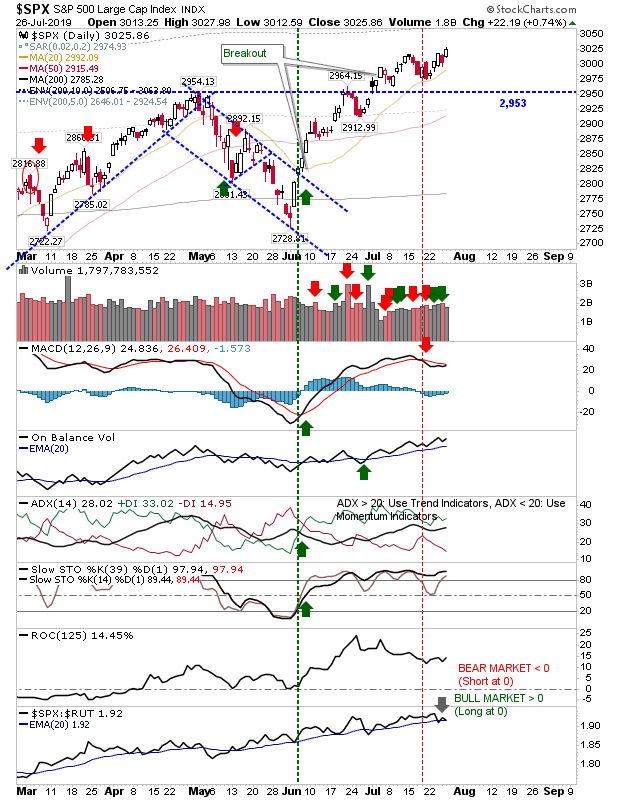

An excellent end-of-week finish left markets well-positioned heading into this week. The S&P 500 finished with a new all-time high on light-ish volume. Gains weren't enough to reverse the MACD trigger 'sell' but other technicals are bullish.

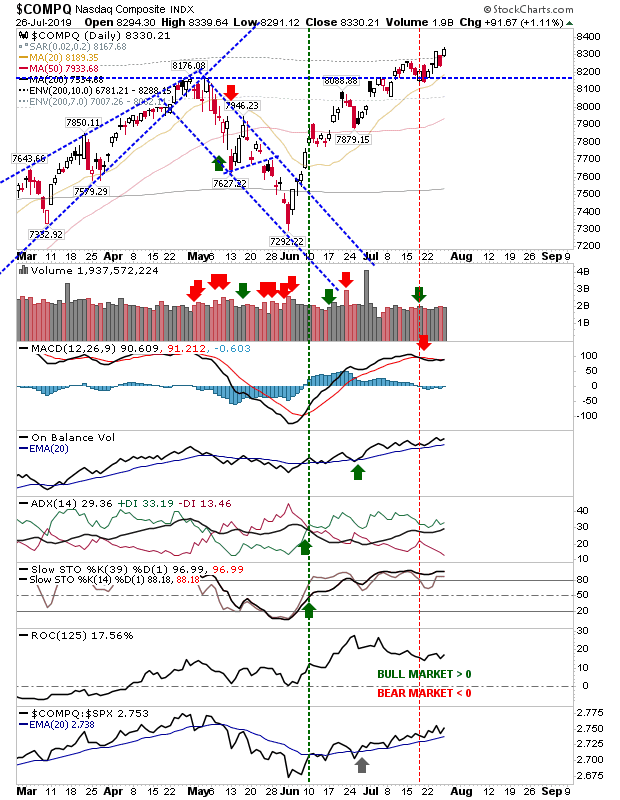

It was a similar story for the NASDAQ as it pushed beyond the 10% price zone off its 200-day MA. When the index gets to 13% or more above the 200-day MA it will have entered the 15% zone of historic overbought action and a good time to take some profits or sell covered calls on your positions

