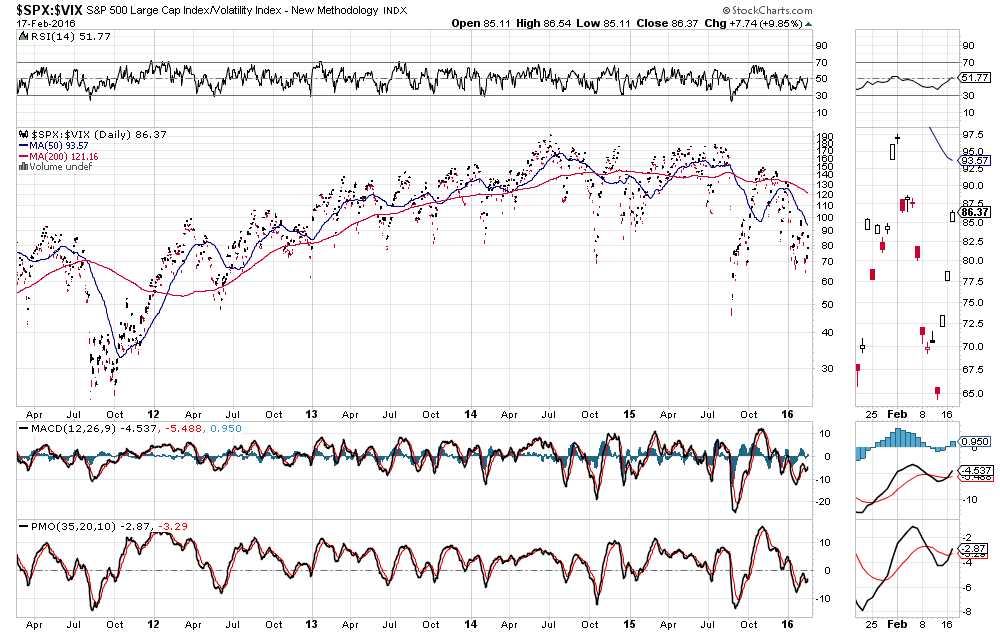

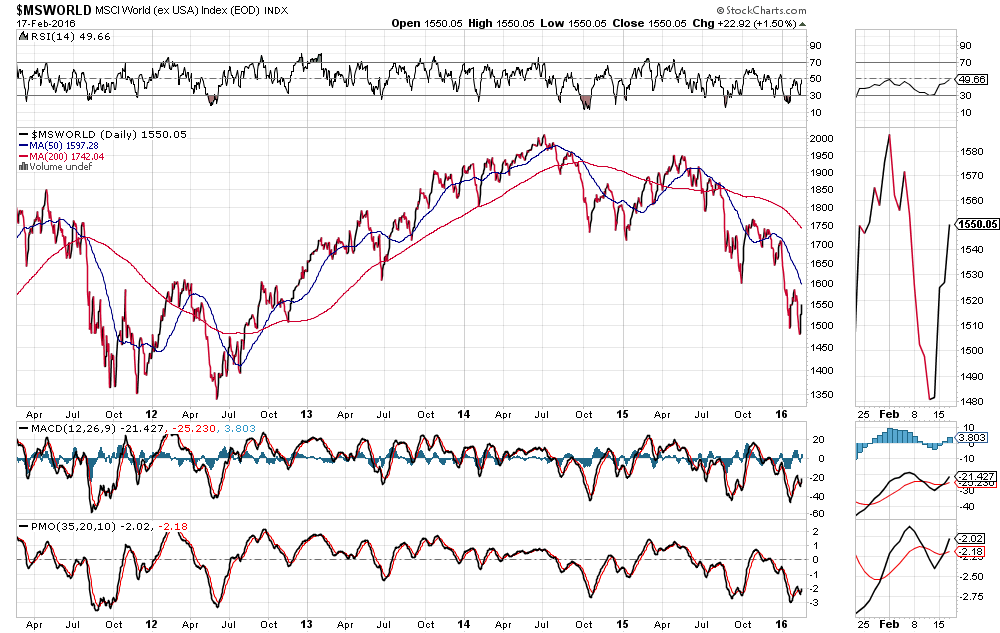

New "BUY" signals have just formed on the RSI, MACD and PMO indicators for:

- SPX:VIX ratio: Price still needs to cross and remain above the 100 level, as outlined in my late January post, and, thus, is still aimless and directionless within the "Uncommitted Zone."

- MSCI World: The RSI is about to cross above the 50 "BUY" level, possibly today (Thursday). Major resistance lies above at 1600, as also mentioned in the above linked post.

