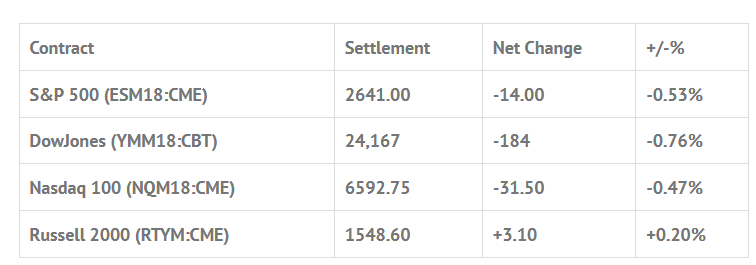

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 9 out of 11 markets closed lower: Shanghai Comp -0.87%, Hang Seng -0.21%, Nikkei -0.12%

- In Europe 11 out of 12 markets are trading higher: CAC +0.20%, DAX +0.46%, FTSE -0.04%

- Fair Value: S&P -0.39, NASDAQ +8.65, Dow -36.23

- Total Volume: 1.6mil ESM, and 859 SPM traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes the Weekly Bill Settlement, Chain Store Sales, Jobless Claims 8:30 AM ET, Import and Export Prices 8:30 AM ET, Bloomberg Consumer Comfort Index 9:45 AM ET, EIA Natural Gas Report 10:30 AM ET, Fed Balance Sheet 4:30 PM ET, Money Supply 4:30 PM ET, and Neel Kashkari Speaks at 5:00 PM ET.

S&P 500 Futures: Bombs Away

Wednesday’s trade started with the Asian markets closing mixed. The Hang Seng and Shanghai Composite both closed up +0.60%, but Japan’s Nikkei and Australia’s S&P ASX 200 both closed down -0.5%. The Stoxx Europe 600 fell -0.6%, and the S&P was down -1% in early morning trade.

After closing sharply higher Tuesday afternoon, the S&P 500 futures did an overnight u-turn. In the early goings the ES was down 14 handles, that’s when I got a call from the PitBull asking why the futures were selling off. The only news was Trump’s statements that the US was going to retaliate for the chemical weapons attack in Syria.

After a small bounce, the S&P futures continued to bleed lower, and around 6:30 am CT it had sold off all the way down to 2626.00, down -29 handles. The ES then start to short cover before trading 2639.50 down 15.50 on the 8:30 futures open. From there, the futures upticked to 2644.00, pulled back down to 2639.75 a few minutes after the open, and at 9:45 traded up to 2654.75. Right around that time, I sent this to the PitBull:

9:37:02 am (DBOY) big rip, could be near an early high…

The PitBull responded by saying:

9:37:30 am Marty Schwartz: near the top of 15 minute channel.

After that, the ES sold off down to 2640.00, a -14.75 handle drop in 18 minutes. At 10:45 the futures had traded back up to 2657.00, up +16.75 handles off the 2640.25 pullback low. The next move was a 21.25 rally up to 2661.25 at 11:13 CT, followed by a selloff back off down to the vwap at 2642.25.

The futures were unable to gain any traction following the 1:00 pm ct FOMC minutes release. The ESM did trade up to a lower high of 2655.00 after the release, but then promptly began to break and drag lower into the final hour, selling off down to 2638.75, -22.50 handles off the high of day. There was a late bounce up to 2647.25, but as the MOC came out $475 million to sell, the futures pulled back down to 2640.00 before settling the day at 2640.50, down -14.50 handles, or -0.55%.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.