Kenny Lam explains the Qingdao Pilot Operation in the latest (Q3 2015) issue of the AIMA Journal. All the direct quotations in what follows will be to Lam’s article.

Lam, a tax partner at PricewaterhouseCoopers, begins at the beginning: given existing restrictions, Chinese investors with capital they want to put to work outside of China have limited choices. For a long time the choices were two: they could work through the QDII program, or the Shanghai-Hong Kong Stock Connect.

Just two years ago the government pioneered another approach, the Qualified Domestic Limited Partner program. This was at first just Shanghai based. Local firms there were allowed to raise yuan to invest in alternative assets overseas, with the involvement of certain foreign fund and PE managers.

Creating A New Center

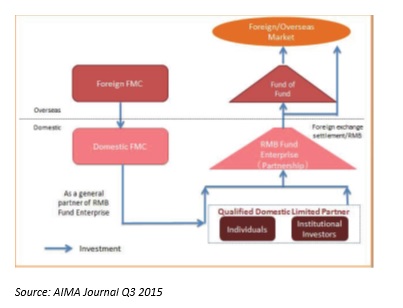

Fortunately (for such investors) the government also wants to turn the coastal city of Qingdao into a wealth management center. In the service of that goal, in February 2015 it created Pilot Measures for Qualified Domestic Limited Partnerships, measures designed to build up this city. The pilot lets foreign investors establish an entity in Qingdao; and, using this established investment entity as a general partner, they can then take on qualified domestic limited partners within an RMB Fund Enterprise.

The main business of this limited partnership, that is, this RMB enterprise, shall be to invest capital in overseas markets, specifically as Lam explains “on overseas listed securities as well as in M&A businesses in overseas unlisted entities and regulated commodities markets.” It must appoint a “qualified commercial bank in Qingdao as custodian bank.” That custodian will be in charge of the forex settlement issues. It will either use RMB or deal with foreign currencies within a quota approved by the Working Group.

An RMB entity cannot invest through a QFII or a QFLP.

Managers and custodians are expected to report to that Working Group on any “significant events or violations made by the RMB Fund Enterprise on a timely basis, and regularly report the net asset valuation.”

Some History

As regular readers of AllAboutAlpha will recall, the Qualified Foreign Institutional Investor (QFII) program got its start in 2002. The program was designed to allow licensed non-Chinese investors to trade in the mainland exchanges of Shanghai and Shenzhen. That it has also served as a narrow channel for Chinese investors to invest in those qualified non-Chinese institutions has been a side effect.

China has a classic central-planners’ economy, and planners hate to lose control. As a logical consequence, the central authorities have only very slowly loosened their grip either on money coming in from outside or on money going out from inside.

In 2008, China’s State Council issued Several Opinions on Providing Financial Support for Economic Development. Though the name may be confusing, that was one document, not several. It was a document that helped codify the PE industry in the PRC. Within a year thereafter the cities of Beijing, Shanghai and Tianjin had each crafted local policies designed to promote the development of RMB funds business. But the chief sort of RMB fund available at that time as the Industrial Investment Fund (IIF), any one of which was subject to special approval from the National Development and Reform Commission and the State Council.

The development of Shanghai’s QDLP took another five years. U.S. based Och-Ziff and Citadel, and UK based Man Group, were among the initial managers involved in the Shanghai set-up.

Comparison

The news, though, the novelty worth reporting, is that the 2015 Qingdao QDLP is significantly more permissive that was its Shanghai precursor, indicating that China is still, slowly but genuinely, engaged in the painful process of opening itself to the world. Lam ends his report with a table comparing the pilot measures of the two cities and the two years, 2013 and 2015.

For example, the Qingdao program requires no minimum requirement on the investment amount of partners. Also, the program allows a broader investment scope for the entities.