So, while we are now seeing fresh "BUY" signals on these charts, we'll need to see a convincing follow-through and a break and hold above these resistance levels to confirm that a new bull market is emerging in equities, especially in view of the economic weakness that was reported in the last Beige Book release.

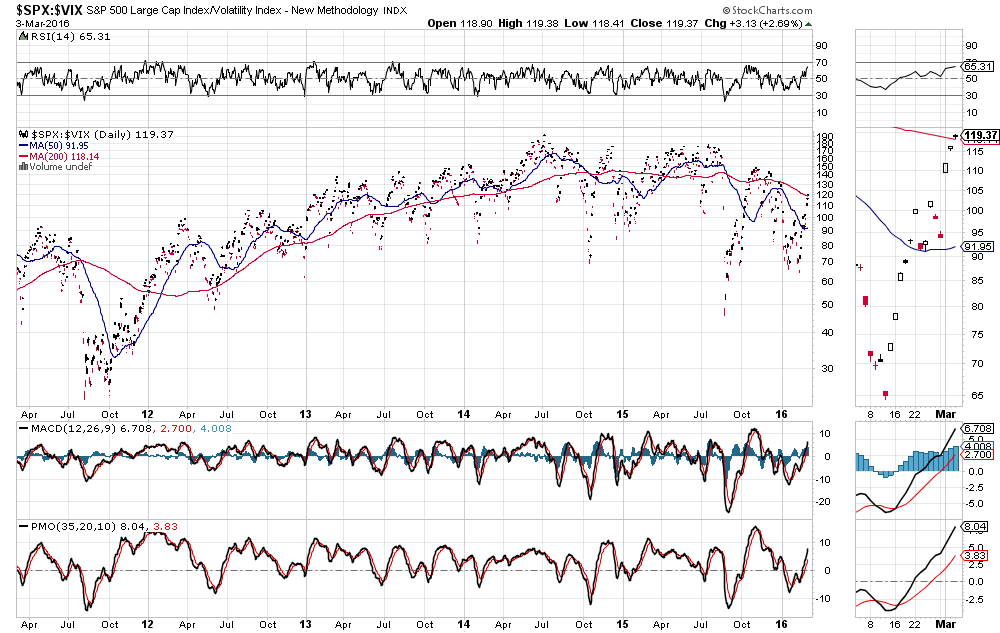

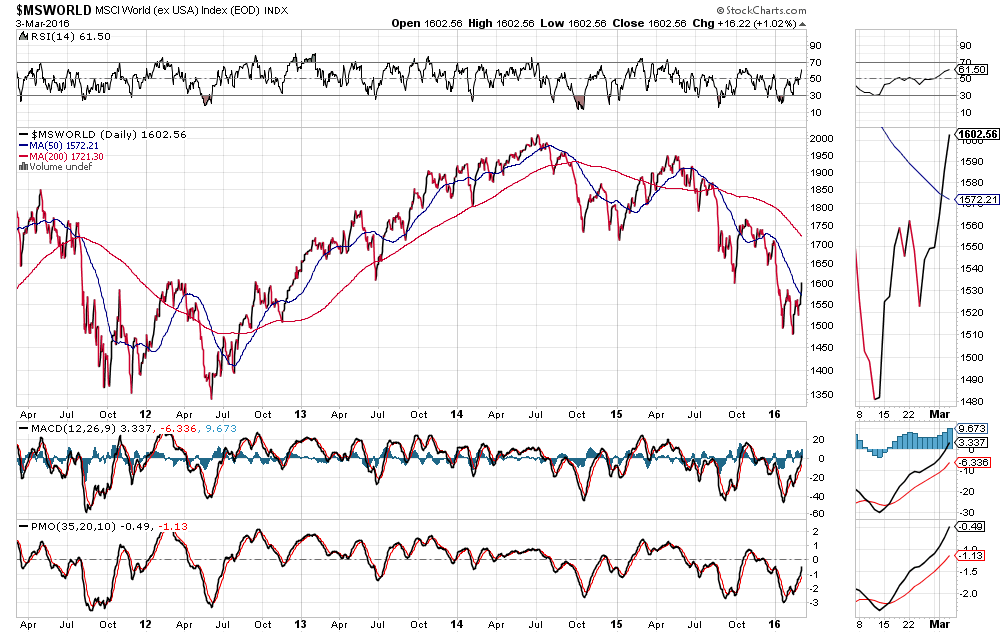

* UPDATE March 3rd:

We'll see if the newly penetrated 100 level holds as support now on the SPX:VIX ratio, as well as the1600 level on the World Market Index, as shown on the following updated Daily charts of both. If so, it looks as though equity markets are in for a new bull run...possibly to new highs sometime this year. Otherwise, another failure of both of these levels will likely begin a new bear run to new lows.