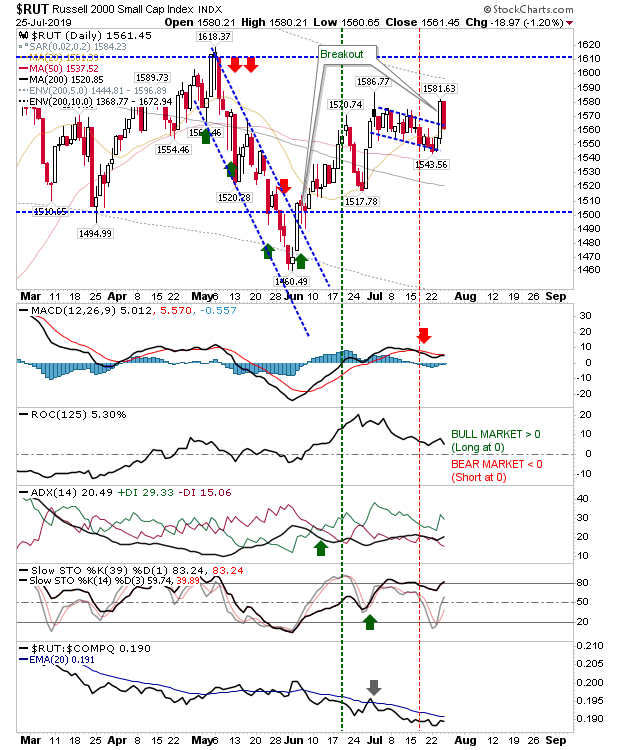

The Russell 2000 had an impressive day despite it been range bound. The 'bull flag' breakout looks to be confirmed by Friday's close and now leaves 1,600 as the next target. The recovery kept the MACD trigger 'buy' in play and other technicals are bullish. Watch for a gap opening on Monday.

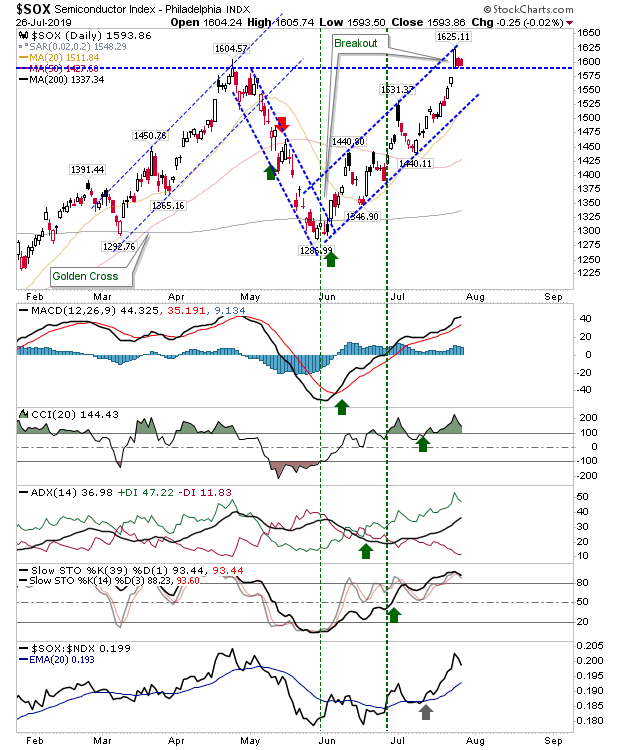

Semiconductors didn't partake in the gains but didn't lose enough ground to reverse the breakout.

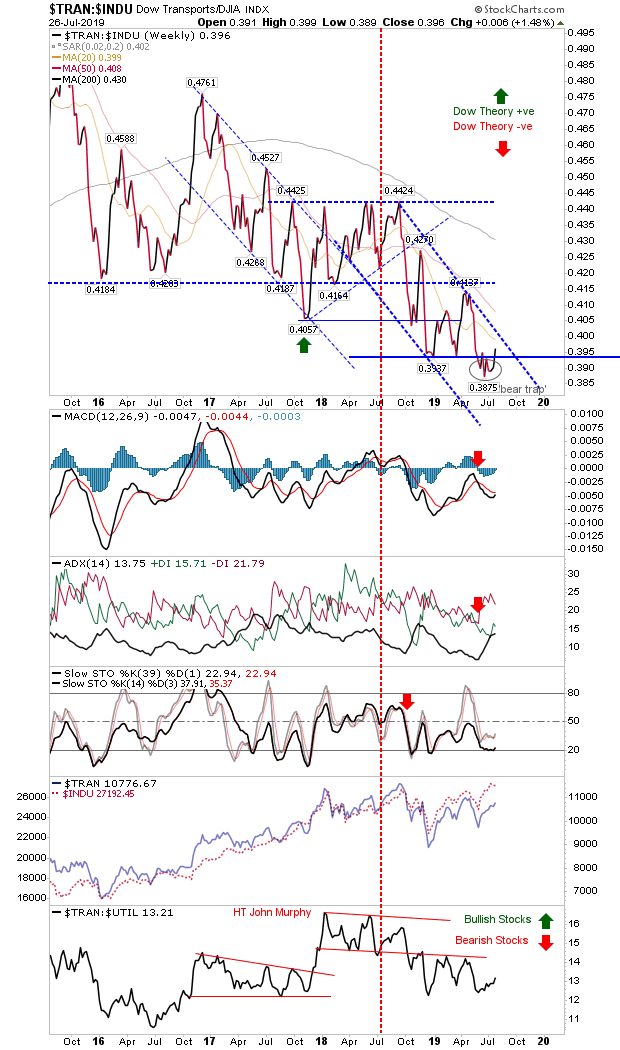

The ratio between the Dow Transports and the Dow Industrial average has ticked upwards to confirm a 'bear trap' and now favors long trades for Transport stocks.

The upcoming week is looking good for bulls (for all markets). Nice to see would be some volume support, but given vacation season I doubt we will get to see it.