- Surging LNG prices, widening interest rate differentials are denting yen

- USD/JPY, a measure of dollar strength, is near 32-year highs

- Nikkei has sharply outperformed other markets

As the energy crisis worsens in Europe, investors should not overlook the dire situation in Japan, too. The island nation and the world’s third-biggest economy has become increasingly dependent on foreign sources of energy—particularly natural gas.

In wake of the 2011 Fukushima nuclear disaster, natural gas was seen as a lower-risk source to produce power. Unfortunately, nobody could foresee the ballistic energy prices that would come a bit more than a decade later. The last price at the Japan-Korea Marker (JKM) for LNG was a whopping $55, according to data from ICE. For context, it traded under $2 a bit over two years ago.

JKM LNG Prices Skyrocket From $2 To $69

Source: TradingView

Surging USD/JPY: What Gives?

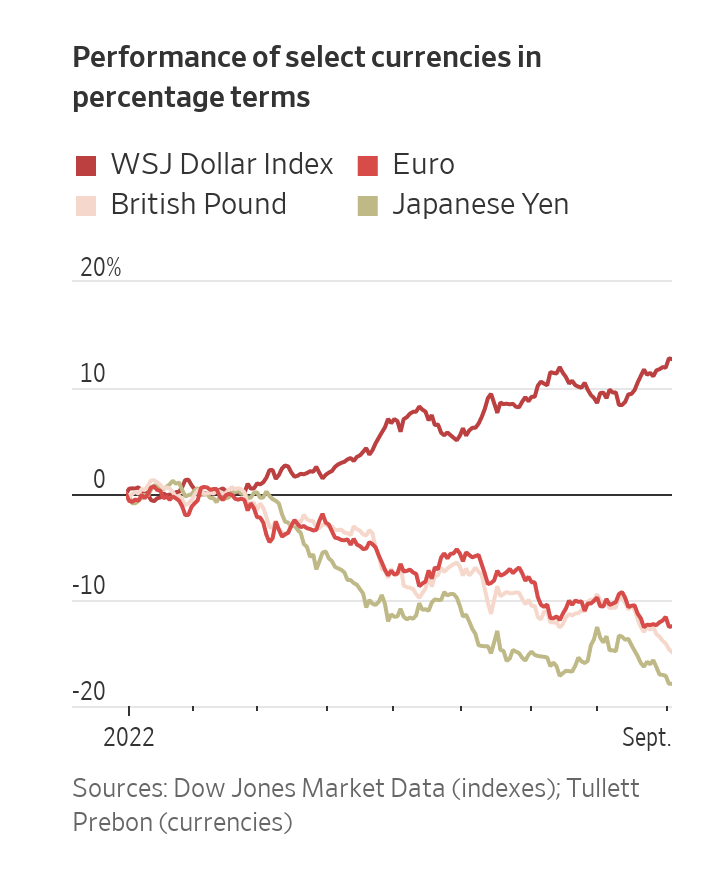

Along with crippling costs to produce electricity in the country, the Bank of Japan has been slower to hike its policy rate compared to the U.S. Federal Reserve. BoJ Governor Kuroda continues to stick to the refrain that the country’s inflation problem is caused by temporary commodity price increases. As a result, the interest rate differential between U.S. Treasurys and JGBs has expanded this year, helping to cause a steep depreciation in the value of the yen. The USD/JPY cross is now near its highest level since 1990. This comes as the EUR/USD pair attracts just about all the media attention in the currency world. At 142 yen per dollar, USD/JPY is up about 40% from the year-end 2020 level.

USD/JPY: A 40% Climb Since Late 2020

Source: TradingView

Yen: Worst Major Currency In 2022

Source: The Wall Street Journal

More Downside To Come For The Yen?

I see more pain ahead for those long the yen. Erik Nelson at Wells Fargo concurs—he expects USD/JPY to touch 150 later this year. Goldman Sachs sees 145.

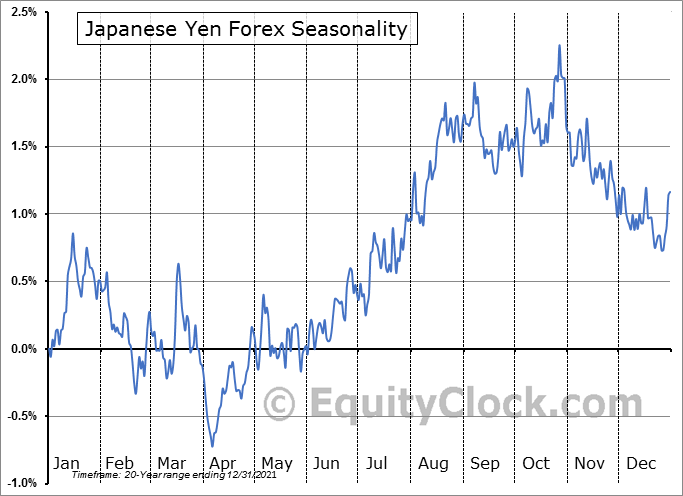

Moreover, according to data from Equity Clock, the September through October period is generally when the yen tops. April through mid-August has, on average, been a period of strength for the currency. We did not see that in 2022, so that tells us the market is particularly weak. The fundamental driver for a further decline in the yen (a rise in USD/JPY) could be ongoing energy woes and a wider interest rate spread between the U.S. and Japan.

Seasonal Trends: A Weaker Yen From November Through Early April

Source: Equity Clock

Assessing The Japanese Stock Market

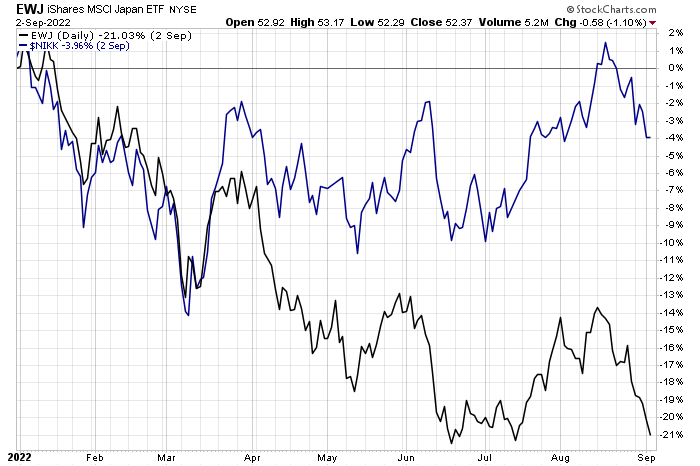

Let’s take a look at what’s happening with Japanese equities, too. The chart below illustrates how pivotal the move in the yen has been this year.

So far in 2022, the iShares MSCI Japan ETF (NYSE:EWJ) is down more than 21%, underperforming the S&P 500. The Nikkei 225 is down by just 4%, though. The difference between the two is explained simply by currency moves. The Nikkei bottomed in early March, well ahead of the S&P 500’s June 16 low—there has been relative strength among Japanese stocks. Given this momentum, I see the Nikkei (long Japanese stock in yen terms) as a better place to be positioned for the balance of the year.

Seeing The Yen’s Impact: Nikkei Vs. EWJ YTD

Source: Stockcharts.com

The Bottom Line

The energy crisis continues to unfold. Investors should watch all global equity markets as well as movements in major currencies to determine near-term asset allocation. Japan is a source of relative price strength and stability this year but knowing how to play it is critical.

Disclaimer: Mike Zaccardi does not own any of the securities mentioned in this article.