. The accumulation pattern which had formed at that level had a count of about 30-31, which has been met. Strong bearish divergence in the oscillators suggests that it has started a period of distribution which should be followed by a correction.

Note:GDX is now updated for subscribers throughout the day along with SPX, on Marketurningpoints.com.

USO (NYSE:USO) (US Oil Trust)

USO is acting predictably. It has found support at the bottom of its channel and bounced. Since it has not yet reached its projections of 8.5 to 9.00 for a final low, odds favor another retracement which should also bottom above the lower channel line and create divergence in the oscillators before a new uptrend can get underway.

Summary

Last week’s price action by SPX has done nothing to deter the perception that another, more important top, which could lead to an intermediate decline, is currently forming.