With a strong move Tuesday, the S&P 500 closed above its previous high from September 20th by almost 3 points. It took 7 months for the full turn around to play out. And once again the Nasdaq 100 lead the charge to new highs first. So after the party, what is next for the S&P 500?

There will be plenty written expressing that this is the top and sell everything. And there will also be a lot of space allocated to the new bull market and how far it will run. I do not know what is next, no one does. but there are some interesting pieces of information to review.

Looking at the S&P 500 chart of daily price action there is very little to suggest the move higher stops here. The RSI has moved into overbought territory, but barely so. It has been a lot higher. The Bollinger Bands® continue to point higher, not flat like the top in September. The MACD is not at extreme levels, just cruising along flat for nearly 3 months.

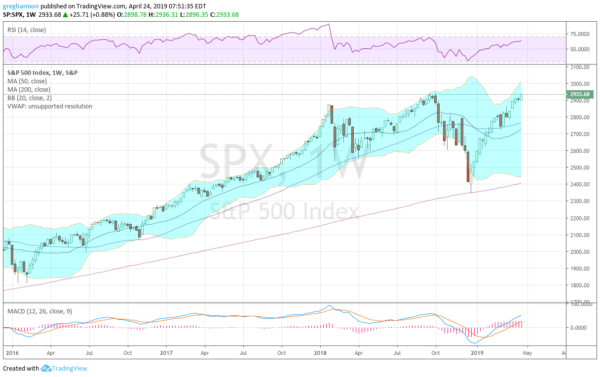

The weekly chart (with 3 days left in the last candle) shows even more reason for upside to continue. The RSI here is rising and nowhere near overbought with the MACD positive and moving up. The major source of brain power attention will come from connecting the tops in the RSI. Should a higher high not prevail in the RSI then a long term divergence will persist and garner attention from market watchers. The same goes for the MACD.

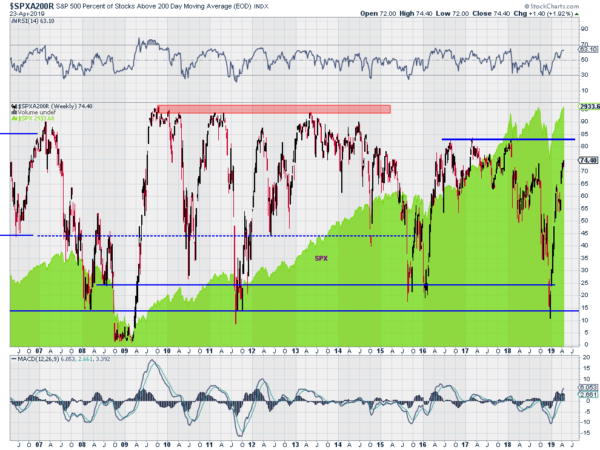

There is also room in terms of breadth. The number of stocks in the S&P 500 over their 200-day SMA is well short of prior tops. As stated earlier, the supporting cast is helping out as well. The Nasdaq 100 is already at record highs. But the Russell 2000 appears ready to break above resistance and join the movement.

Everything may stop in their tracks today. No one knows. But the bulk of the evidence suggests there is room to head higher still.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.